- February 16, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

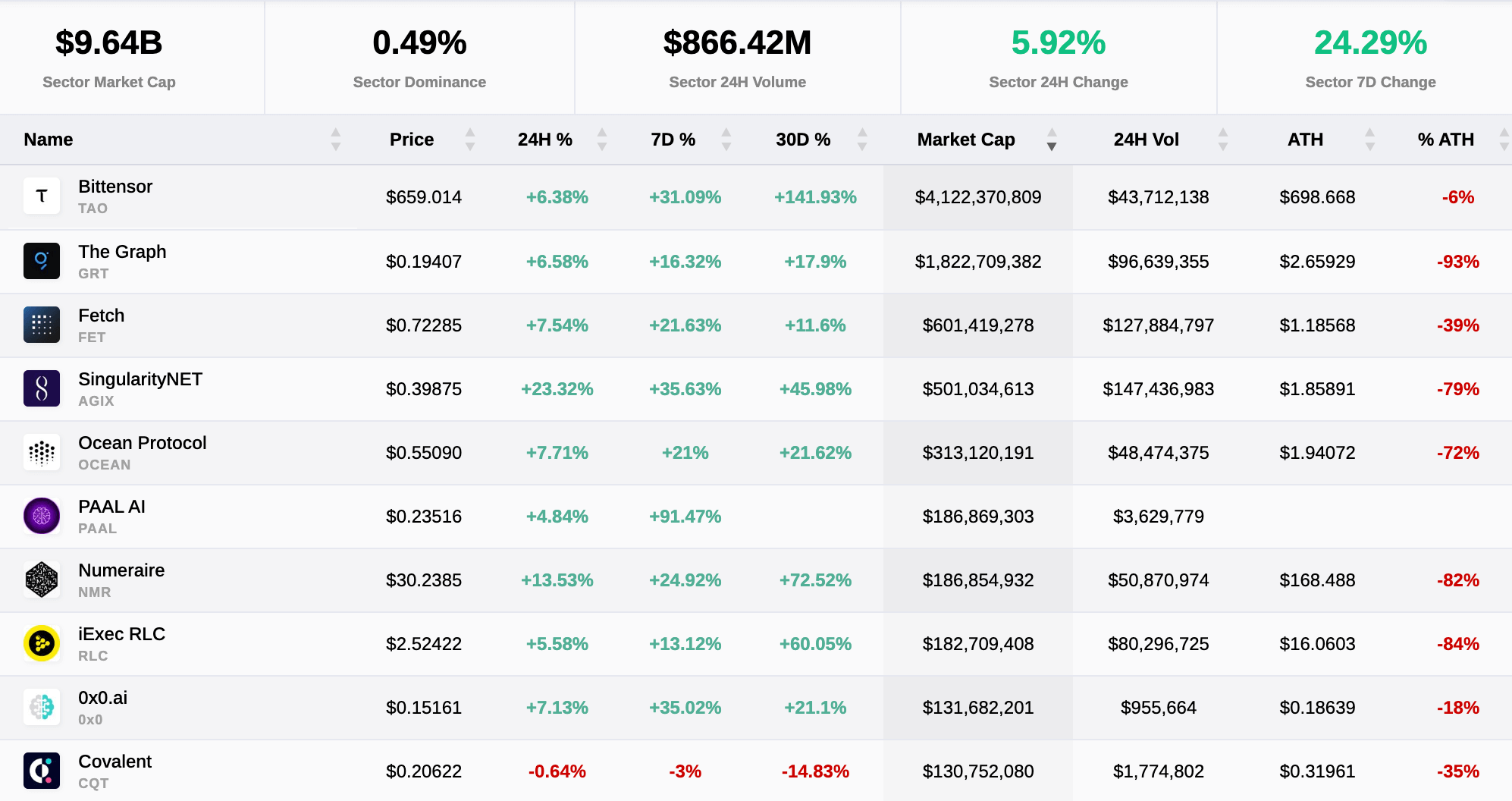

The AI blockchain sector is closing in on a $10 billion market cap following the meteoric surge of Bittensor, which is up 140% over the past 30 days. Native token TAO surpassed $4 billion in market cap, reaching an all-time high on Feb. 15 of $698 before retracing to around $659 as of press time.

The top five AI crypto projects by market cap are Bittensor, The Graph, Fetch.ai, SingularityNET, and Ocean Protocol. All five are up over 10% in the last seven days, with Bittensor and SingularityNET up 31% and 35%, respectively.

Bittensor (TAO)

Bittensor is a Polkadot substrate-based project that merges blockchain technology and AI to create a decentralized machine learning network. This initiative is designed to revolutionize the development and utilization of machine learning platforms by decentralizing the process and fostering a collaborative environment where the collective intelligence of AI models can be harnessed and shared. At the heart of Bittensor’s ecosystem is the TAO token, which incentivizes the contributions of developers and the quality of their models, essentially acting as a measure of the network’s collective intelligence and knowledge.

The Graph (GRT)

The Graph is designed for indexing and querying data from blockchains, making it easier to retrieve complex information that is difficult to query directly. It is a critical layer for decentralized applications (dApps) needing to access blockchain data efficiently. The Graph uses GRT, its native token, to incentivize data indexing and querying. Projects with intricate smart contracts, such as Uniswap and various NFT initiatives, benefit significantly from The Graph’s ability to facilitate complex data queries beyond basic blockchain-read operations.

Fetch.ai (FET)

Fetch.ai integrates artificial intelligence to automate and optimize various tasks and processes across multiple sectors, including transportation, supply chain, and healthcare. It aims to create a decentralized digital economy powered by autonomous software agents. These agents can perform tasks autonomously, facilitating a self-sustaining economy. The FET token, an ERC-20 utility token, is used within the Fetch.ai ecosystem to power transactions and computational services. Fetch.ai’s technology is relevant for many industries, aiming to revolutionize them by leveraging AI and machine learning.

SingularityNET (AGIX)

SingularityNET is a decentralized AI marketplace that allows for creating, sharing, and monetizing AI services at scale. It uses AGIX, its utility token, for transactions, decentralized governance, and incentivizing the provision of platform liquidity. The platform supports a diverse range of AI services and enables developers to publish their AI services, which can then be integrated into various applications. SingularityNET aims to facilitate the development of Artificial General Intelligence (AGI) to create a beneficial technological singularity. It emphasizes an ethics-first approach, making AI technologies accessible and practical for all.

Ocean Protocol (OCEAN)

Ocean Protocol seeks to democratize data, making it accessible for individuals and businesses to share and monetize their data and data-based services. The protocol provides a secure platform for data exchange. It aims to unlock the value of data by enabling data owners to control their data while making it available for consumption. By facilitating a secure and transparent data-sharing environment, Ocean Protocol aims to power a new data economy where data can be freely shared and monetized, fostering innovation and driving growth across various industries.

Global surge in AI investments continues

As NVIDIA, a critical cog in the ‘AI hype wheel,’ approaches its earnings report on Feb. 21, anticipation for continued record returns is high among investors. NVIDIA has seen significant growth over the past year, with its stock price increasing by 230.23%. The company’s previous earnings report exceeded expectations, with earnings of $4.02 per share compared to estimates of $3.36, reflecting a positive earnings surprise of 19.64%. The company is expected to report $4.52 per share for the upcoming earnings release, representing a year-over-year increase of 413%.

Other AI-adjacent companies, such as those in the semiconductor sector, have also rallied throughout 2024. For example, Taiwan Semiconductor Manufacturing Company (TSM), a major component manufacturer for AI technology, is up 30% since Jan. 1.

Additionally, OpenAI revealed its new text-to-video model, Sora, on Feb. 15, which showcased the ability to create lifelike video scenes of up to 1 minute and multiple camera angles. The example videos were far beyond many current generative video solutions, suggesting another giant leap forward for generative content.

The rapid advancement of centralized AI development may be partly fueled by the resurgence in decentralized AI projects as investors hope to keep pace.

Disclaimer: The author has a small holding of TAO.

The post AI crypto sector nears $10 billion market cap as Bittensor surges 220% in 2024 appeared first on CryptoSlate.