- March 25, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

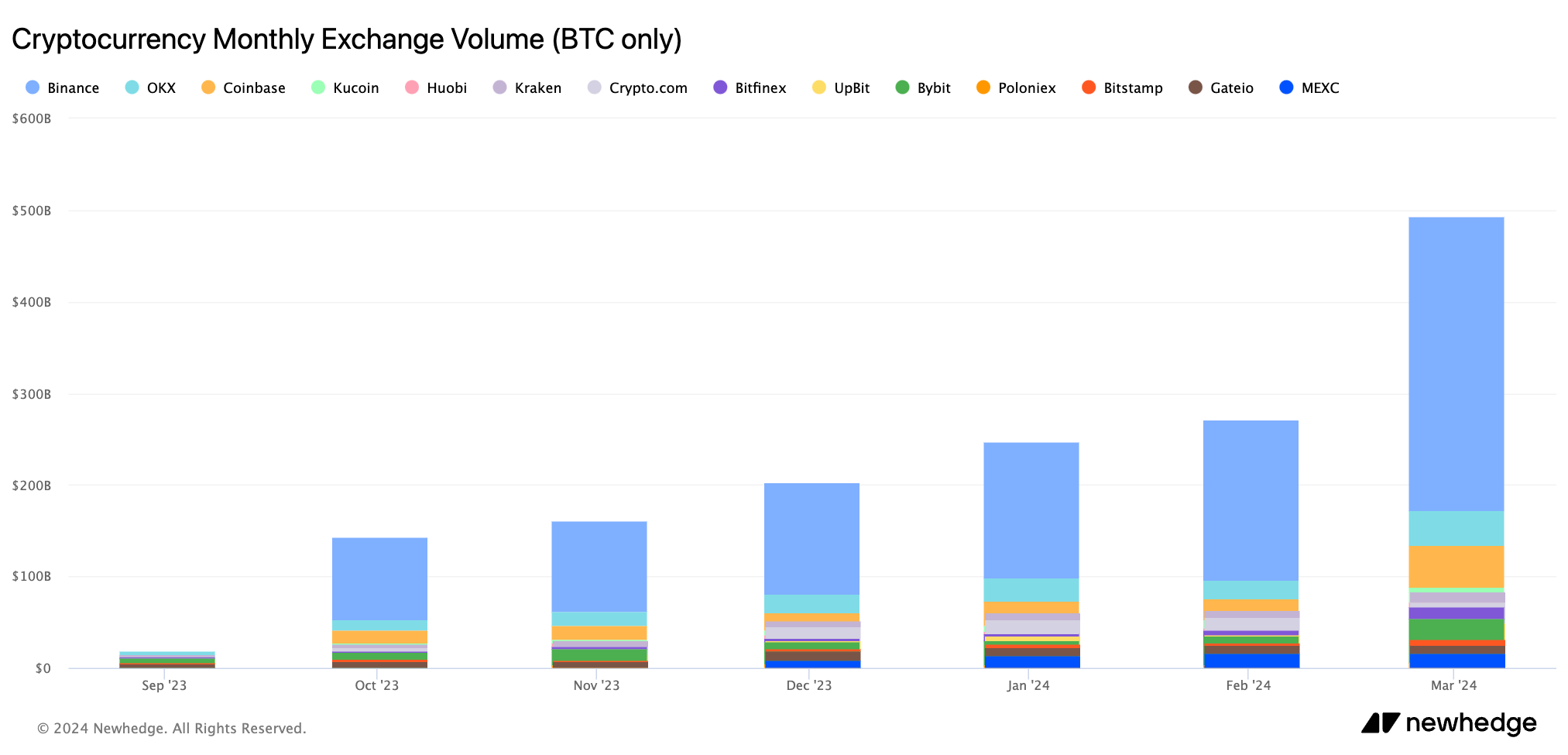

Bitcoin‘s trading volume on centralized exchanges (CEXs) saw a significant spike in March, marking the highest recorded CEX volume since May 2021 — and the month isn’t over yet. Monitoring trading volume on CEXs offers invaluable insights into market sentiment, liquidity, and the overall health of the crypto market.

From September 2023 to Mar. 24, 2024, Bitcoin’s trading volume on CEXs saw an astronomical rise from $18.409 billion to $494.056 billion. This eightfold increase in volume over just seven months is particularly noteworthy, considering Bitcoin’s price escalated from a close of $34,667 in September to over $73,000 in mid-March 2024. Despite a substantial correction, with Bitcoin consolidating at $67,000 by Mar. 23, trading volume continued its upward trajectory, indicating robust market participation and liquidity.

The distribution of this trading volume across various exchanges reveals a surprising trend, especially considering the significant role the US plays in the global crypto market. Despite hosting popular spot Bitcoin ETFs and driving much of the market sentiment, a comparatively small portion of CEX trading volume occurs in the US. On Mar. 24, data showed that 52% of Bitcoin’s total CEX trading volume was on Binance, aligning with the year-to-date average of above 50%. Following legal challenges last fall, Binance saw its BTC trading volume surge from $91.9 billion in October 2023 to $321.6 billion in March 2024, with the month yet to close.

In contrast, Coinbase accounted for only 4.22% of the total CEX trading volume, ranking third overall, while OKX held the second position with just 6.41% of the total BTC trading volume. This dominance of Binance, raking in hundreds of billions in BTC volume, highlights its continued dominance in the CEX landscape, consistently accounting for half of the trading volume on centralized exchanges.

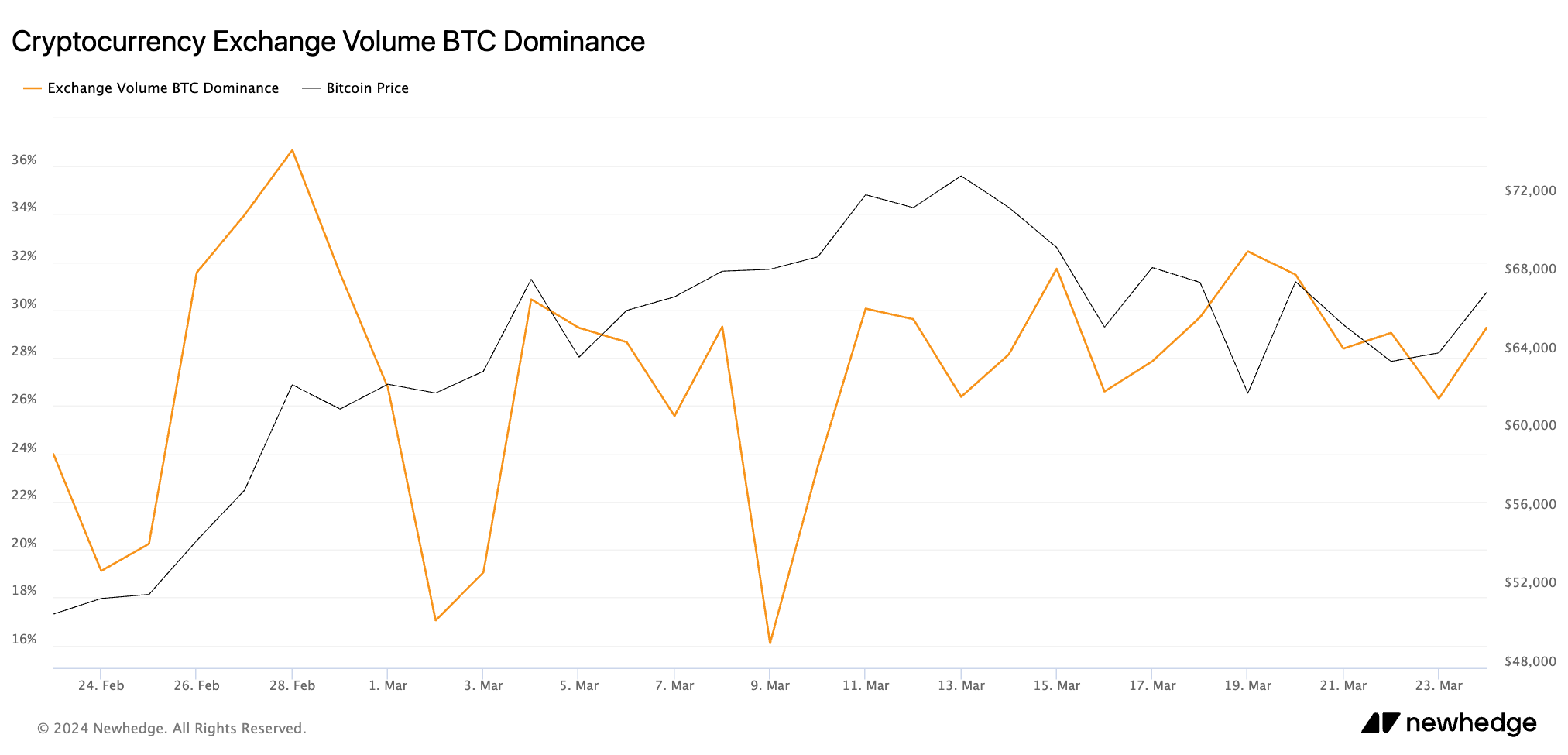

Binance’s position becomes even more pronounced when considering Bitcoin’s trading volume relative to the rest of the market. As of Mar. 24, Bitcoin represented just over 29% of the total crypto trading volume on CEXs, according to data from Newhedge. Despite the emergence of numerous altcoins and the growth of DeFi platforms, CEX volumes remain a critical gauge of market sentiment and an integral component of the crypto market infrastructure.

The significant price correction after Bitcoin’s peak in early March, coupled with the sustained increase in trading volume, suggests a market that, despite its inherent volatility, is moving towards greater resilience and stability over the long term. This indicates a maturing market landscape, where increased participation and liquidity contribute to a more stabilized price environment capable of absorbing market shocks and fluctuations.

The post Bitcoin CEX trading volume hits record high in March appeared first on CryptoSlate.