- June 11, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

When analyzing the DeFi market, Solana is almost exclusively compared to Ethereum. Both are Layer 1 networks, and Solana is often perceived as an alternative to Ethereum, which yields an interesting market perspective.

However, comparing Solana to Base makes more sense as the two blockchains are similar in the type of activities and user engagement they foster.

Both Solana and Base cater to a rapidly growing user base with a strong emphasis on dApps. Despite their different layers, Solana and Base attract similar DeFi projects, gaming applications, and NFT marketplaces. This convergence of use cases creates a comparable landscape in terms of user interaction, transaction volume, and ecosystem development.

Furthermore, the innovation and adoption patterns we’ve seen on Solana and Base show a parallel in their communities and developer engagement. Solana’s focus on scalability and speed has drawn a wide array of projects looking to leverage these advantages for complex dApps and high-frequency transactions.

Similarly, Base offers a solution to Ethereum’s scalability issues, enabling a more efficient and cost-effective environment for similar projects. The critical distinction lies in the nature of the network activity — both prioritize user experience and transaction efficiency, leading to a thriving ecosystem of DeFi and NFT activities that are more reflective of each other than Ethereum’s broader and more established infrastructure.

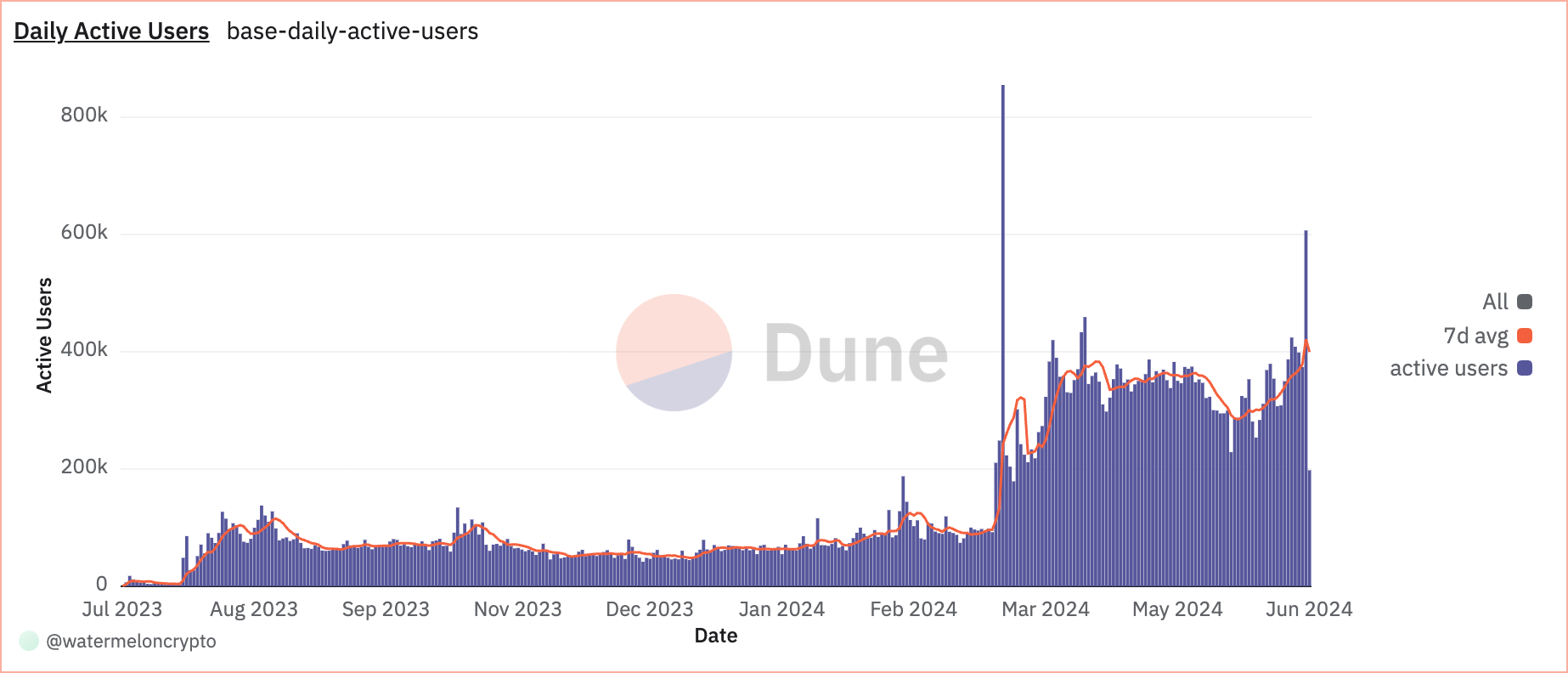

Despite some Base metrics being lower than Solana’s, the data points to a rapid and explosive growth trajectory for Base. For instance, Base’s daily active users have increased from 437,214 on June 7 to 642,630 on June 9. This rise shows a clear surge in user engagement and growing interest in the platform.

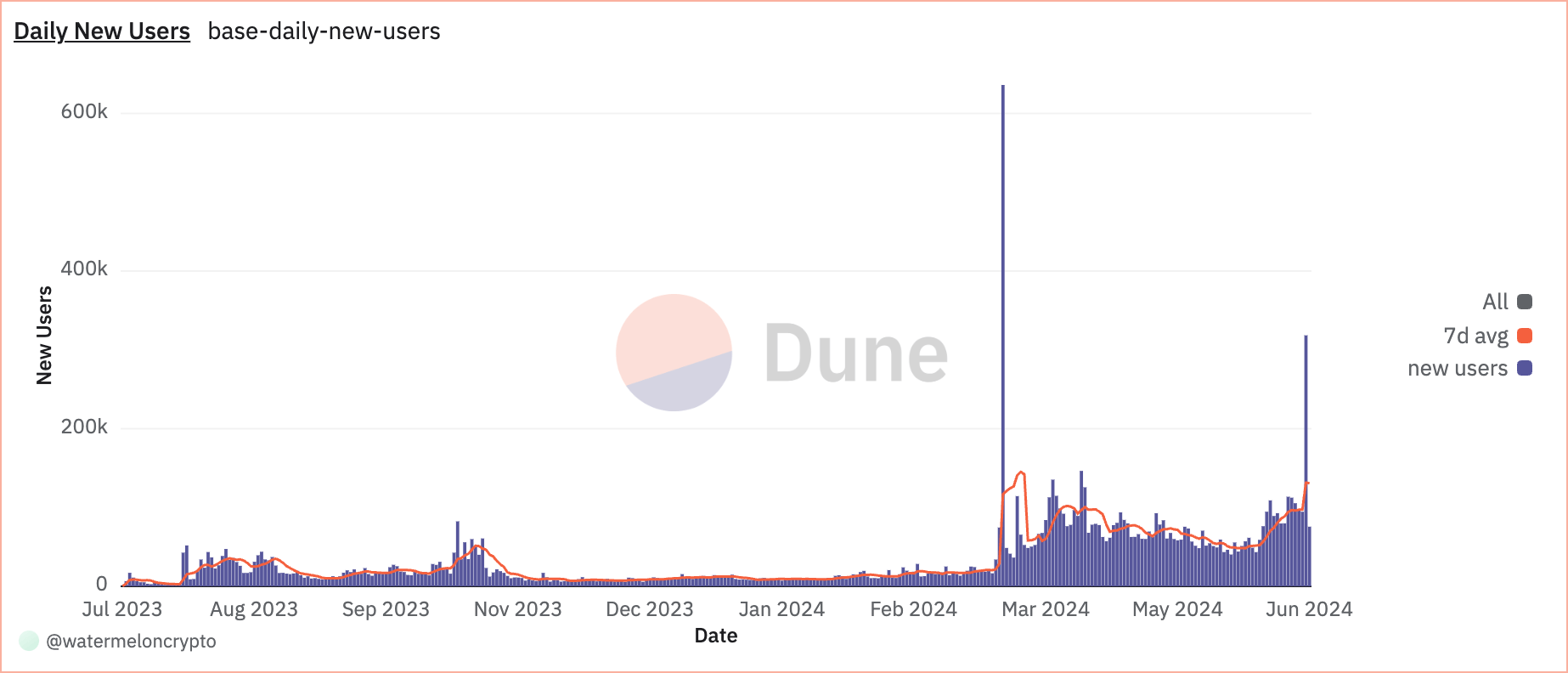

The number of daily new users increased from 108,528 on June 7 to an impressive 334,702 on June 9, further illustrating the rate of adoption Base is seeing.

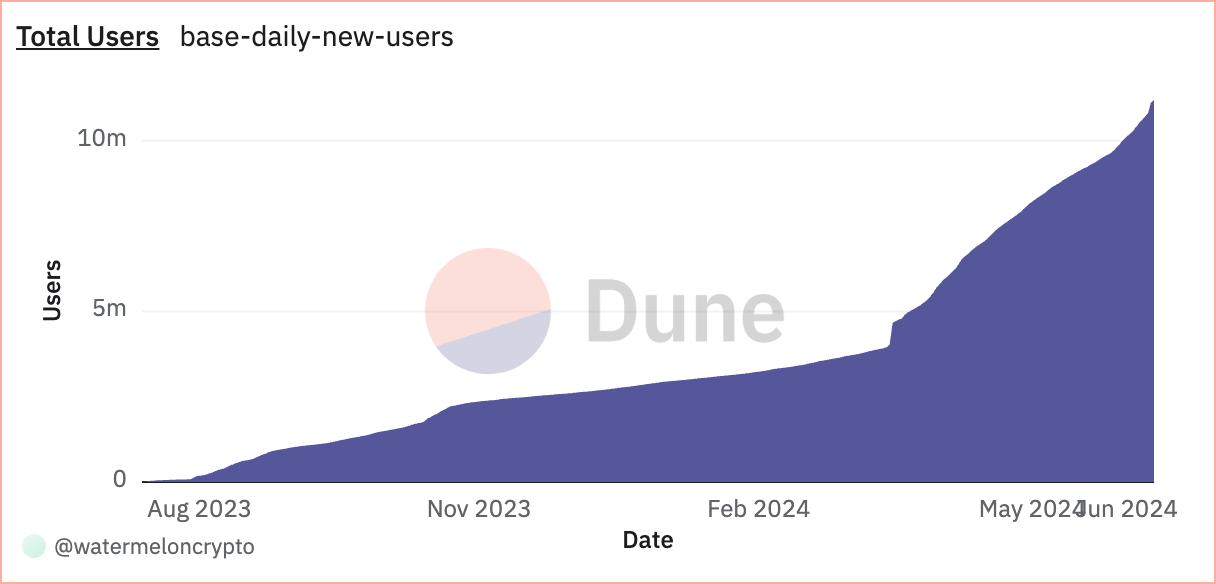

Cumulatively, Base’s user base has grown from 12.199 million to 12.641 million within the same three-day period.

In terms of transactions, Base demonstrates a healthy activity level, with daily transactions that ranged from 2.339 million to 2.766 million over the weekend.

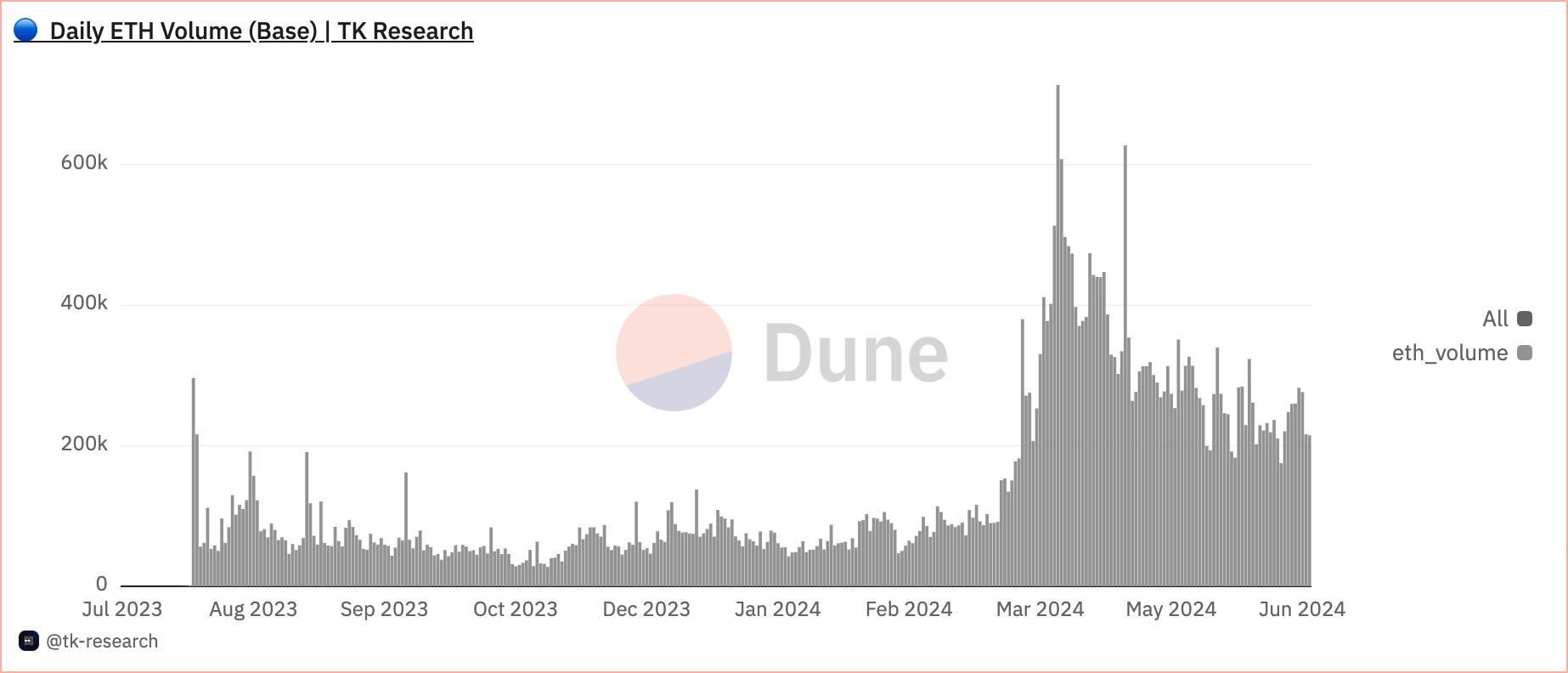

The cumulative transaction count rose from 266.369 million to 271.247 million, reflecting sustained usage and interaction with the platform. While the daily ETH volume on Base has shown a slight decline from 276,392 ETH to 214,792 ETH, this metric still represents significant transactional value.

The total value bridged remains stable, with a slight increase from $2.060 billion to $2.074 billion. Meanwhile, active addresses reached 501,909 on June 9, and the total value locked on Base is reported at $1.783 billion, showcasing substantial financial activity and commitment from its users.

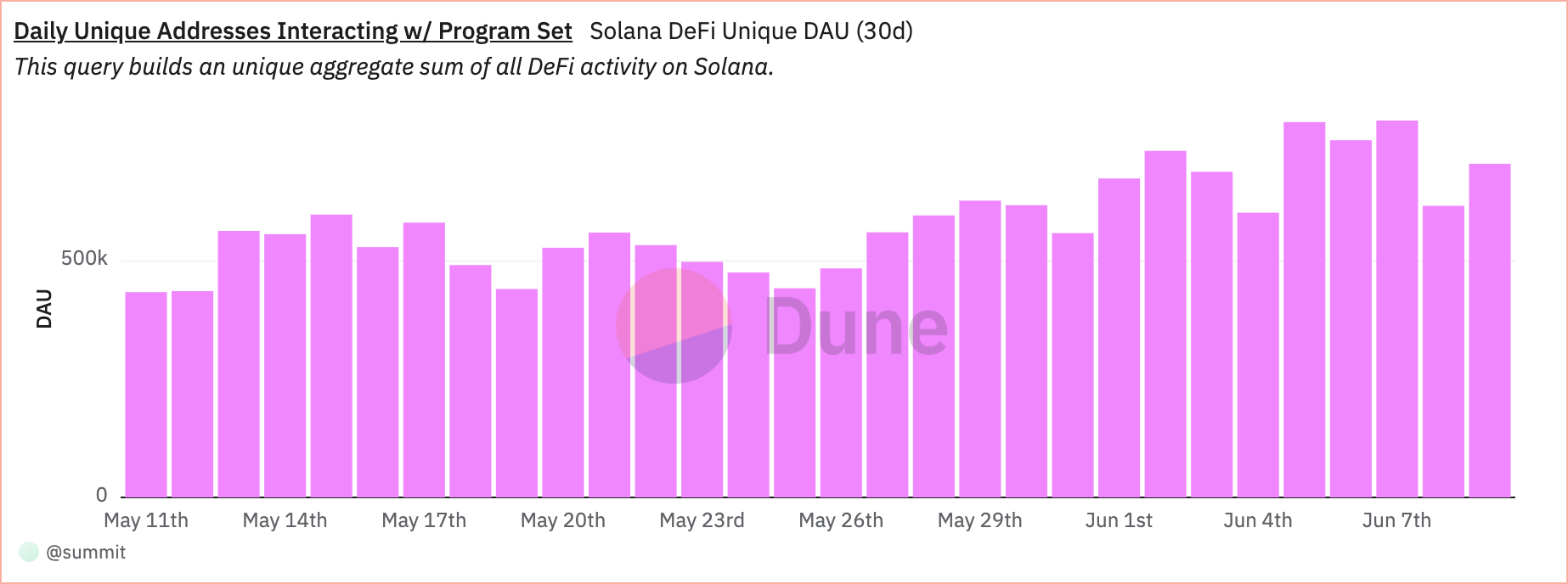

Looking at Solana, we can see a significantly higher number of daily unique addresses. The larger number is no surprise, given its extended presence and popularity in the market.

Between June 7 and June 9, the number of unique addresses interacting with the program set fluctuated from 796,985 to 705,523.

Data from DeFi Llama showed over 930,000 addresses active on Solana in the past 24 hours, with its TVL standing significantly higher than Base at $4.546 billion. However, it’s important to contextualize these numbers. Solana has been in the market longer, thus naturally accruing a larger user base and higher locked value over time.

Despite being lower in absolute terms, the metrics for Base reveal an accelerated growth rate, which is remarkable for a newer platform. This explosive growth is particularly evident in the sharp increase in new users and transactions within a short period, indicating a rapidly expanding ecosystem.

The post Newcomer Base challenges Solana with rapid adoption appeared first on CryptoSlate.