- May 1, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

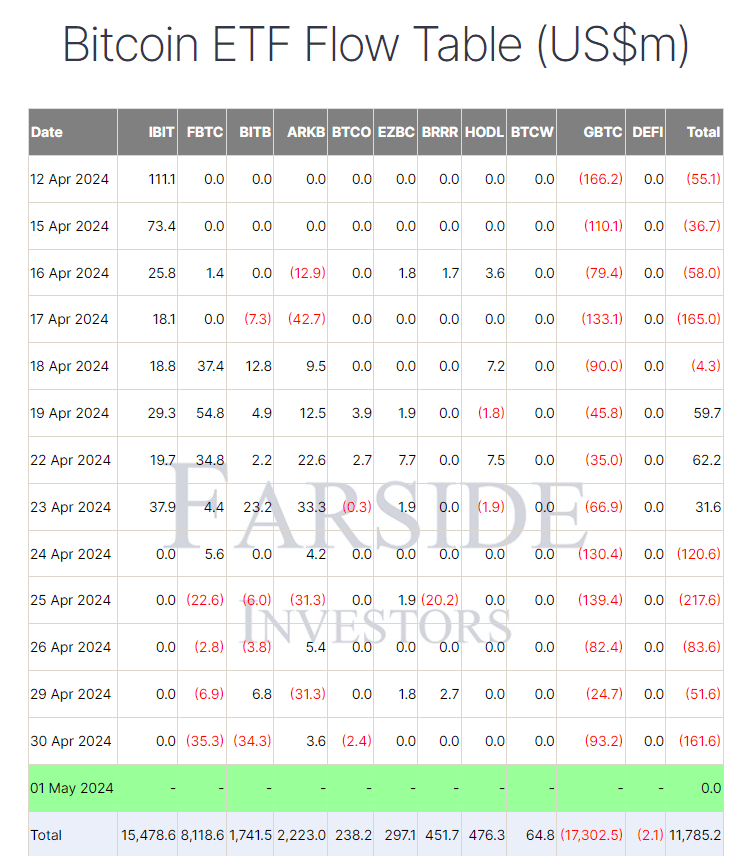

Farside data shows that Bitcoin (BTC) exchange-traded funds (ETFs) experienced another outflow of $161.6 million on April 30. Currently, BTC ETFs are seeing a joint record stretch of outflows, with investors pulling money for the fifth consecutive trading day on April 30. Over this five-day period, the total outflow has reached a staggering $635 million.

Leading the pack in outflows was Fidelity’s FBTC, which saw its most significant single-day redemption of $35.3 million since its launch. Despite this, FBTC still boasts total inflows of $8,118.6 billion, though it has now suffered four straight trading days of outflows. Bitwsie’s BITB wasn’t far behind, with a record $34.3 million outflow on April 30, bringing its total inflows down to $1,741.5 billion. In contrast, BlackRock’s IBIT has seen no inflows or outflows for the past five trading days, leaving its total holdings steady at $15,478.6 billion, according to Farside data.

Farside data reports that Grayscale’s GBTC continued to bear the brunt of the selling, with a further $93.2 million outflow, increasing its total outflows to $17,302.5 billion. Overall, Bitcoin ETF inflows have now dropped to $11,787.3 billion.

The post Bitcoin ETFs endure outflows, totaling $635 million over five trading days appeared first on CryptoSlate.