- June 10, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Investor confidence in crypto-related investment products surged last week, buoyed by the US macroeconomic situation.

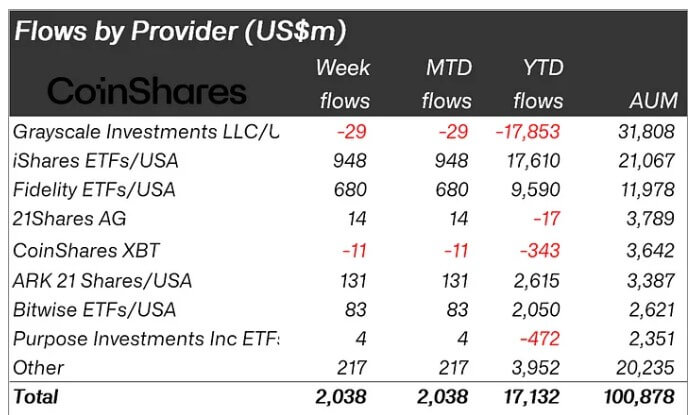

In its latest weekly report, CoinShares observed that these financial instruments saw net inflows of $2 billion last week, matching the total inflows recorded for May.

Additionally, this marks the fifth consecutive week of positive inflows, with the assets drawing around $4.3 billion worth of investments during the period. Notably, this is the second-longest streak of inflows since the US Securities and Exchange Commission (SEC) approved spot Bitcoin exchange-traded funds (ETF) in January.

James Butterfill, CoinShares’ head of research, noted that inflows were widespread across providers like BlackRock, Fidelity, Proshares, Bitwise, and Purpose, with a notable reduction in outflows from Grayscale.

Butterfill explained that the inflows could be attributed to the “weaker-than-expected US macro data,” which has raised expectations for monetary policy rate cuts. He added:

“[The] positive price action saw total assets under management (AuM) rise above the $100 billion mark for the first time since March this year.”

Meanwhile, trading activity for these investment products surged after weeks of subdued activities. Last week, trading volume was boosted by 55% to $12.8 billion, significantly exceeding the $8 billion recorded in the prior week.

Bitcoin, Ethereum drive flows

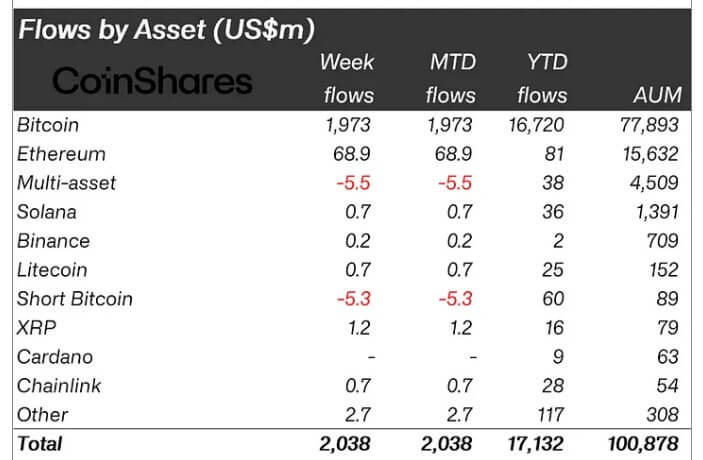

Bitcoin (BTC) remains a crucial interest for investors, registering $1.9 billion in inflows. Meanwhile, short BTC products experienced outflows for the third consecutive week, totaling $5.3 million.

Ethereum (ETH) saw a significant resurgence, with $69 million in inflows, marking its best week since March. This pushed ETH’s year-to-date flows to $81 million, recovering from earlier losses before the SEC approved several spot Ethereum ETF 19b-4 filings.

Other significant altcoins had minor activities, with inflows under $1 million. However, Fantom and XRP stood out, recording inflows of $1.4 million and $1.2 million, respectively.

The post Crypto investments soar with $2 billion inflow amid US macroeconomic shifts appeared first on CryptoSlate.