- May 29, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

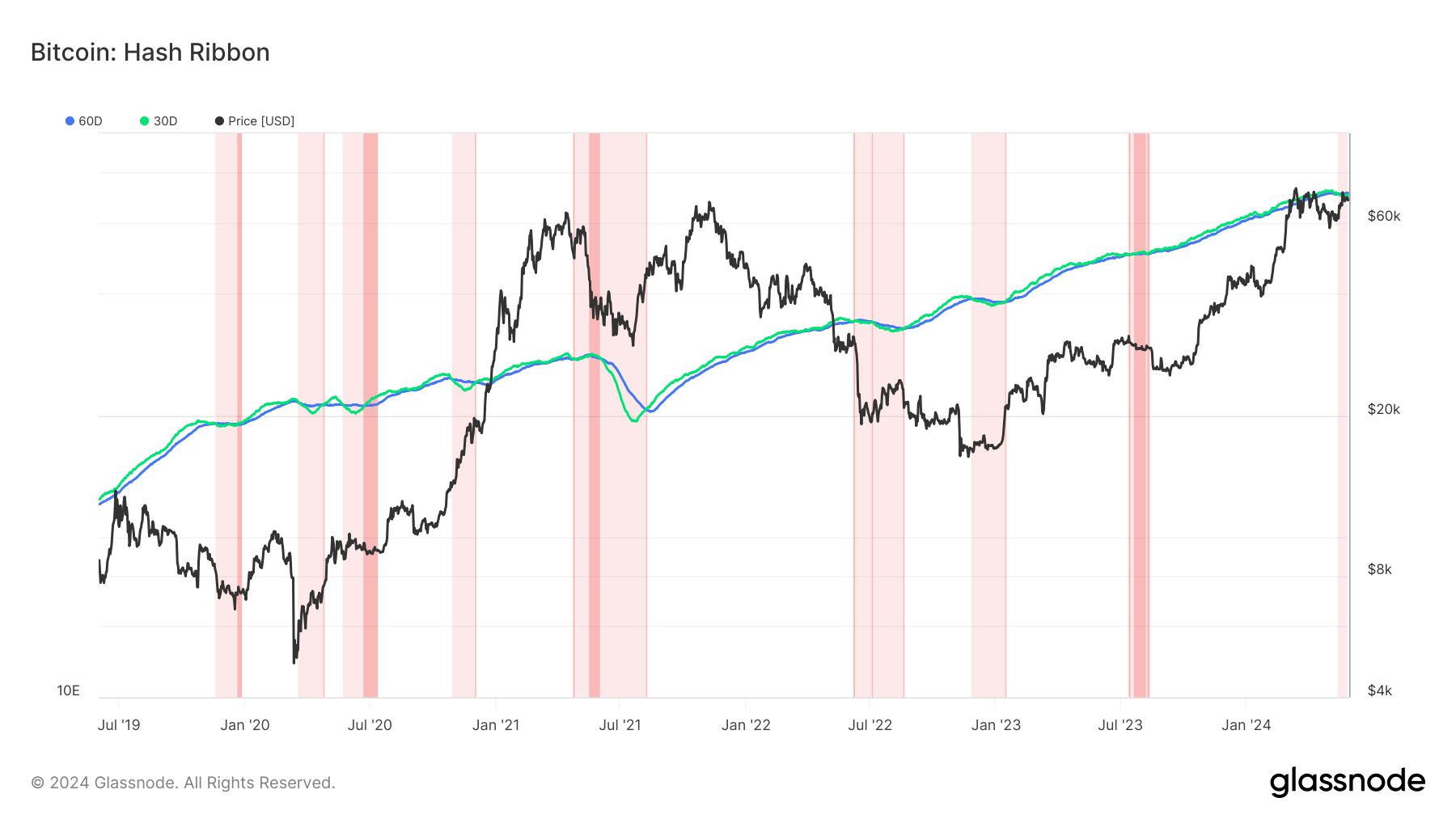

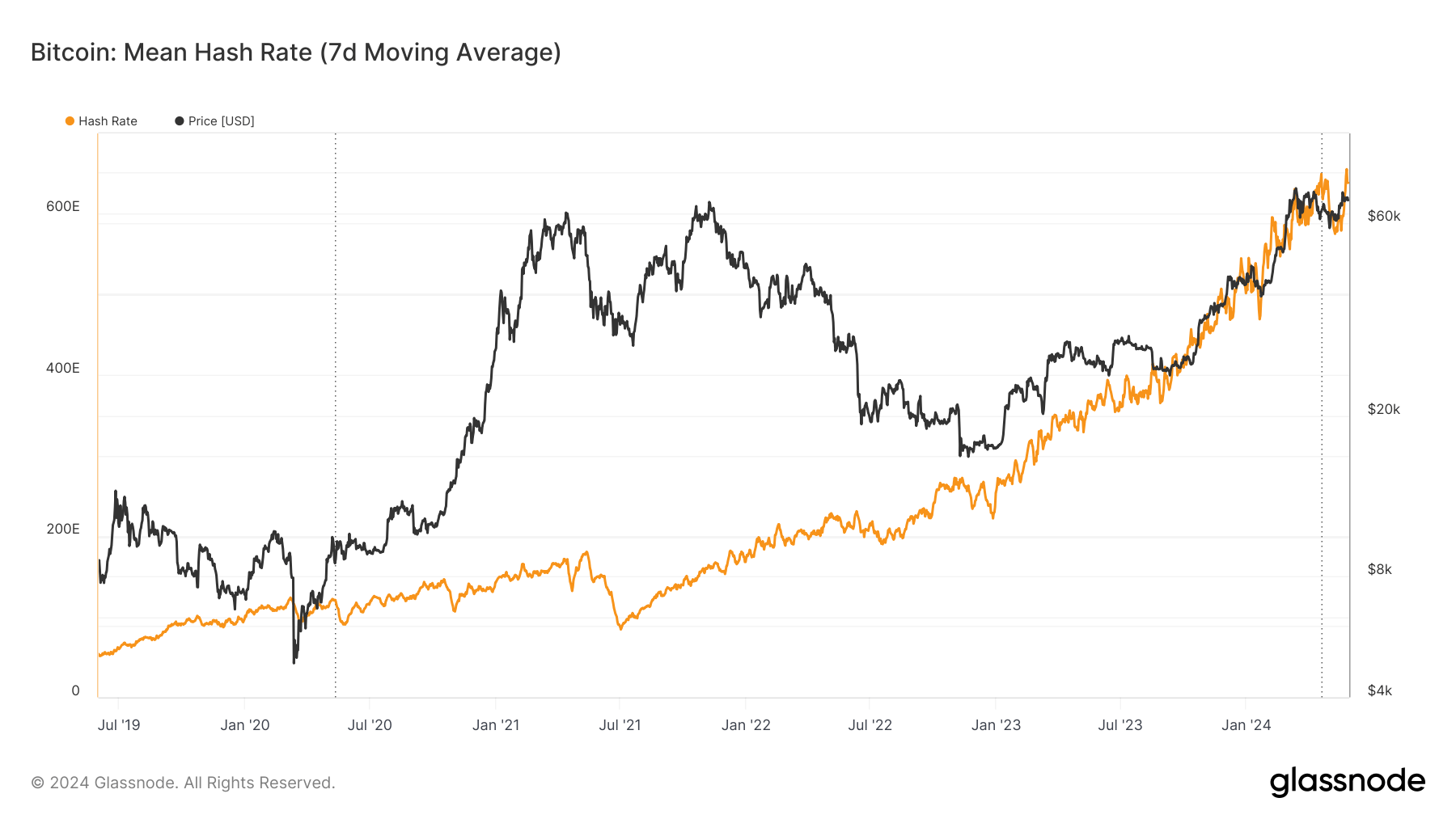

The Hash Ribbon chart by Glassnode is a market indicator that identifies potential bottoms in Bitcoin’s price by analyzing miners’ behavior. Specifically, it suggests that Bitcoin reaches a bottom when miners capitulate, meaning mining becomes unprofitable relative to the costs. The key signal from the Hash Ribbon occurs when the 30-day moving average (MA) of the hash rate crosses above the 60-day MA, transitioning from light red to dark red areas on the indicator. When this crossover coincides with a switch from negative to positive price momentum (dark red to white), it historically indicates good buying opportunities.

Currently, CryptoSlate is monitoring a 14-day miner capitulation. To put this into perspective, the average duration of miner capitulations over the past five years is approximately 41 days, equivalent to about three difficulty adjustments (each adjustment spans roughly 14 days or 2016 blocks). A prolonged miner capitulation occurred in May 2021 following China’s mining ban, which halved the global hash rate and took months to recover.

Given the effectiveness of the Hash Ribbon in identifying Bitcoin bottoms, the ongoing choppy price action may present a favorable buying opportunity.

| Start Date | Duration (days) |

|---|---|

| 2019-11-20 | 31 |

| 2020-03-19 | 37 |

| 2020-05-25 | 29 |

| 2020-10-28 | 35 |

| 2021-05-19 | 81 |

| 2022-06-09 | 70 |

| 2022-11-27 | 49 |

| 2023-07-16 | 27 |

| 2024-05-14 | 14 |

| Average | 41.44 |

Source: Glassnode

The post Bitcoin miner capitulation: 14 days in, compared to 41-day average over the past 5 years appeared first on CryptoSlate.