- June 19, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

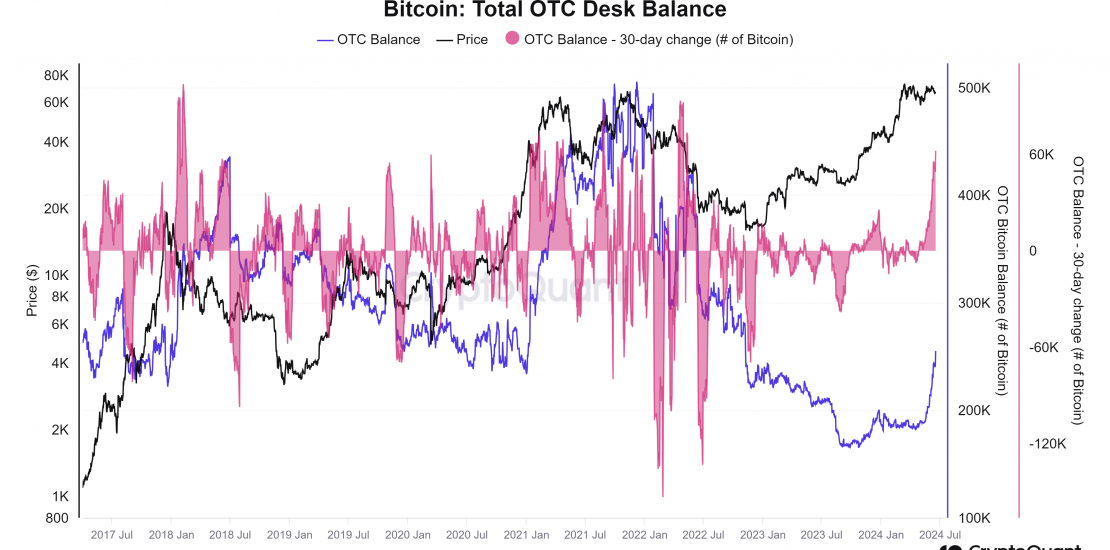

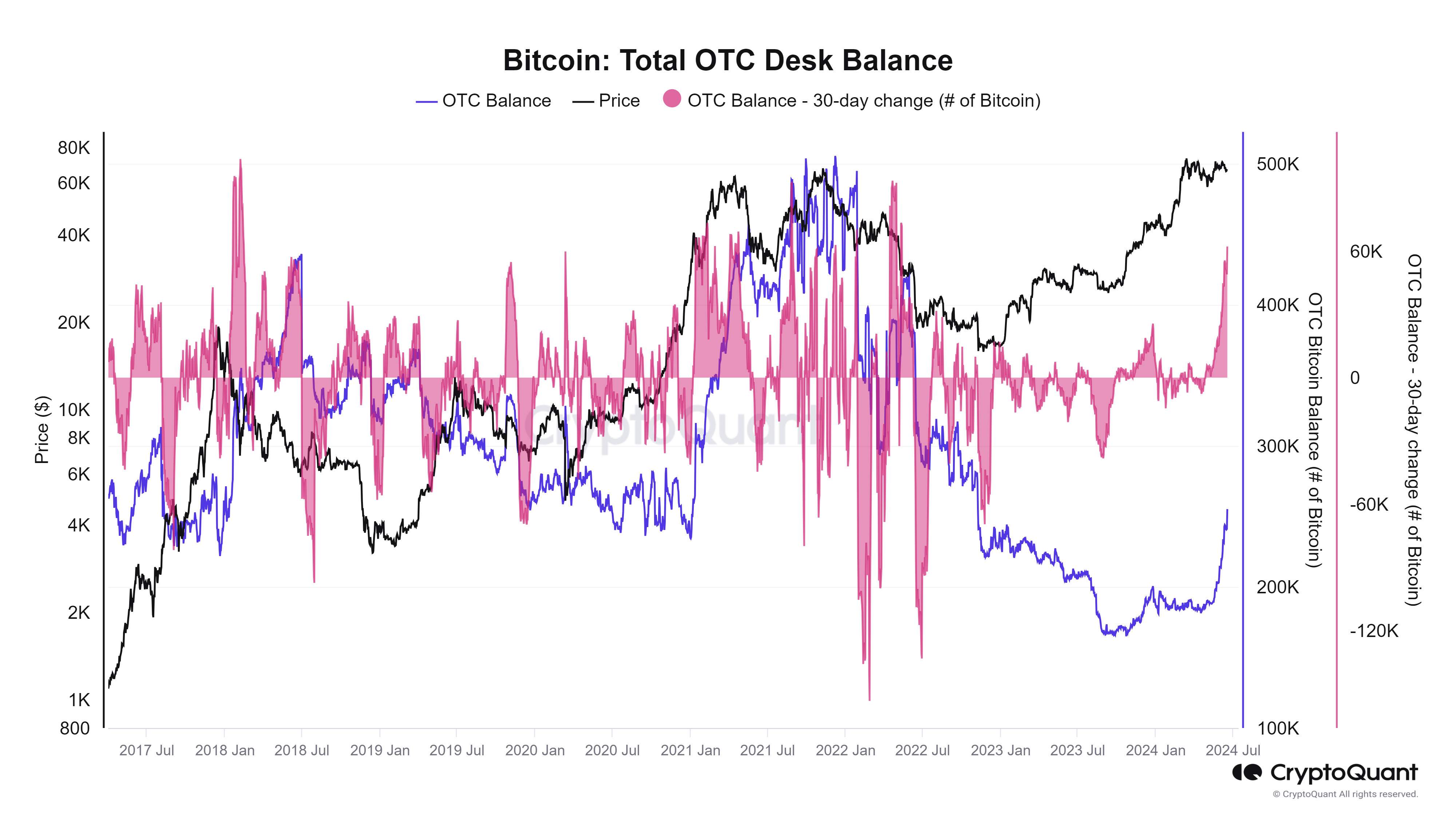

CryptoQuant data shows that OTC (over-the-counter) desk balances have surged to 255,000 BTC (BTC), a level last observed during the FTX collapse in November 2022. This increase in OTC balances is typically associated with downward pressure on BTC prices or local tops. Historically, during the 2021 bull run, OTC desk balances rose as smart money sold into the rally. Conversely, during the 2022 bear market, these balances decreased as accumulation occurred while prices were suppressed.

In October 2023, the OTC desk balance stood at 168,000 BTC, growing by approximately 85,000 BTC by June 17, 2024. The recent 30-day change, adding over 62,000 BTC, is one of the highest levels since mid-2018 and 2021, highlighting significant market movements.

Other headwinds are occurring, such as the basis trade in relation to ETF inflows, suggesting these may not be as impactful as data might imply.

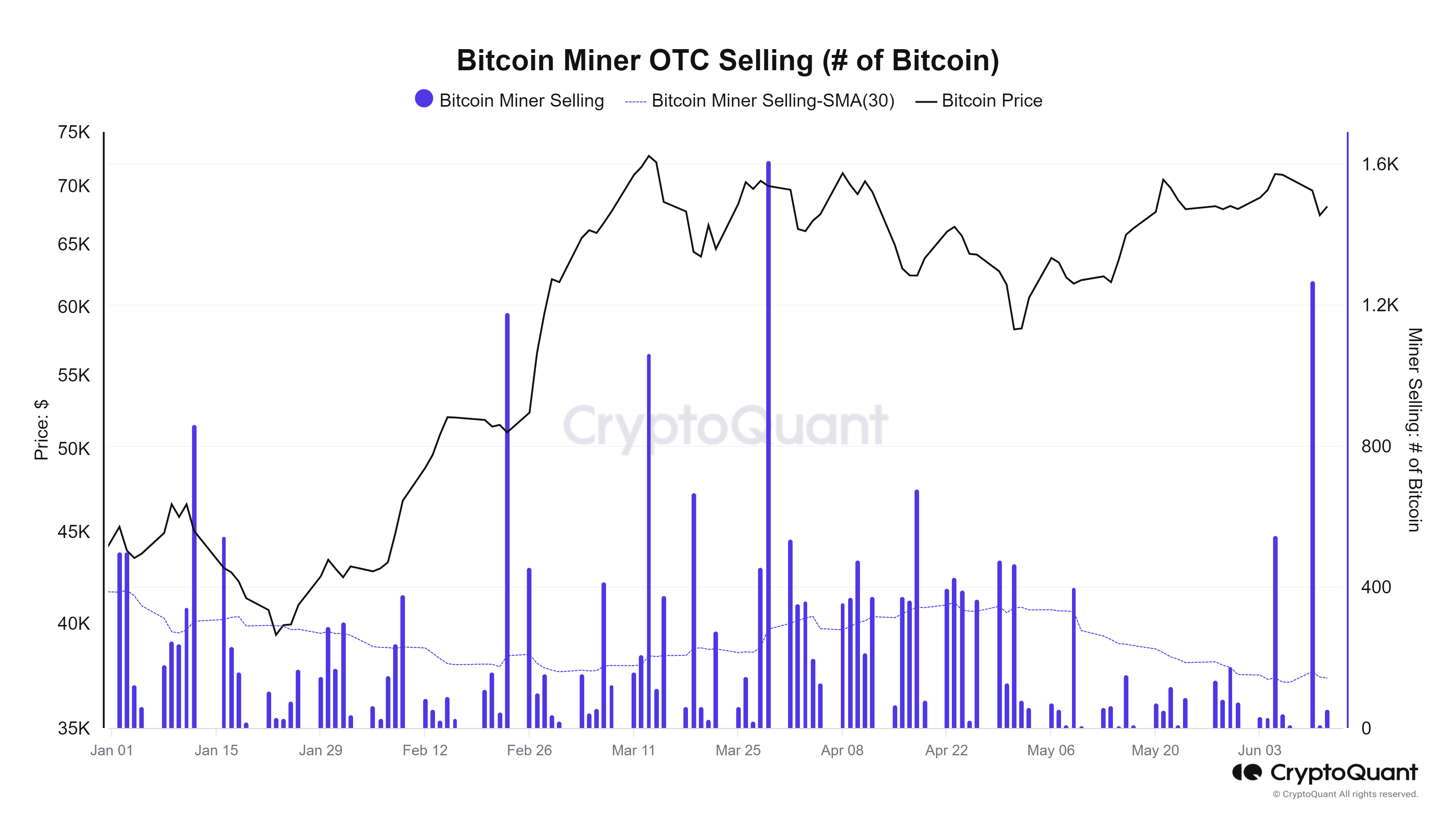

Furthermore, CryptoSlate notes an ongoing mining capitulation, where miners are selling off Bitcoin. Data from CryptoQuant supports this, showing over 1,200 Bitcoin sold via OTC on June 10, the second most significant sell-off in one day in 2024. This combination of factors suggests a complex and potentially bearish market outlook for Bitcoin in the near term.

The post Bitcoin OTC balances spike by 62,000 BTC in 30 days, highest since 2021 appeared first on CryptoSlate.