- February 16, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

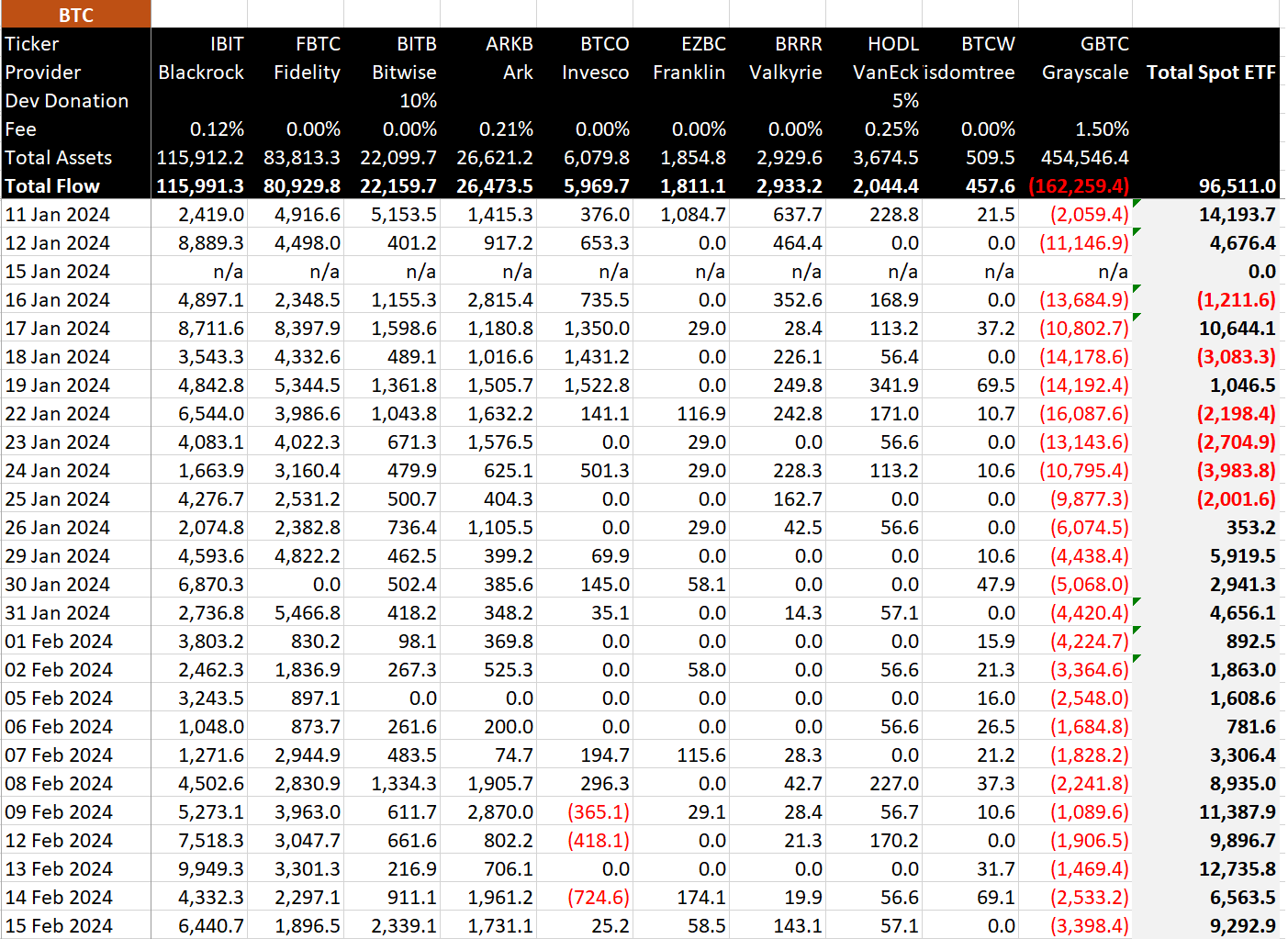

Bitcoin ETFs notched an impressive day with a strong inflow of $477 million (roughly 9,300 BTC,) according to BitMEX Research.

BitMEX data shows that BlackRock’s IBIT stood out on Feb. 15, seeing a $331 million inflow that bolstered its cumulative total to a staggering $5.2 billion. Fidelity’s FBTC, while registering a substantial $97 million inflow, broke its streak of consecutive $100 million or higher inflows, taking its total net to $3.5 billion. Bitwise’s BITB recorded its most substantial inflow since the opening trading day with $120 million, achieving a total net inflow milestone of $1 billion.

In contrast, Invesco’s BTCO reported its first inflow since Feb. 8, albeit a modest $1.3 million.

Grayscale’s GBTC experienced substantial outflows totaling $175 million, escalating its net outflow to a whopping $6.9 billion. Despite the disparate fund performance, the total net inflows remained strong at $4.6 billion, equivalent to roughly 96,500 Bitcoin, signaling robust investor interest in Bitcoin ETFs.

The post Bitcoin ETF market thrives with nearly 9,300 Bitcoin added in one day appeared first on CryptoSlate.