- April 29, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Market expert and researcher Jim Bianco recently voiced cautionary remarks regarding the alleged risks of spot Bitcoin ETFs. Bianco’s insights shed light on these ETFs’ implications for the market and address specific concerns related to investor behavior.

Minimal Involvement In New Bitcoin ETFs?

In a thought-provoking social media post on X (formerly Twitter), Bianco emphasized his increasing worries as more data becomes available. Notably, he expressed concerns about the potential risks that spot Bitcoin ETFs pose to the market.

Bianco highlighted that investment advisors (IAs) hold a substantial portion, approximately 35%, of all ETFs. Surprisingly, their holdings account for less than 1% of spot BTC ETFs. For Bianco, this revelation challenges the popular belief that “boomers are coming” to invest in these ETFs.

Bianco proceeded to describe spot BTC ETFs as “orange FOMO poker chips” primarily enticing “paper-handed” small-time traders, commonly referred to as “degens.”

These traders are believed to be approaching their break-even point, potentially triggering significant selling pressure for the world’s largest cryptocurrency.

The expert cited a Citibank study indicating that investment advisors hold a mere fraction of new BTC ETFs, while their holdings in non-equity ETFs such as Gold (GLD) and Tech Leaders Income (TLT) are significantly higher, at 22% and 40%, respectively.

Bianco’s analysis suggests that wealth managers’ holdings in Bitcoin ETFs are practically negligible, accounting for insignificant rounding errors.

Selling Pressure Looms?

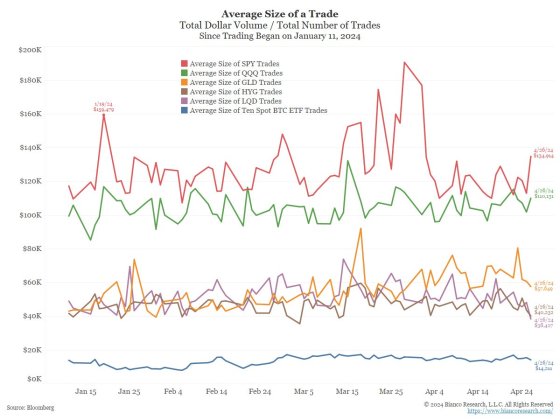

Another aspect Bianco highlighted was the average trade size of BTC ETF buyers, particularly retail investors. His observations indicate that the average trade size is significantly small, at just $14k, less than half the size of the next smallest trade.

This pattern suggests that a significant portion of BTC ETF holders are retail investors who may have a higher propensity to chase momentum.

Ultimately, the fear lies in that these retail investors, commonly known as “degen retail,” are more likely to sell at the first signs of trouble, especially when the BTC price falls below their average purchase price of $58,000.

Bianco drew attention to the potential consequences if BTC traded below $58k, indicating that historical data shows traditional finance “degens” tend to sell.

Notably, as the BTC price approaches the average purchase price of these retail investors, net inflows into BTC ETFs, excluding Grayscale’s Bitcoin ETF GBTC, start to turn into outflows.

Bianco likened this scenario to a forest fire, where the selling of BTC is unleashed when the price falls below the average purchase price, potentially disrupting the market.

Bianco emphasized the need for an alternative to the traditional finance system by expressing support for the idea of Ethereum and Bitcoin ETFs as part of the digital age toolbox.

However, the researcher cautioned against relying solely on Bitcoin ETFs as the “orange FOMO poker chip” that would attract “boomers” and cause a price surge, as was the narrative during the BTC peak in March, as the inflows were also increasing in the ETF market. Bianco argued that this approach would hinder the primary goal of establishing a robust digital finance system.

While Bianco acknowledges the merits of Bitcoin ETFs as part of a broader digital finance landscape, he urges caution to ensure they do not become a speculative tool that detracts from the overarching goal of building a resilient financial ecosystem.

At the time of writing, BTC is trading at $62,500, down 2% in the past 24 hours and over 5% in the past seven days.

Featured image from Shutterstock, chart from TradingView.com