- January 16, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

As Bitcoin (BTC) charts a modest increase, pushing toward the $43,000 mark—an approximately 1% rise over the last 24 hours, exchange-traded funds (ETFs) are experiencing a rather contrasting trend.

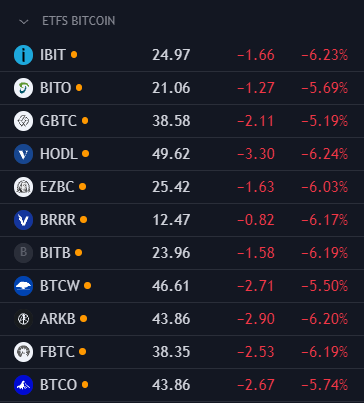

With the pre-market trading showing negative indicators, notable ETFs such as the IBIT BlackRock ETF and HODL Van Eck ETF have registered significant losses, down by -1.66% and -3.30%, respectively. These figures further accentuate the overall downward trajectory since their launch, with both ETFs recording a drop of over 6%.

The adverse trend isn’t confined to these ETFs alone. Data indicates that the majority of crypto-equities have succumbed to a similar fate, with MSTR down -0.27%, roughly 30% down from the Jan. 2 high at $706.

Notably, the price used to calculate the Net Asset Value (NAV) for Bitcoin ETFs is currently $42957.16 and will next be updated at 9 pm GMT on Jan. 16.

As the trading day culminates, CryptoSlate will continue monitoring to provide readers with the most recent and comprehensive analysis.

The post Bitcoin inches up while leading ETFs slide further down in pre-market trading appeared first on CryptoSlate.