- May 17, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

As Bitcoin’s (BTC) price surged from around $60,000 to $66,000 this week, on-chain data revealed intriguing trends among long-term holders (LTHs) and short-term holders (STHs). LTHs, defined as those who have held BTC for 155 days or more, have seen their supply grow by approximately 70,000 BTC from the April low.

We anticipate LTH supply to continue to grow as around 46% of Bitcoin’s circulating supply has remained unmoved for at least three years, suggesting a significant portion of holders are in it for the long haul and will continue to accumulate.

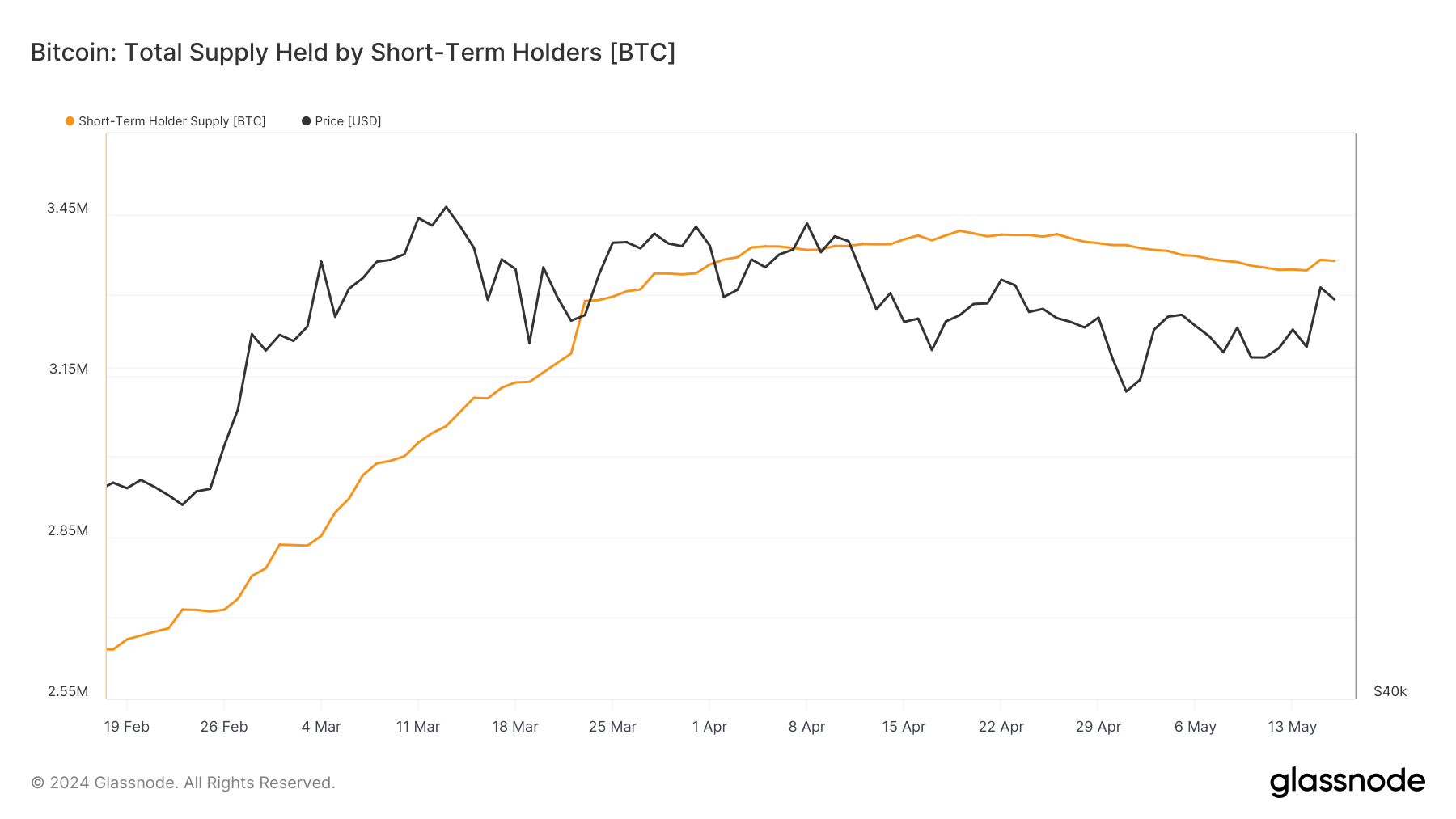

On the other hand, according to Glassnode data, STHs, who have held their coins for less than 155 days, have increased their supply by roughly 20,000 BTC since May 14. Around 50% of the volume can be attributed to wallets tied to US ETFs which are currently considered STHs.

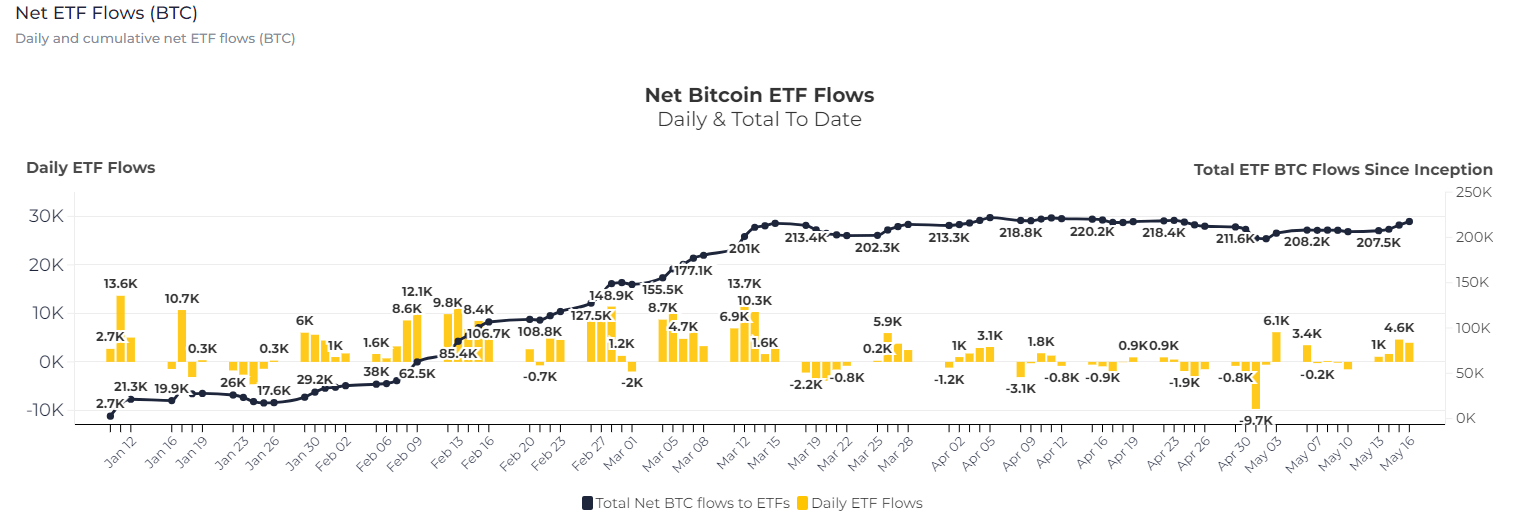

CryptoSlate has covered the news of substantial inflows this week into the BTC ETFs; they have accumulated roughly 11,100 BTC, according to heyapollo data. The on-chain data suggests that an additional 9,000 BTC on a net basis has been acquired from other sources, potentially reflecting broader institutional or individual investor interest.

The post Short-term Bitcoin holders increase by 20,000 BTC this week, with just over 50% from US ETFs appeared first on CryptoSlate.