- July 2, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

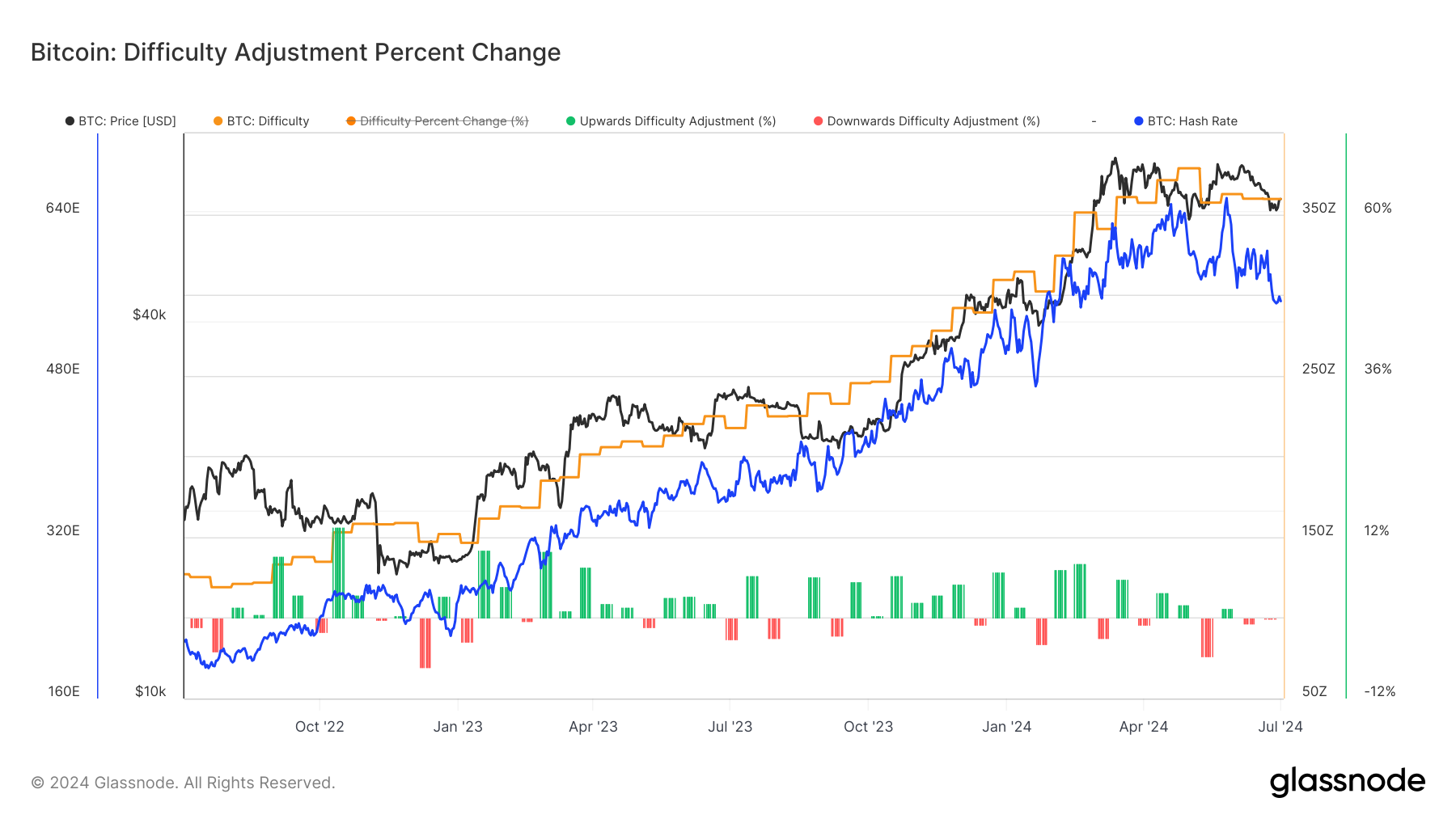

According to Newhedge, Bitcoin mining difficulty is anticipated to adjust negatively by 6% on June 5, marking one of the most significant drops since the FTX collapse. At the beginning of December 2022, there was a notable -7.3% decline, coinciding with Bitcoin’s price plummeting to $15.5k during the FTX crisis, which marked the cycle’s bottom.

The hash rate had dipped to a low of 222 EH/s but subsequently surged to an all-time high of 647 EH/s post-halving in May 2024, around the time miner capitulation began.

Just before this hash rate peak in May, there was a 5.6% difficulty decline, which coincided with the May 1 Bitcoin low of approximately $56,500.

Currently, the hash rate has dropped to 553 EH/s, mirroring levels seen in February. This upcoming adjustment will be only the 14th negative adjustment since the FTX collapse, highlighting the resilience of the hash rate despite these fluctuations.

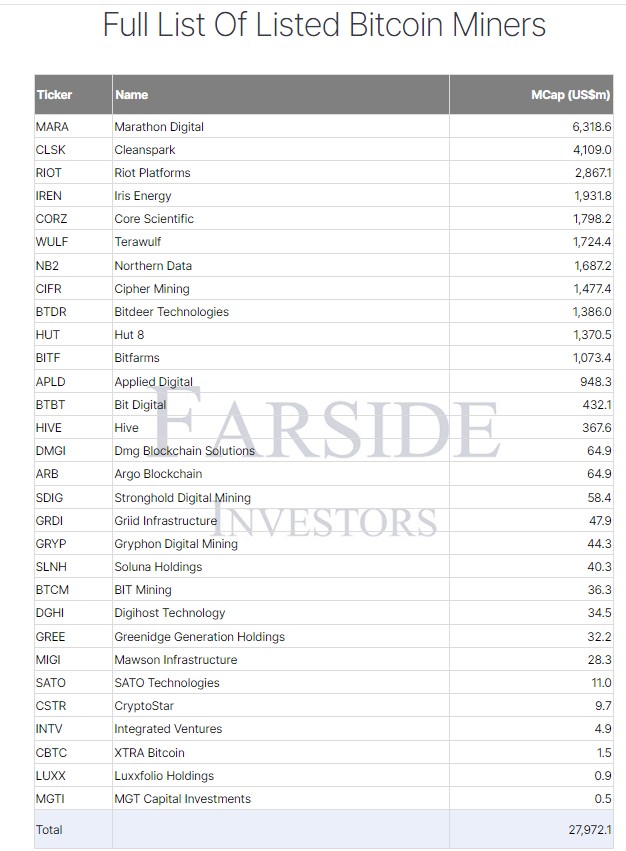

This upcoming difficulty adjustment will serve as an additional tailwind for publicly traded miners, whose market cap exceeded $25 billion in the last week of June and, according to Farside data, is already at $28 billion.

The post Bitcoin mining difficulty is anticipated to drop by 6%, marking one of the most significant declines since the FTX collapse appeared first on CryptoSlate.