- January 10, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

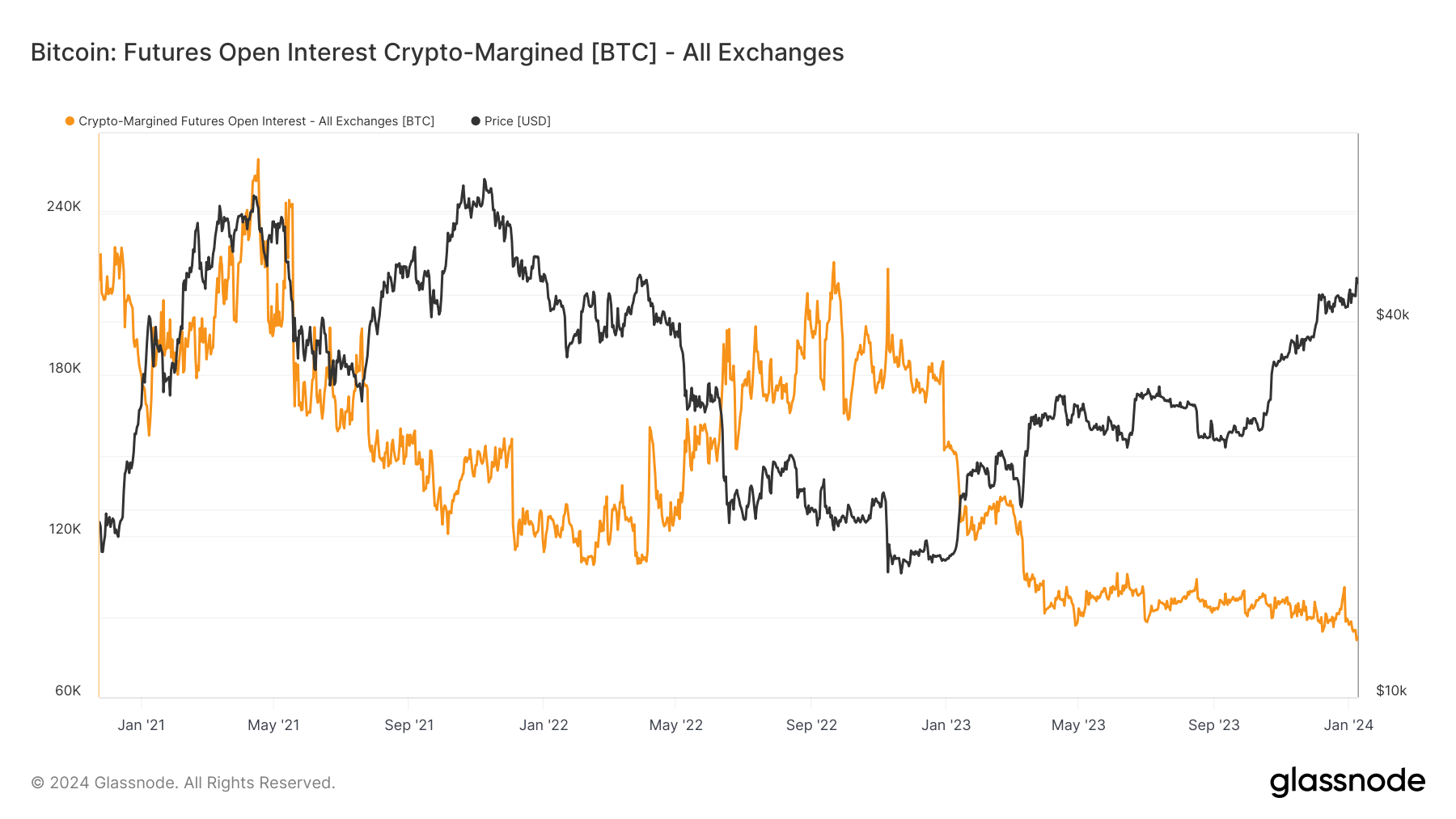

A noteworthy shift is visible in the landscape of Bitcoin futures contracts, as evidenced by the current state of open interest margined in native Bitcoin (BTC). There has been a significant fall in BTC-margined futures contracts, down from a peak of 240,000 BTC during the 2021 bull market to an all-time low of 82,000 BTC. Multiple exchanges mirror this trend. Binance currently holds 21,500 BTC, nearing a new low.

Similarly, Bitmex and Bybit are at all-time lows with holdings of 6,000 and 14,500 BTC, respectively. Deribit, while not at its lowest, has seen a significant reduction from its December high of 34,000 BTC, now sitting at 22,000 BTC. OKX’s holding has stagnated at 15,000 BTC since April 2023, while Kraken and Huobi hold a few thousand BTC each.

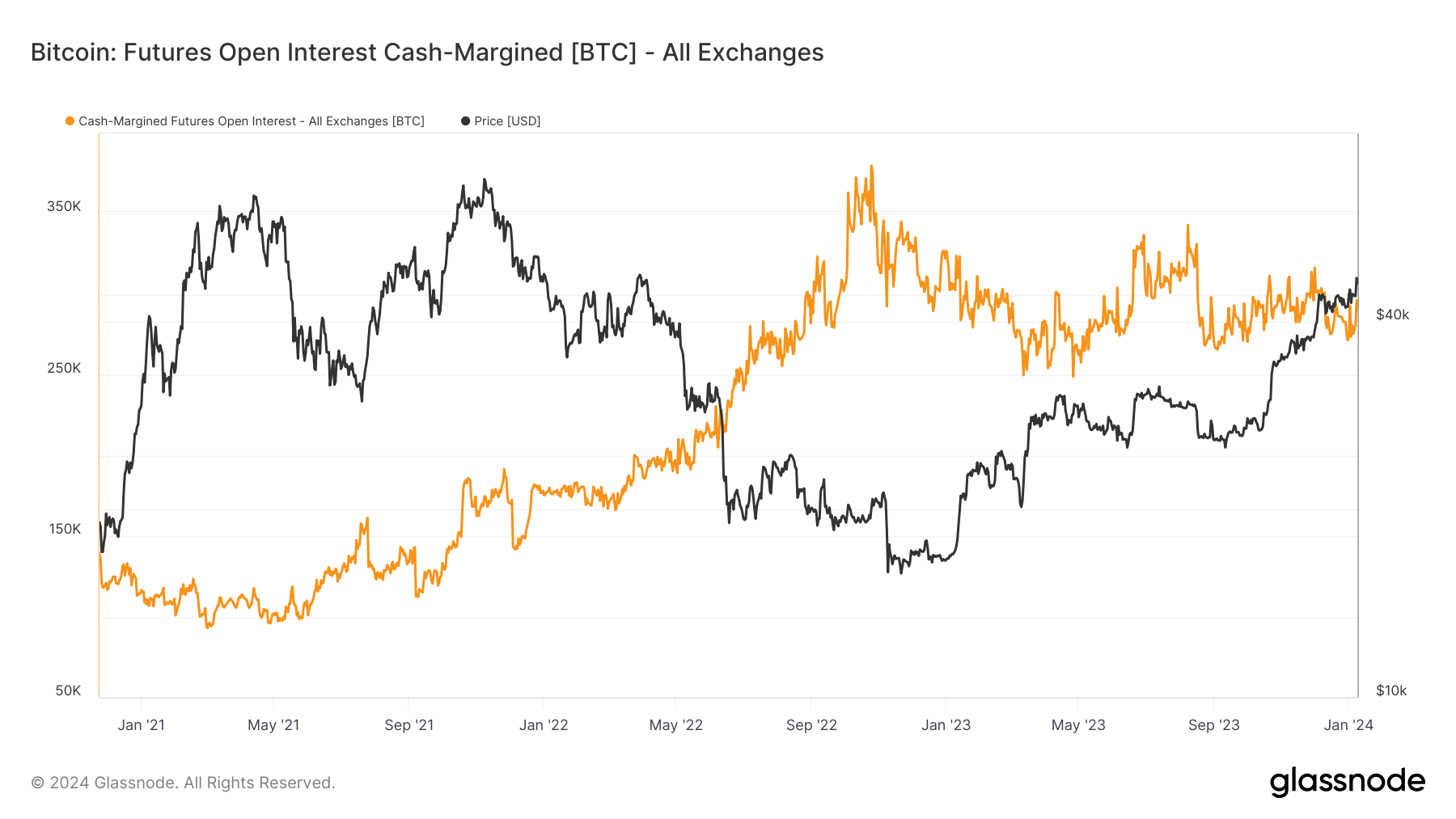

The Bitcoin futures market sees fewer contracts margined in native coins; roughly 22% of all futures contracts use crypto-margin. Meanwhile, cash-margin remains steady at around 300,000 Bitcoin. Bitcoin’s shift from volatile futures to more stable cash margins could signal reduced market volatility.

The post Bitcoin futures margined in BTC hit historic lows as cash options prevail appeared first on CryptoSlate.