- February 19, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

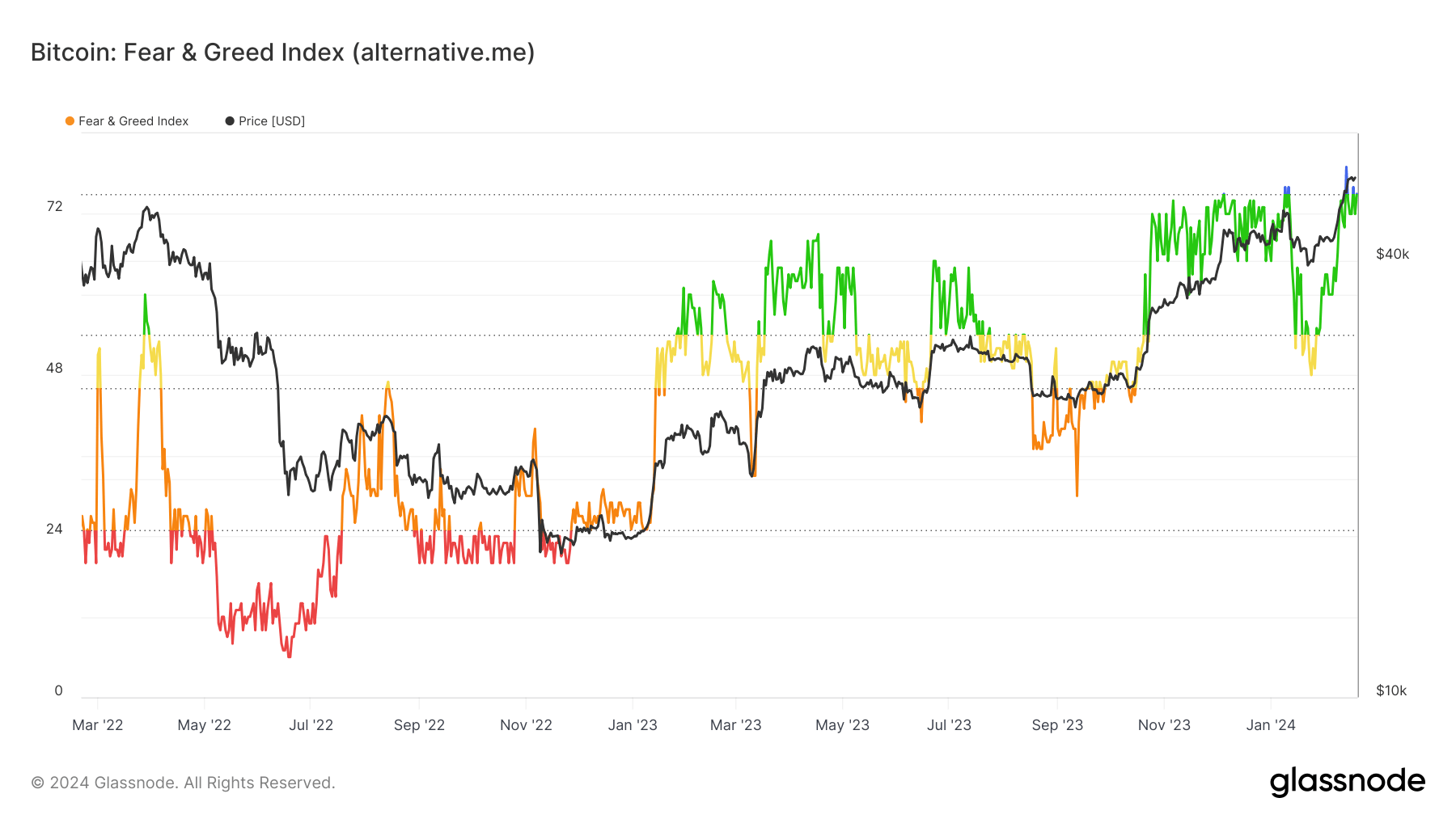

The Bitcoin market, currently priced above $52,000, is treading the thin line between market greed and euphoria, according to Glassnode.

The sentiment of greed has predominantly been the narrative since October 2023, with a brief period of neutrality during a 20% dip below the $40,000 mark. However, multiple indicators suggest the peak euphoria of the cycle still lies ahead.

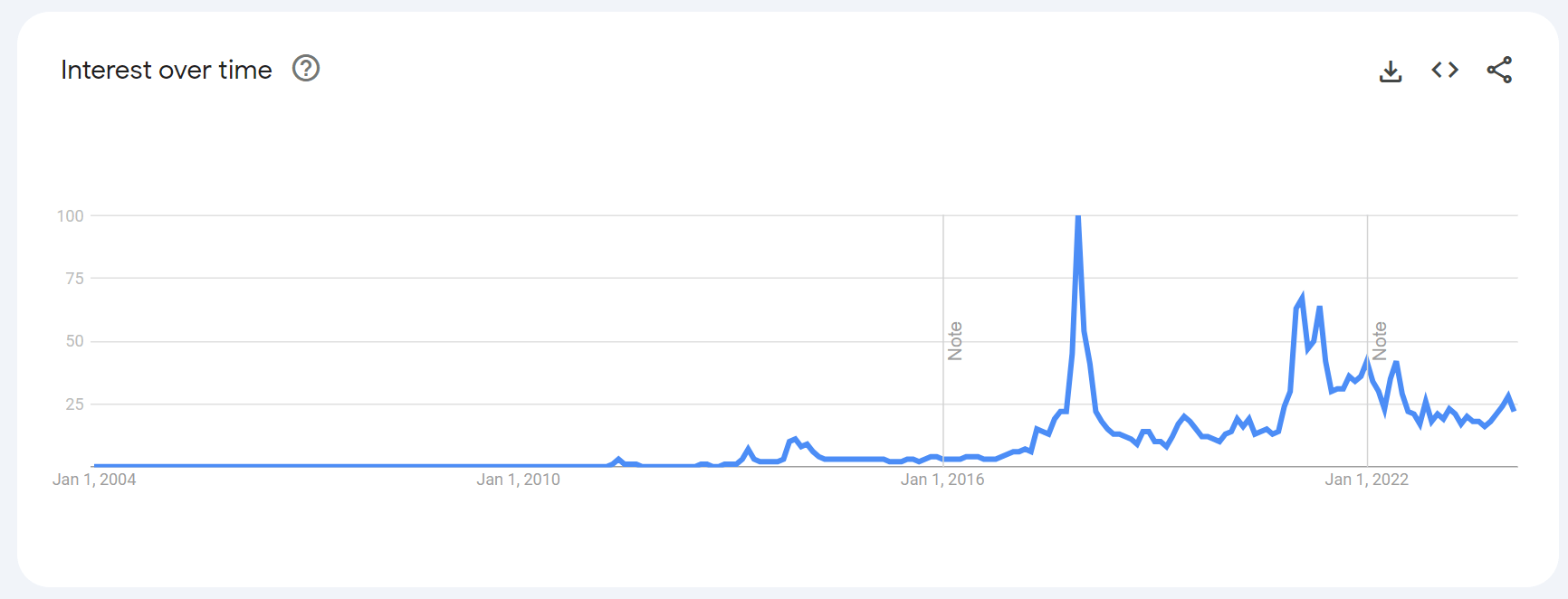

Currently, at 22, Google Trends’ search of “Bitcoin” signals a vast distance from the 2021 bull run’s relative peak value of 100.

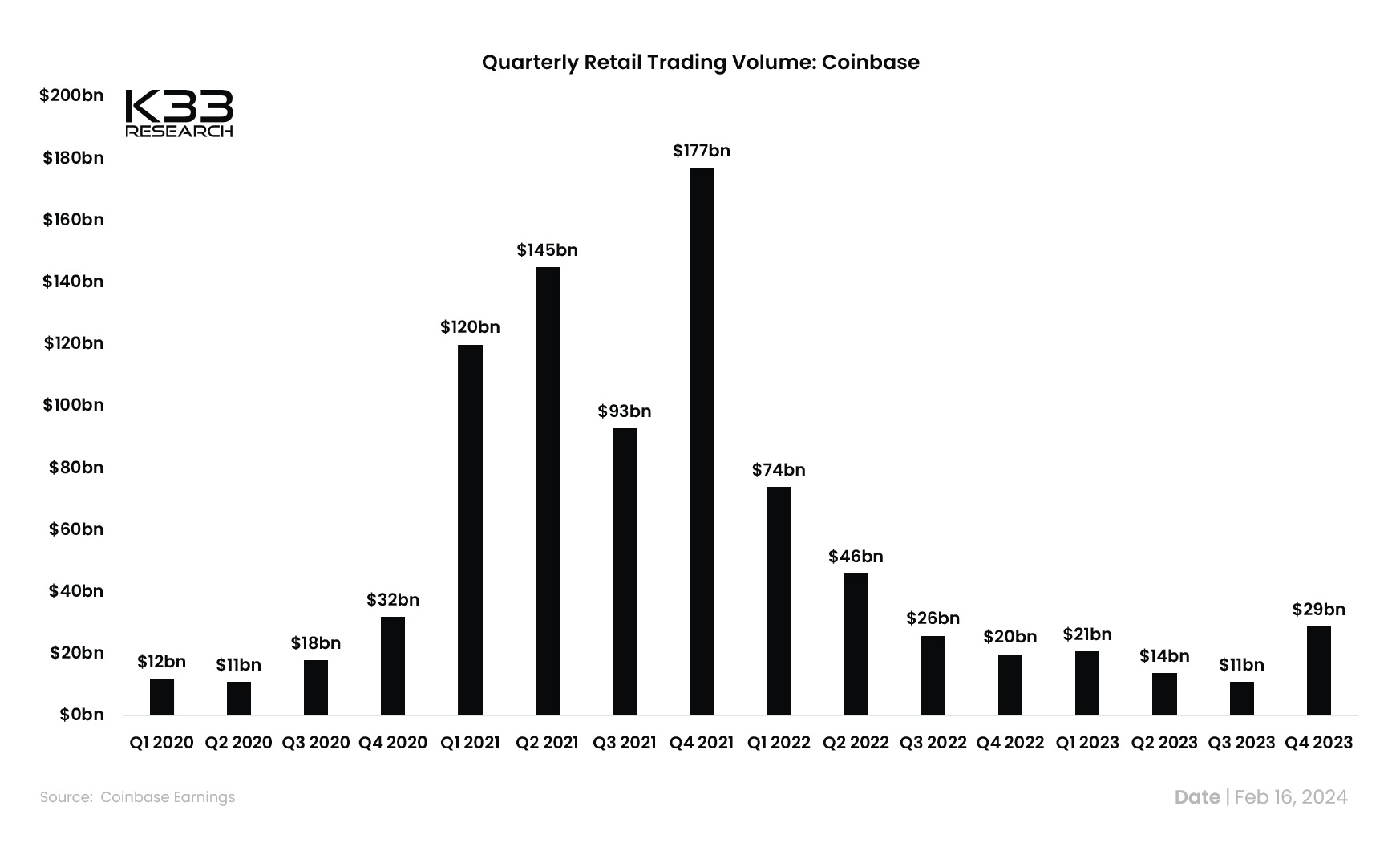

Furthermore, according to analyst Vetle Lunde from K33 Research, the quarterly retail trading volume of Coinbase in Q4 2023 stands at $29 billion, a significant increase since Q3 2023 of $11 billion but still a fraction of the $177 billion seen in Q4 2021.

The quarterly retail trading volume mimics a similar trading volume of Q4 2020, just before the bullish surge.

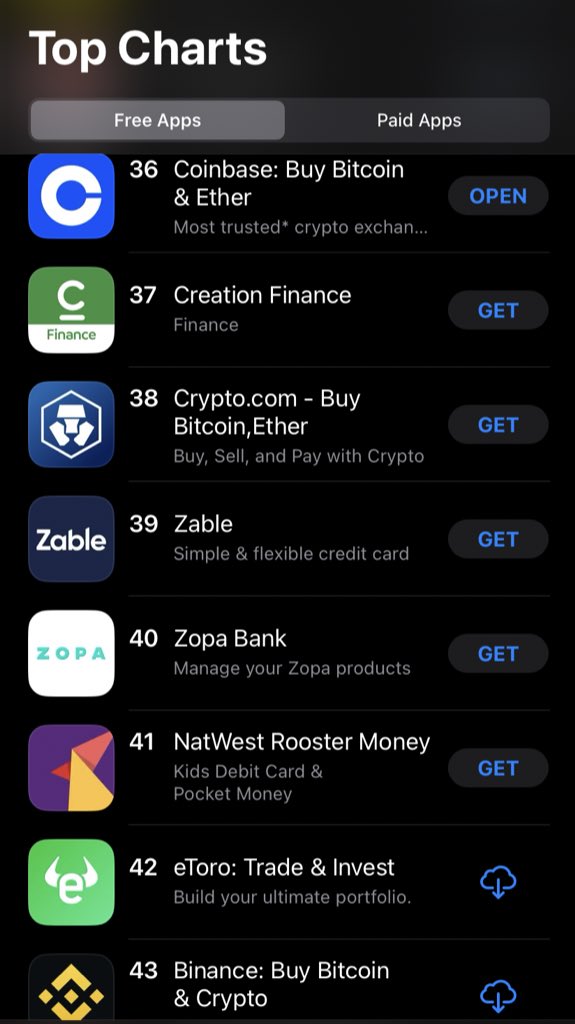

Another indicator is the ranking of Coinbase within finance apps – a reliable retail market thermometer. At 36th place, just above Crypto.com, its ranking is far from an expression of peak euphoria.

Consequently, the data suggests that the market euphoria peak remains distant, indicating room for further growth.

The post Bitcoin euphoria phase far off, Coinbase data suggests more growth potential appeared first on CryptoSlate.