- December 20, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

As Bitcoin’s market cap rises, comparing Bitcoin’s price to that of gold becomes increasingly relevant. This comparison is embodied in the BTC/GOLD ratio, a metric that divides the price of Bitcoin by the price of gold per ounce.

The significance of the ratio lies in its ability to indicate shifts in investor preference and market dynamics. A rising ratio suggests a growing preference for Bitcoin over gold, often reflecting investor confidence in Bitcoin as a hard asset and a hedge against inflation. Conversely, a declining ratio can signal increased confidence in gold or a cautious approach towards digital currencies.

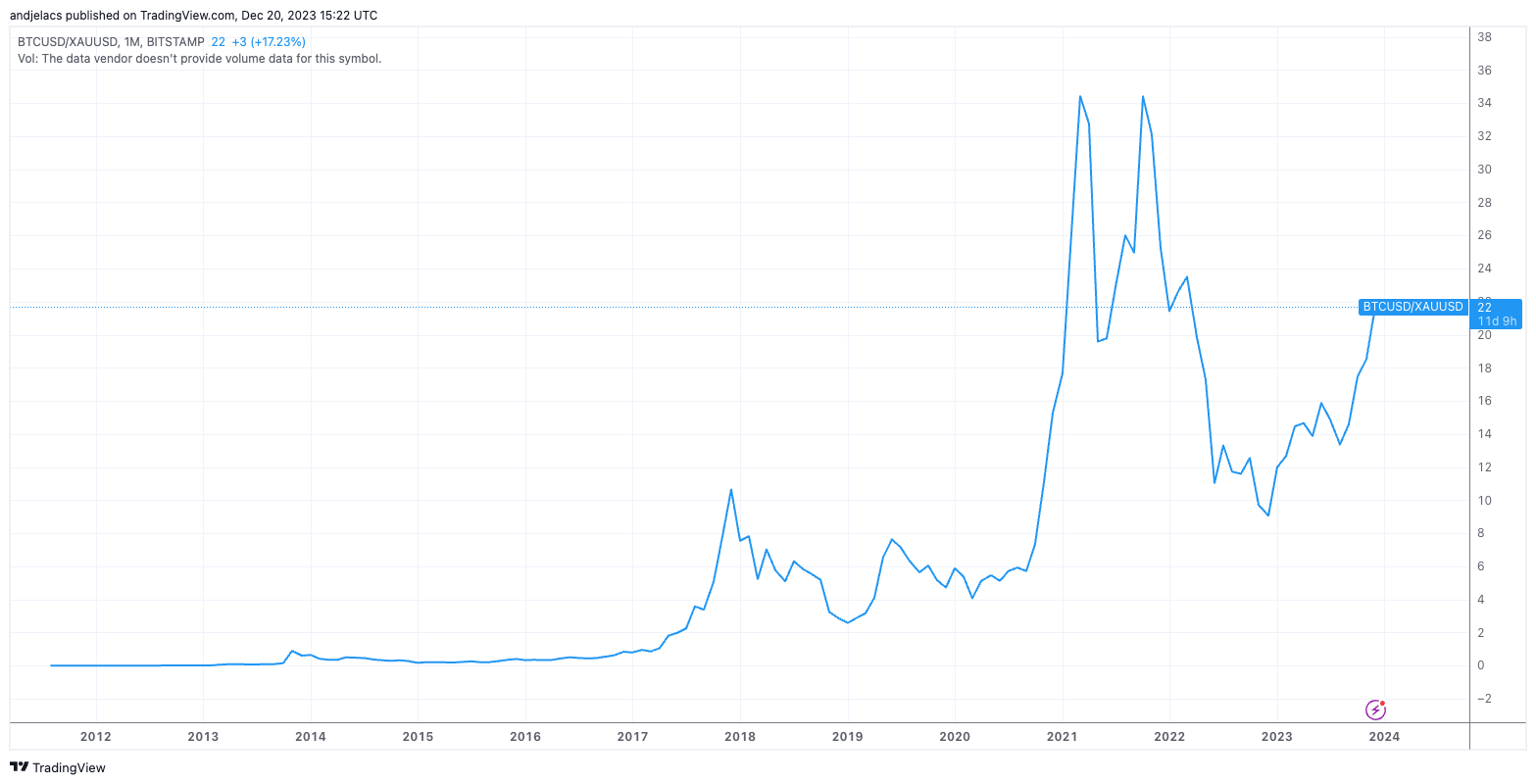

Between 2011 and 2017, the ratio witnessed a slow and gradual increase, reflecting the growing interest and acceptance of Bitcoin. The crypto industry’s first true bull market in 2017 saw this ratio reaching unprecedented heights, only to decline sharply by the beginning of 2019. Specifically, the ratio plummeted by 75.75% from its peak on Dec. 1, 2017, showcasing the market’s volatility and the shifting investor sentiment during the bear market.

The period between 2019 and 2021 marked a phenomenal recovery and growth for Bitcoin, mirrored in the BTC/GOLD ratio. The ratio soared 1,232% between Jan. 1, 2019, and Mar. 1, 2021, achieving an all-time high. This period highlighted Bitcoin’s resilience and growing appeal as a digital asset. However, this peak was followed by a 37.94% decrease in the ratio by the beginning of 2023, reflecting the complex interplay of market forces, regulatory developments, and global economic conditions.

However, this year has been particularly significant for the ratio’s performance. Since the start of the year, the ratio has shown a remarkable increase of 139.9%. The average ratio is approximately 15.31, peaking at about 21.36 and a trough of around 11.99. The standard deviation of approximately 2.66 indicates significant variability, underscoring the inherent volatility of Bitcoin’s price.

The performance of the BTC/GOLD ratio in 2023 carries significant implications for the valuation and perception of both Bitcoin and gold in the financial market. The rising ratio indicates the market’s increasing preference for Bitcoin over gold, possibly due to its perceived attributes as a digital store of value and a hedge against inflation. The variability of the ratio, however, also speaks to the persistent uncertainties and the evolving regulatory landscape surrounding cryptocurrencies.

The BTC/GOLD ratio is not just a measure of price comparison — it reflects the changing financial landscape where digital assets are increasingly pitted against traditional ones. While Bitcoin continues to gain ground as a potential alternative to gold, the journey is marked by volatility and uncertainty. This ratio, therefore, remains an essential tool for analysis, offering insights into market sentiments and the evolving role of Bitcoin in the broader financial market.

The post Bitcoin challenges gold’s supremacy as safe haven asset appeared first on CryptoSlate.