- February 9, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

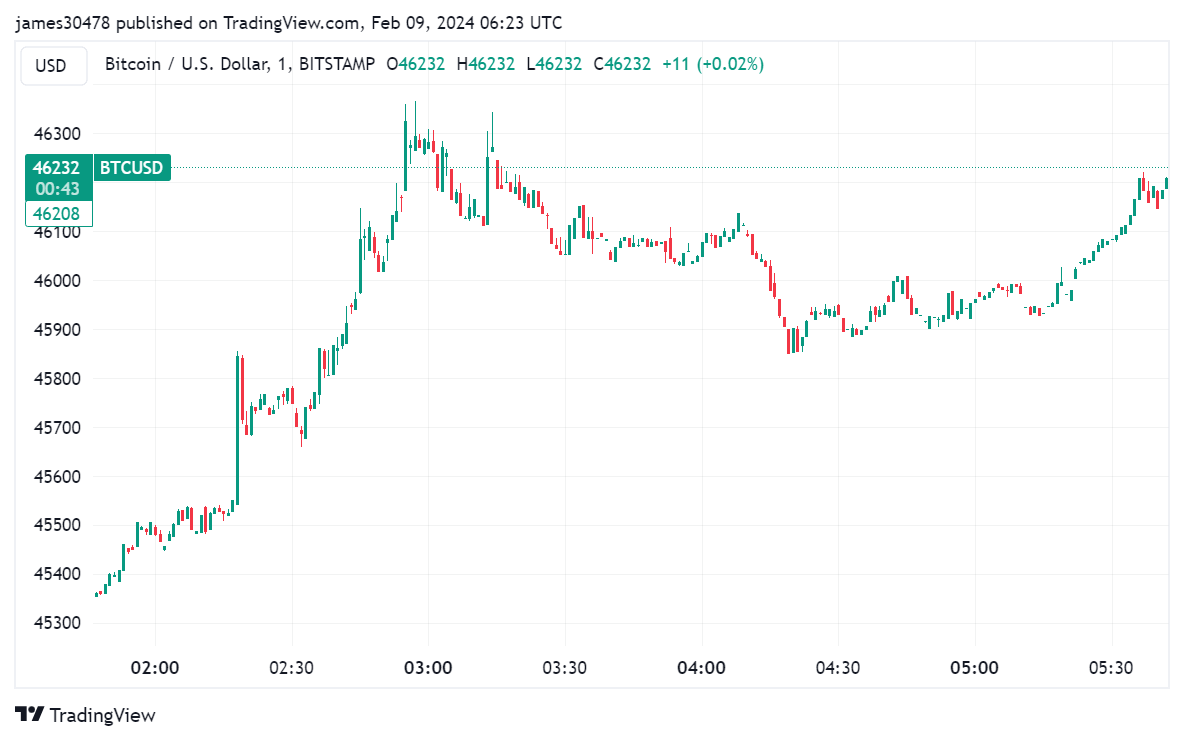

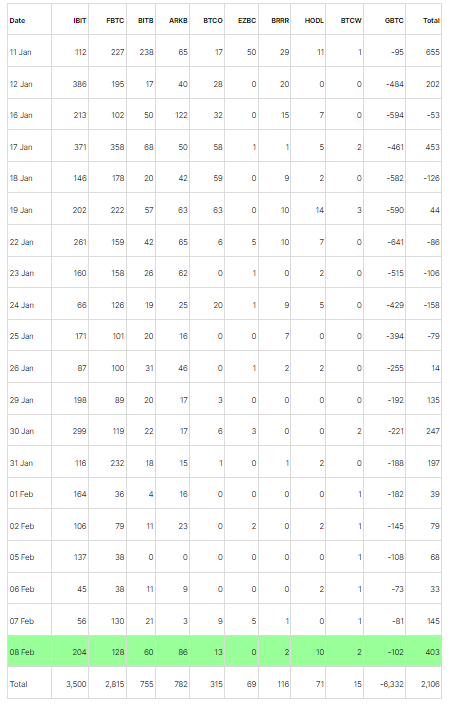

Farside Investors data shows that Bitcoin ETFs marked a significant inflow on Feb. 8 by posting $403 million in net inflows – the highest since Jan. 17. This rally also saw Bitcoin surmount the $46,000 threshold to peak at over $46,300. The bullish trend was considerable across various ETFs. According to Farside Investors, BlackRock’s IBIT led the pack with a remarkable inflow of $204 million, pushing its total net inflow to an impressive $3.5 billion.

Fidelity’s FBTC also demonstrated a noteworthy uptick with $128 million of net inflows, raising its cumulative total to $2.8 billion. Bitwise’s BITB ETF followed closely with a net inflow of $60 million, marking its best day since Jan. 17. ARKB from Ark Investment had its second most robust day with $86 million in net inflows, placing both BITB and ARKB above the $750 million total net inflow mark.

However, it is worth noting that GBTC faced a net outflow of above $100 million, resulting in a cumulative total of $6.3 billion in net outflows. Despite this, the overall trading total for all Bitcoin ETFs now stands at a solid $2.1 billion, signifying the market’s ongoing interest in these investment vehicles.

The post Bitcoin breaks $46,000 amid rampant ETF inflows reaching $403 million appeared first on CryptoSlate.