- January 5, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

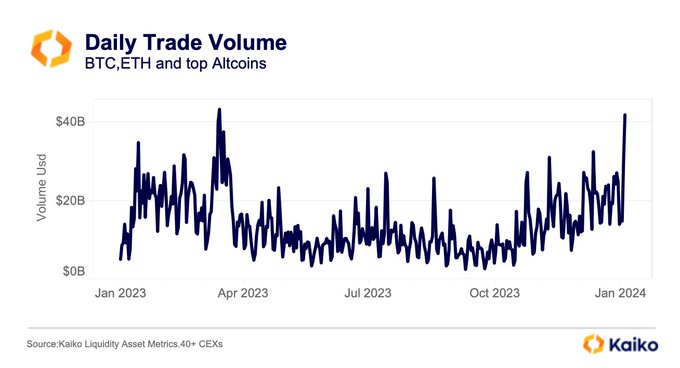

Despite fear, uncertainty, and doubt (FUD), Kaiko data on January 4 shows that the crypto market is buzzing with activity as Bitcoin, Ethereum, and top altcoins trade volume surged past $40 billion on January 3, 2023.

Trading Volume Rising Hours After Crypto Flash Crash

Notably, the sharp uptick in trading volume comes despite unverified concerns that the Securities and Exchange Commission (SEC) might not, after all, approve any Bitcoin Exchange Traded Funds (ETFs) in January 2023.

Despite the lack of ETF approval, the crypto community remains bullish, with Bitcoin and top assets stable and arresting sharp losses of January 3. When writing, Bitcoin prices are steady, rejecting lower lows.

However, the January 3 bar is engulfing, bearish, and has high trading volume. Since BTC prices are still trending inside this bar, sellers are in control. A break above $46,000 and a complete reversal of recent losses will invalidate this short-term bearish outlook.

Hopes Of Bitcoin ETFs And Eventual Approval May Prop Up Prices And Volume

There are a few possible explanations for the surge in trading volume. One possibility is that investors, despite unconfirmed rumors, are bullish that the crypto and Bitcoin scene stands to benefit.

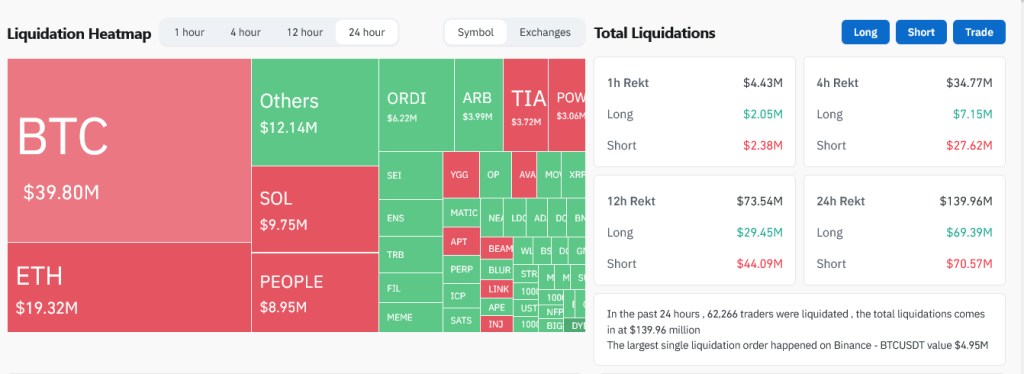

Accordingly, following the initial reaction that forced markets to lower, triggering liquidation, investors doubled to stem losses, further boosting trading volume.

Along the same vein, investors are generally hopeful about what lies ahead for Bitcoin and the crypto market in general from a regulatory standpoint. To illustrate, the SEC is currently reviewing applications for Bitcoin ETFs. If one or more of these applications are approved, it is estimated that billions, if not hundreds of billions, will flow to Bitcoin and indirectly to top altcoins.

Overall, the spike in trading volume, as Kaiko notes, is bullish for crypto. It signals that despite the January 3 shake-off that saw over $650 million worth of Bitcoin positions closed by derivatives exchanges, mostly OKX and Binance, the sphere’s liquidity is still healthy.

Even so, for now, how the market will react and how the trading volume will behave going forward is unknown. As historical performance shows, the crypto scene is volatile, which can massively influence Bitcoin.

If the SEC does approve Bitcoin ETFs in January 2023, it could lead to a significant increase in institutional investment in cryptocurrencies. This event could further boost Bitcoin and altcoin prices, driving trading volume to new 2024 levels.