- December 18, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Data shows the Bitcoin transaction fee has recently had its biggest difference over that of Ethereum for the first time in more than five years.

Bitcoin Transaction Fees Has Observed A Sharp Increase Recently

As explained by analyst James V. Straten in a post on X, the Bitcoin fees have been greater than Ethereum’s recently. The “fee” here naturally refers to the transaction fee that the users on the network have to attach with their transfers as a payment for the chain validators (miners for BTC, stakers for ETH).

The total fees earned by the validators in a single day depend on the blockchain conditions on that day. Whenever the network is congested (that is, a large amount of users are making transfers at once), the fees can spike up.

This is because the blockchain only has a limited capacity to handle transactions, so in times of high traffic, a large amount of them can go through long waiting times in the mempool.

This forces users to start attaching higher fees if they want their transfers through faster, as the validators naturally prioritize transactions with the highest amount of fees.

While fees can shoot up during a period of high activity, the opposite happens when only a few users are making moves on the network, as they don’t have any incentive to attach a high amount of fees to their transactions.

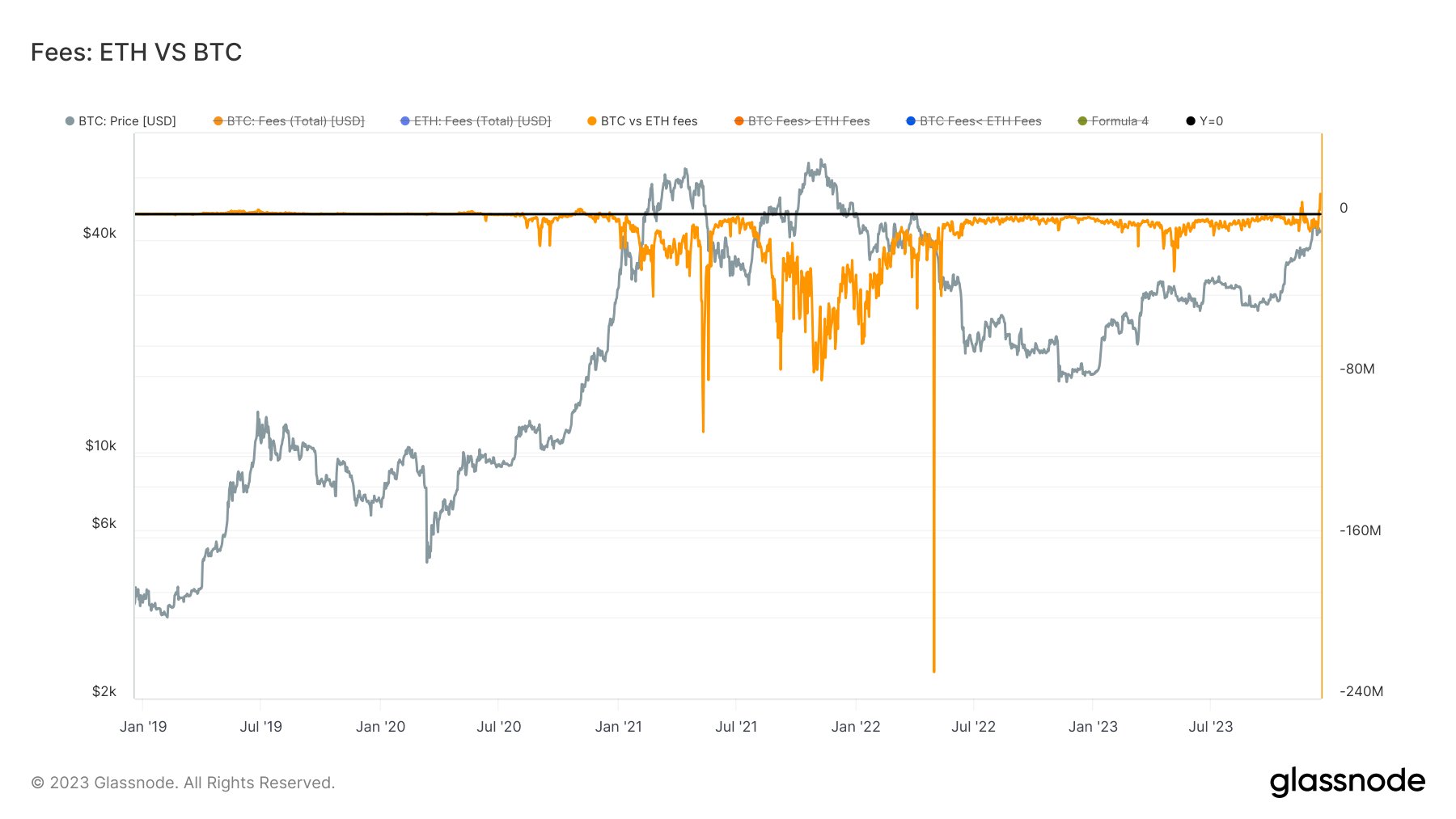

Now, here is a chart that shows the difference between the total daily fees on the Bitcoin and Ethereum networks over the past five years:

From the graph, it’s visible that the Bitcoin transaction fees have been greater than that of Ethereum for a few days now. This is a pretty rare event, as ETH had the higher value for the metric during the vast majority of the last five years.

The difference between the two metrics is also especially remarkable this time, as such a large lead by the original cryptocurrency hasn’t been witnessed in the window of the chart.

Now, what’s causing this sudden surge in the BTC fees? There is obviously high activity because of the recent rally, but ETH has also benefited from it, as it has seen a surge of its own.

What’s driving the difference in the fees between the two networks is the comeback of the Inscriptions. These special BTC transactions that inscribe data directly on the blockchain (hence the name) influence blockchain economics as much as any other transaction, so their exploding in popularity has led to the fees spiking.

As is apparent from the chart, BTC fees overtook ETH a while back as well, and back then, too, the Inscription applications like the BRC-20 tokens and NFTs acted as the instigators. This time, the spike is even higher, suggesting that this type of transaction has only gained further steam.

BTC Price

Bitcoin has seen a plunge during the last 24 hours as its price is now floating under the $41,000 level.