- July 14, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

In the ever-evolving crypto space, stability is a coveted virtue, and stablecoins have played a pivotal role over the past. Yet, a storm could be brewing, casting a shadow of uncertainty over the entire crypto market.

Techteryx Takes Full Charge Over TUSD

Today, the official Twitter account of TUSD an announced that, “effective July 13, 2023, the final stage of TUSD’s international transition will commence and Techteryx will assume full management of all offshore operations and services related to TUSD, including minting and redemptions […] Plus customer onboarding and compliance, as well as fiat reserve and supervision of all banking and fiduciary relationships.”

1/

#TrueUSD Announcement:

In December 2020, TrueCoin, LLC (a subsidiary of Archblock, Inc.) transferred the business ownership of TrueUSD (“TUSD”) to Techteryx, an Asia-based consortium.

— TrueUSD (@tusdio) July 14, 2023

The completion of this transfer of power, coupled with the lack of transparency and information surrounding Techteryx, are raising red flags, as the renowned research firm Kaiko stated yesterday:

While Circle has made huge efforts to improve USDC transparency (and even Tether has made some efforts over the past year), the relatively unknown TUSD is today posing the biggest risk, offering the least information about its reserves or corporate structure.

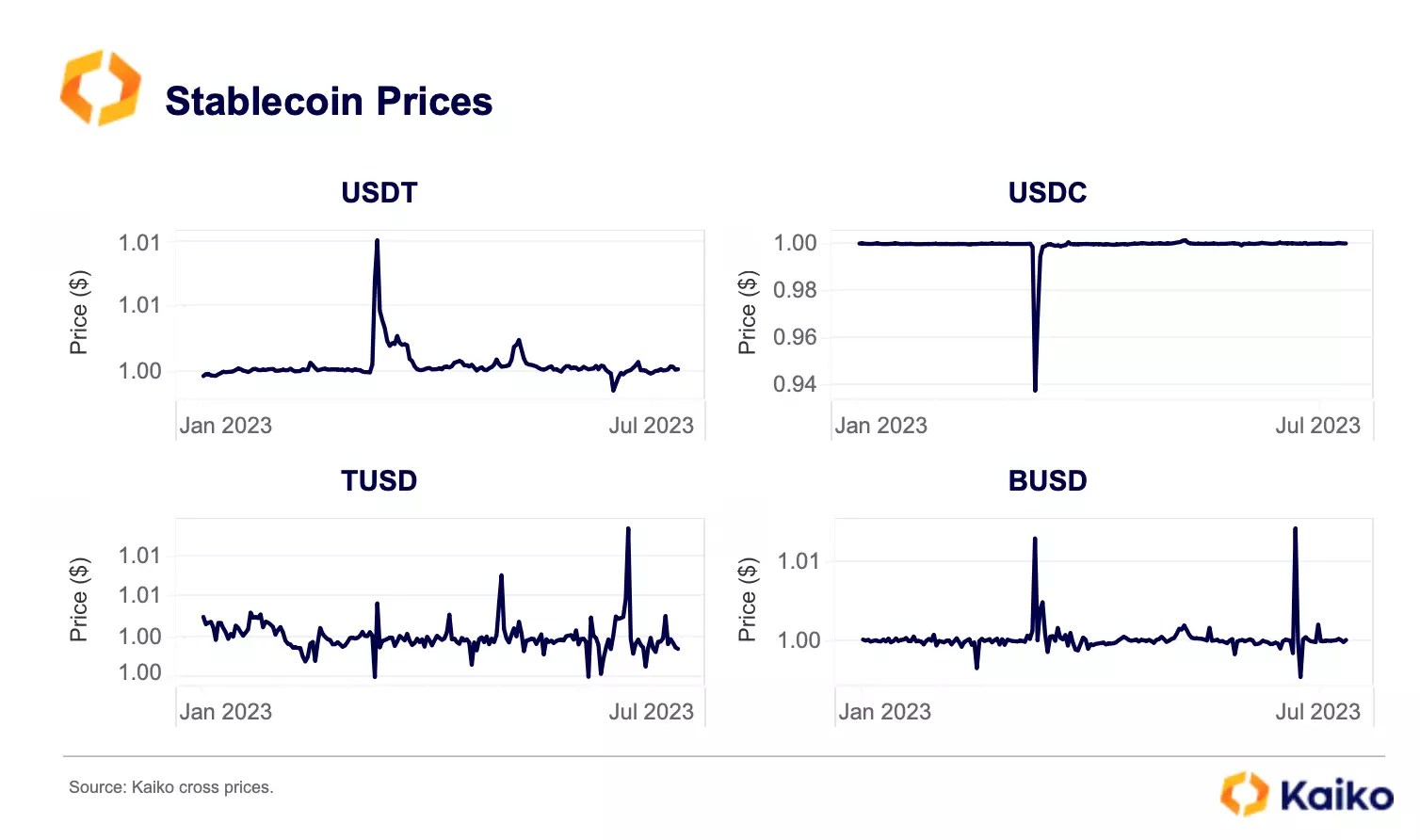

As stablecoins are systemically important in crypto markets, any disturbance in their peg or instability can trigger mass market contagion. The volatility of stablecoins such as TUSD, USDT, BUSD, and USDC has sent shockwaves through the crypto ecosystem in 2023.

Risks For The Crypto Market

However, TUSD’s offshore transition amplifies the magnitude of this risk, especially with regards to the growing market share due to Binance. “While TUSD is not yet a systemically important stablecoin, Binance is an extremely influential exchange, so any activity on it should be scrutinized,” says Kaiko.

The lack of clarity surrounding TUSD’s reserves and corporate structure adds to the already mounting concerns. Kaiko warns, “While upcoming regulation in the European region puts pressure on stablecoins to clean up their governance, there is still a long way to go.” The European Banking Authority’s call for stablecoin issuers to comply with the upcoming MiCA regulation further underscores the urgency to address these transparency issues.

Tether’s market share has long been unrivaled. However, the unexpected rise of TUSD has shaken the status quo. Within a short span of three months, TUSD’s market share climbed from less than 1% to a staggering 19%. Binance’s support, particularly through its zero-fee BTC-TUSD pair, played a pivotal role in this meteoric ascent.

Nonetheless, the sudden prominence of TUSD raises a critical question: What are the risks for the crypto market associated with a stablecoin that lacks transparency?

Remarkably, the concerns about TUSD are not new. As Bitcoinist reported, TUSD saw a wave of criticism due to doubts about its stability following concerns over its custodian, PrimeTrust. Adam Cochran, a partner at Cinneamhain Ventures, pointed out several red flags surrounding TrueUSD.

Among them: The auditor responsible for certifying Prime Trust’s USD audits is the same person involved in the FTX scandal. TUSD’s chain oracle, which verifies reserves, consists of only 17 nodes from a single source.

Crypto Market Rallies

With Ripple’s victory against the SEC, the overall crypto market cap has surged, with yearly highs continuing to act as upside resistance.