- March 26, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

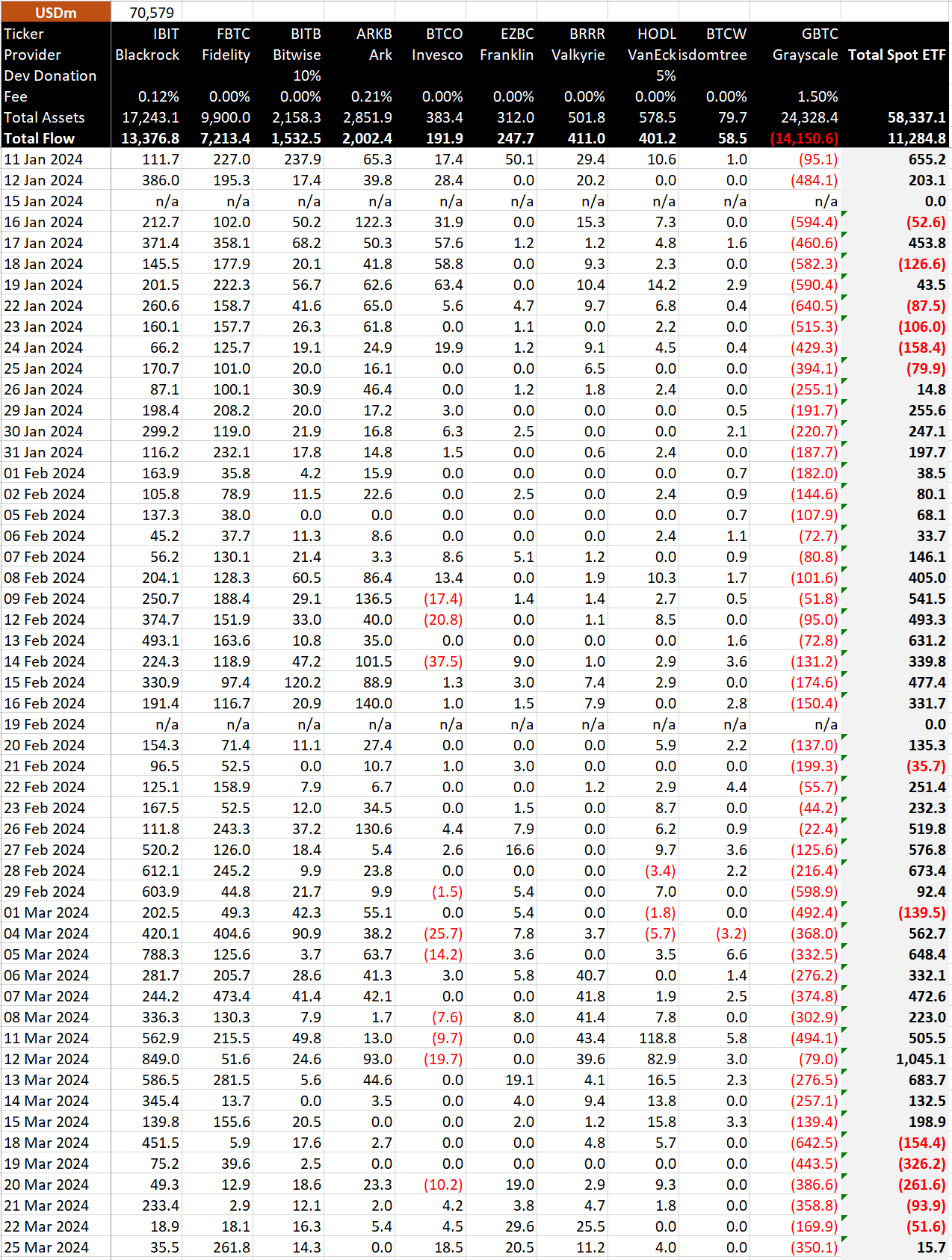

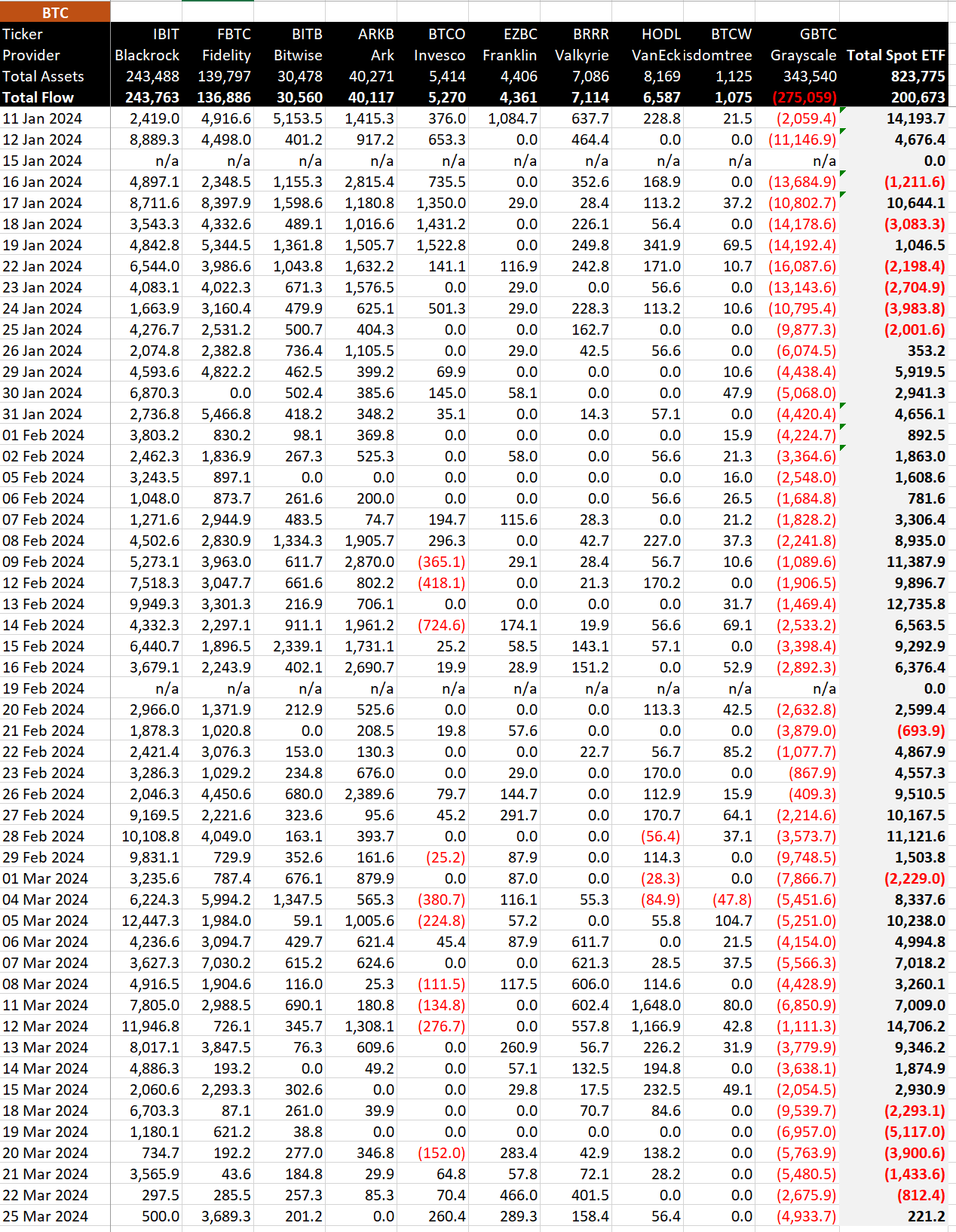

According to data from BitMEX, the Bitcoin (BTC) ETF market experienced its first day of net inflows since March 15, collecting a modest $15.7 million, or 221.2 Bitcoin. This event paused five consecutive days of net outflows and represented the second-smallest day of inflows recorded. Despite this positive shift, the larger narrative remained overshadowed by the substantial outflows from GBTC, which amounted to $350.1 million or 4,933.7 BTC. Consequently, GBTC’s cumulative outflows have reached $14,150.6 billion, equivalent to 275,059 BTC.

Data from BitMEX shows that Fidelity experienced an intense day with net inflows of $261.8 million, equivalent to 3,689.3 BTC, pushing its total inflows to $7,213.4 billion, equivalent to 136,886 BTC. It’s noteworthy that none of the remaining eight ETFs recorded any outflows. Both ARKB and BTCW remained stagnant, registering neither inflows nor outflows. As a cumulative figure, the Bitcoin ETFs have amassed $11,284.8 billion, equivalent to 200,673 BTC.

The post Bitcoin ETFs break trend recording modest inflows as GBTC continues outflow appeared first on CryptoSlate.