- July 10, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Last week, Bitcoin and the crypto market continued their sideways trend. While Bitcoin has been consolidating in the trading range between $29,800 and 31,300 for more than two weeks now, most altcoins have followed this trend, with a few exceptions.

However, the coming days have the potential to bring new momentum to the market. This week, Bitcoin and crypto investors need to watch out for three key macro events: The release of the US Consumer Price Index (CPI) and the US Producer Price Index (PPI) for June, as well as the consumer sentiment data will set the tone for the market.

The Most Crucial Day For Bitcoin And Crypto This Week

On Wednesday, July 12 (8:30am EST), the highly anticipated US Consumer Price Index (CPI) data for June will be released, making this the most important day of the week. In May, consumer prices had come in below experts’ expectations at 4.0% instead of the expected 4.1%.

For June, market experts expect the headline CPI to fall further to 3.1 %. If this forecast proves accurate, it could improve the Federal Reserve’s (Fed) chances of continuing its pause in rate hikes at the end of July. Falling inflation could provide a favorable environment for the financial market and encourage a new uptrend in Bitcoin and crypto prices.

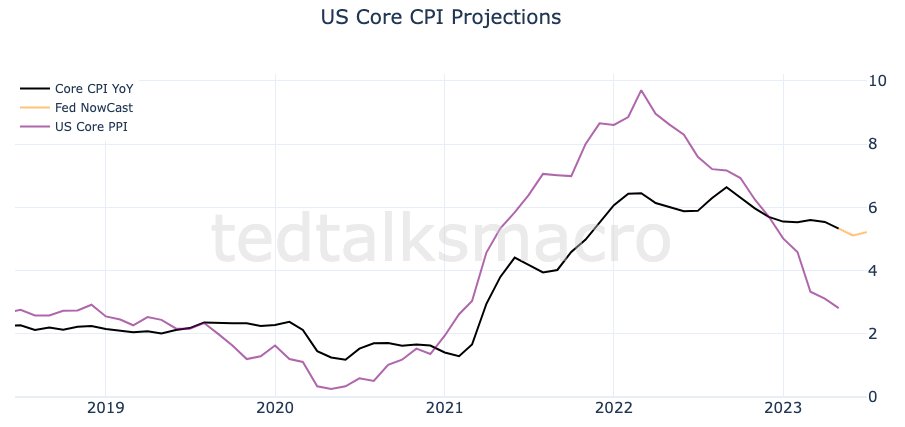

However, core CPI is likely to become more important than headline CPI. While headline inflation has fallen sharply due to the normalization of supply chain issues and is very quickly approaching the Fed’s 2% target, core inflation is a different story.

During recent public appearances, Fed members continued to express a hawkish stance and expressed concern about a possible resurgence of inflation. The underlying fear is based on the fact that inflation has been falling primarily due to fixing supply chain problems, while core inflation remains high.

Rising wages could lead to an upward spiral in sticky core inflation. While core CPI stood at 5.3% in May, experts now expect a slow decline to 5.0% in June after all. Any positive surprise to the downside is likely to be a much-welcomed gift to the financial markets, triggering a rally in the Bitcoin and crypto markets.

According to the CME FedWatch Tool, the probability of an additional rate hike by the Federal Reserve on July 26 is currently at a significant 93%. This probability is likely to drop massively if the core CPI surprises to the downside.

Macro analyst Ted aptly captures the essence of the market’s focus, stating, “Core remains the concern for the market, and I’d anticipate the market gives it more weight in its reaction on Wednesday.”

PPI And Consumer Sentiment Data

The US PPI figures for June, due on Thursday, July 13 at 8:30 am EST, are expected by analysts to show a significant month-on-month increase from -0.3% to +0.2%. It is important to note that experts’ estimates on producer prices have been prone to inaccuracies in recent months, often rating them higher than the actual outcomes.

However, if the price increases align with expectations, it could lead to a positive reaction from the US dollar, potentially exerting downward pressure on stock and crypto markets. On the contrary, if the producer price indices fall below market experts’ estimates and the US dollar continues its recent weakening trend, this could alleviate pressure on Bitcoin and crypto. Consequently, the market might experience a bullish price reaction, providing renewed optimism for investors.

On Friday, market participants await the release of consumer confidence and household consumption expectations for July. In June, household confidence stabilized at 61.5, while consumer confidence stood at 64.4.

Analysts anticipate an increase in both figures for July, signaling potential economic stabilization. Positive consumer sentiment would likely have a favorable impact on the financial markets and the crypto sector. Conversely, a decline in consumer confidence could lead to market markdowns.

At press time, the Bitcoin price stood at $30,141, staying inside the trading range of the past two weeks.