- May 1, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

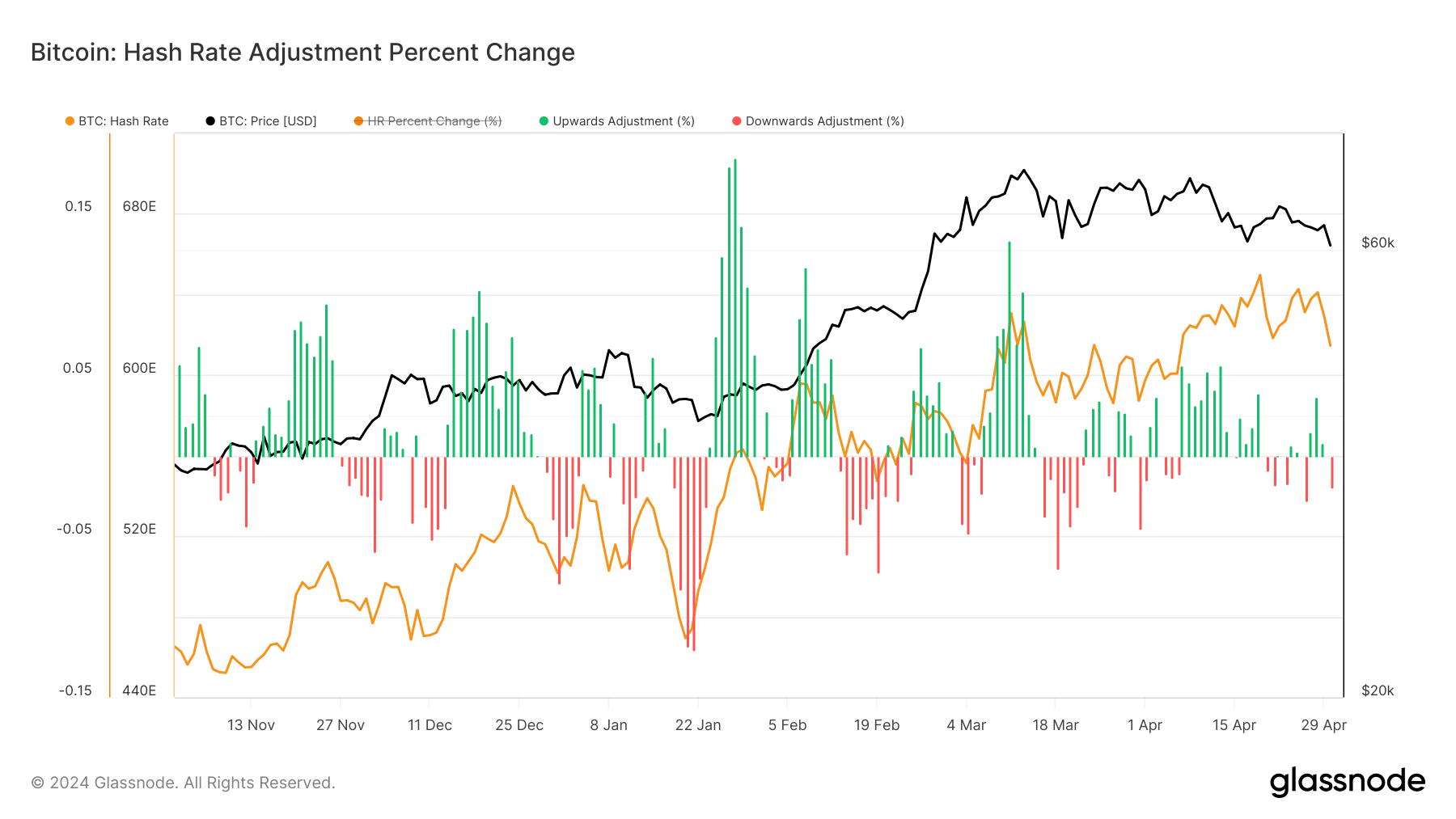

CryptoSlate’s analysis sheds light on the anticipated hash rate adjustment, with historical trends indicating a potential 20% decrease post-halving. Past cycles reflect significant hash rate corrections: 39% in 2012, 11% in 2016, and 26% in 2020. As of 2024, we’ve observed a 6% decline so far, taking the hash rate from 649 eh/s to 619 eh/s.

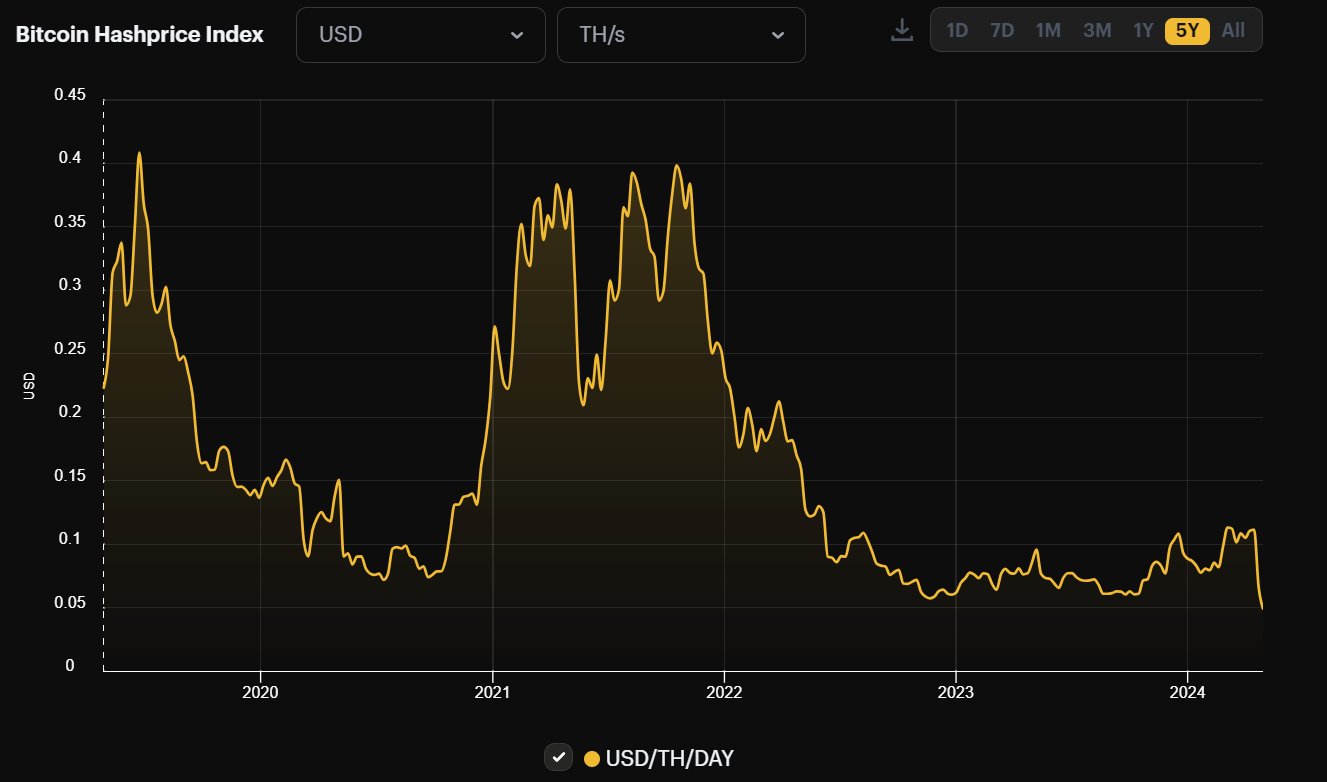

The price of Bitcoin has tumbled from its highs of around $73,500 to below $57,000, and as a result of this, further hash rate drops are expected. Luxor’s “hashprice” metric, which quantifies the expected value of 1 TH/s of hashing power per day, currently sits at a five-year low of $0.045 per terahash/second per day.

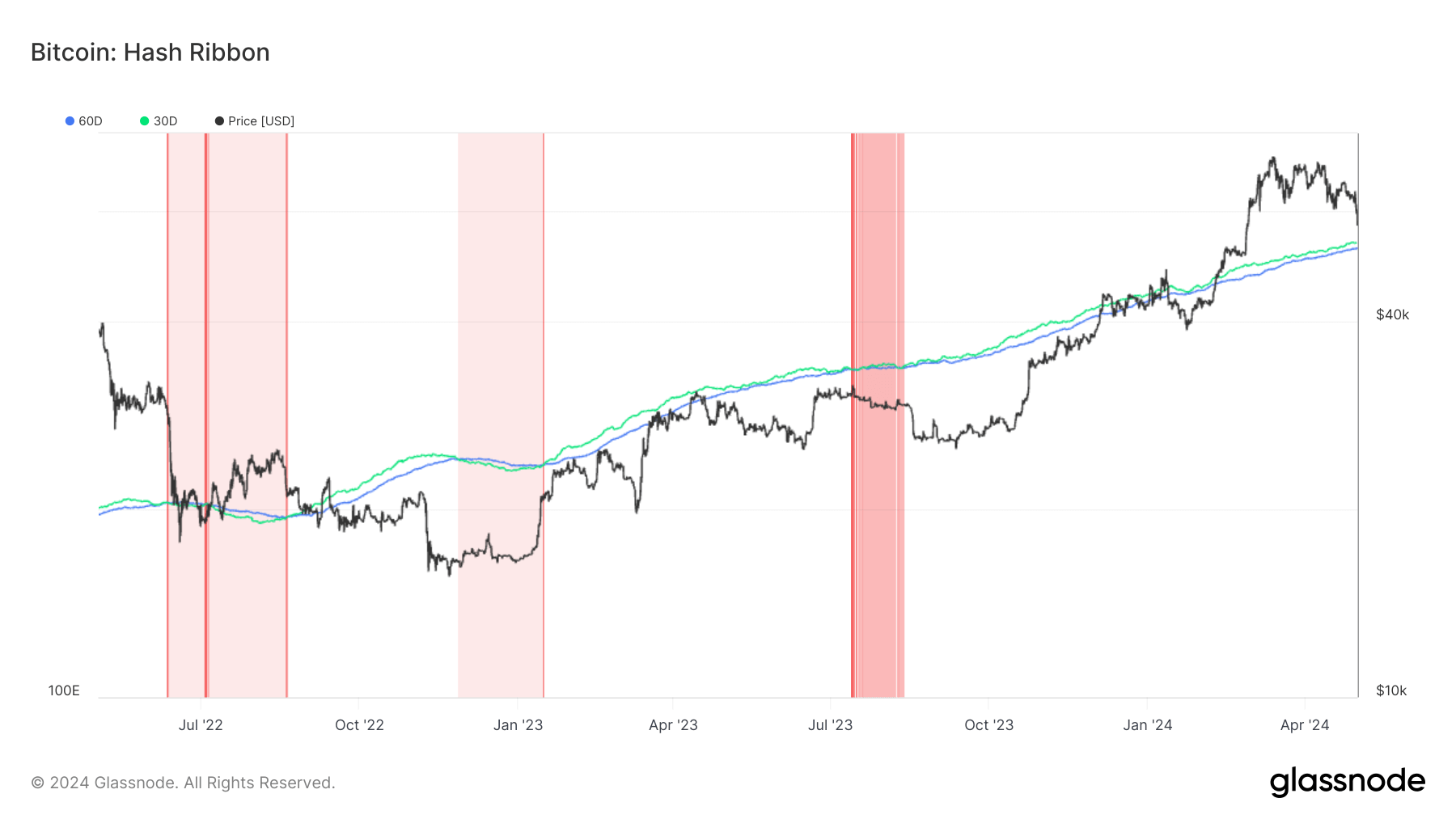

If this trend persists, the digital asset community may witness a miner capitulation event, where Bitcoin mining becomes too expensive relative to the cost of mining. This scenario is typically identified by Glassnode’s hash ribbon metric, which has historically signaled bottoms in Bitcoin cycles.

The upcoming difficulty adjustment, scheduled for May 8, is forecasted to decrease by 1.5% to 2%.

The post Bitcoin faces potential miner capitulation as hash rate continues to drop appeared first on CryptoSlate.