- December 15, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

On-chain data shows the largest of the Bitcoin whales have switched to selling recently, a potential sign that these investors think the top is in.

Bitcoin Investors With More Than 10,000 BTC Are Now Distributing

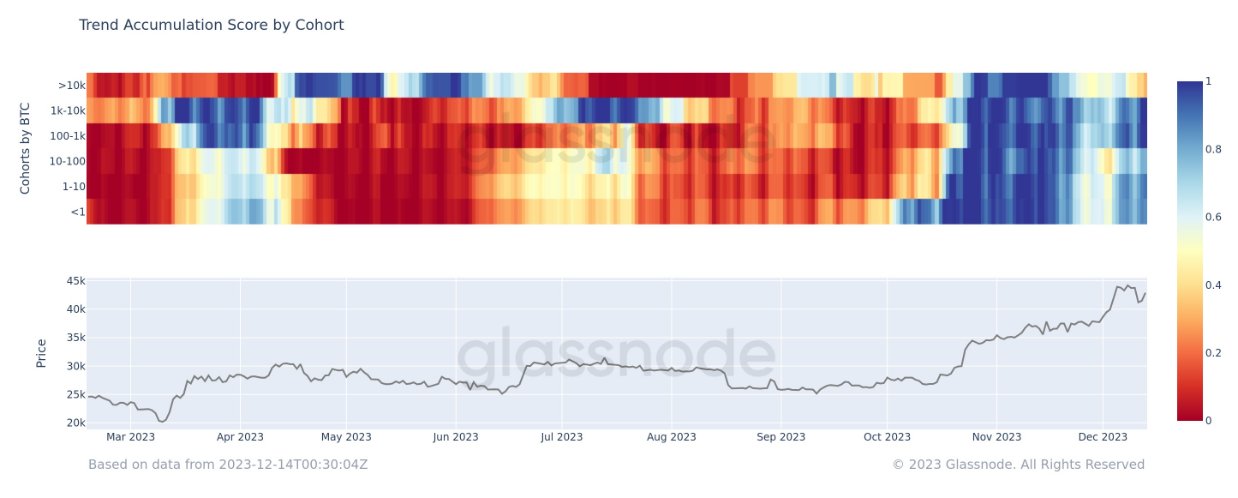

In a new post on X, analyst James V. Straten has shared a chart that shows the behavior the different Bitcoin investor cohorts are displaying right now. The indicator of interest is the “Accumulation Trend Score” from the on-chain analytics firm Glassnode.

The metric basically tells us about whether the Bitcoin investors have been participating in accumulation or distribution during the past month. The metric not only takes into account for the balance changes happening in the holders’ wallets, but also for the size of the wallets.

When the value of this metric is close to 1, it means that the large investors have been accumulating recently, or alternatively, a large number of small investors have been showing this behavior.

On the other hand, values of the score close to 0 imply the holders have either been participating in distribution, or simply not been taking part in any accumulation.

Now, here is the chart shared by the analyst that shows the trend in the Bitcoin Accumulation Trend Score separately for the different investor segments of the cryptocurrency:

As displayed in the above graph, the Bitcoin Accumulation Trend Score had been exceptionally dark blue for all of the cohorts during late October and most of November, suggesting that the investors across the market had been participating in heavy accumulation.

Accumulation became a bit more lighter in the leadup to the rally towards the $44,000 level, with some groups even dipping into distribution, but the market returned to accumulation as the rally took place.

At present, all groups except for one are doing some notable amount of buying. The one exception being the holders carrying more than 10,000 BTC in their wallets.

Generally, the investors owning more than 1,000 BTC are called the “whales,” so these entities with more than 10,000 BTC would be humongous even for whale standards.

Naturally, the larger the holdings of an investor, the more influence they carry in the market. Because of this reason, the whales are considered powerful entities. This would, thus, make the mega whales the most influential beings on the network, as they are even larger than the whales.

As these humongous investors have switched focus towards distribution recently, it could be bad news for the market. This cohort may believe that the top is already in, hence why they have decided to sell their bags here.

Nonetheless, the rest of the investors, including the whales, are still accumulating, so now it remains to be seen whether the mega whales or these hopeful smaller entities are right about the cryptocurrency.

BTC Price

At the time of writing, Bitcoin is trading around $42,400, down 3% in the past week.