- July 10, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

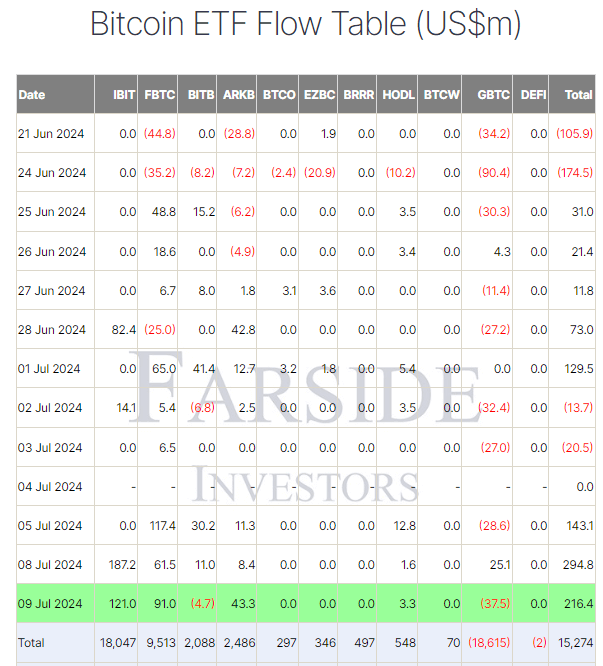

On July 9, Farside data revealed significant inflows into Bitcoin exchange-traded funds (ETFs), with $216.4 million added, marking a total inflow of $654.3 million over three consecutive trading days.

Leading the charge was BlackRock IBIT, which saw an inflow of $121.0 million, bringing its total net inflows to over $18 billion. Fidelity FBTC followed with a $91.0 million inflow, taking its total net inflows to $9.5 billion. Meanwhile, ARK’s ARKB received $43.3 million, pushing its total net inflows to $2.5 billion. However, not all ETFs experienced positive movement; Grayscale GBTC faced an outflow of $37.5 million, and Bitwise saw a $4.7 million outflow. Overall, the total inflows into Bitcoin ETFs now stand at $15.3 billion.

This surge in ETF investments coincided with Bitcoin’s price climbing above $59,000, surpassing the ETF buyers’ 2024 cost basis of $58,060. CryptoSlate emphasized the importance of Bitcoin maintaining a price above the 200-day moving average (200DMA), which is currently at $58,720, highlighting it as a critical level to sustain.

The post Bitcoin ETFs see massive $654.3 million inflow over three trading days appeared first on CryptoSlate.