- April 24, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

On-chain data suggests the selling pressure from the Bitcoin miners and HODLers has been drying up, a sign that could be positive for the asset.

Bitcoin LTHs Stop Selling, While Miner Distribution Slows Down

As explained by analyst James Van Straten in a post on X, two BTC groups in particular have been a source of major sell-side pressure in the market recently: the long-term holders (LTHs) and miners.

The LTHs refer to the investors who have been holding their coins since more than 155 days ago. These holders are considered the resolute side of the sector, as they rarely sell regardless of whatever is going on in the wider market.

The rally to the new all-time high this year, however, managed to entice even these HODLers into selling their coins and harvesting the profits that they had earned over their long holding time.

According to Straten, though, the selloff from these investors has petered out recently. “LTHs have been relatively flat for the past few weeks, as BTC ranges, which is a good sign that profit-taking is subsiding,” notes the analyst.

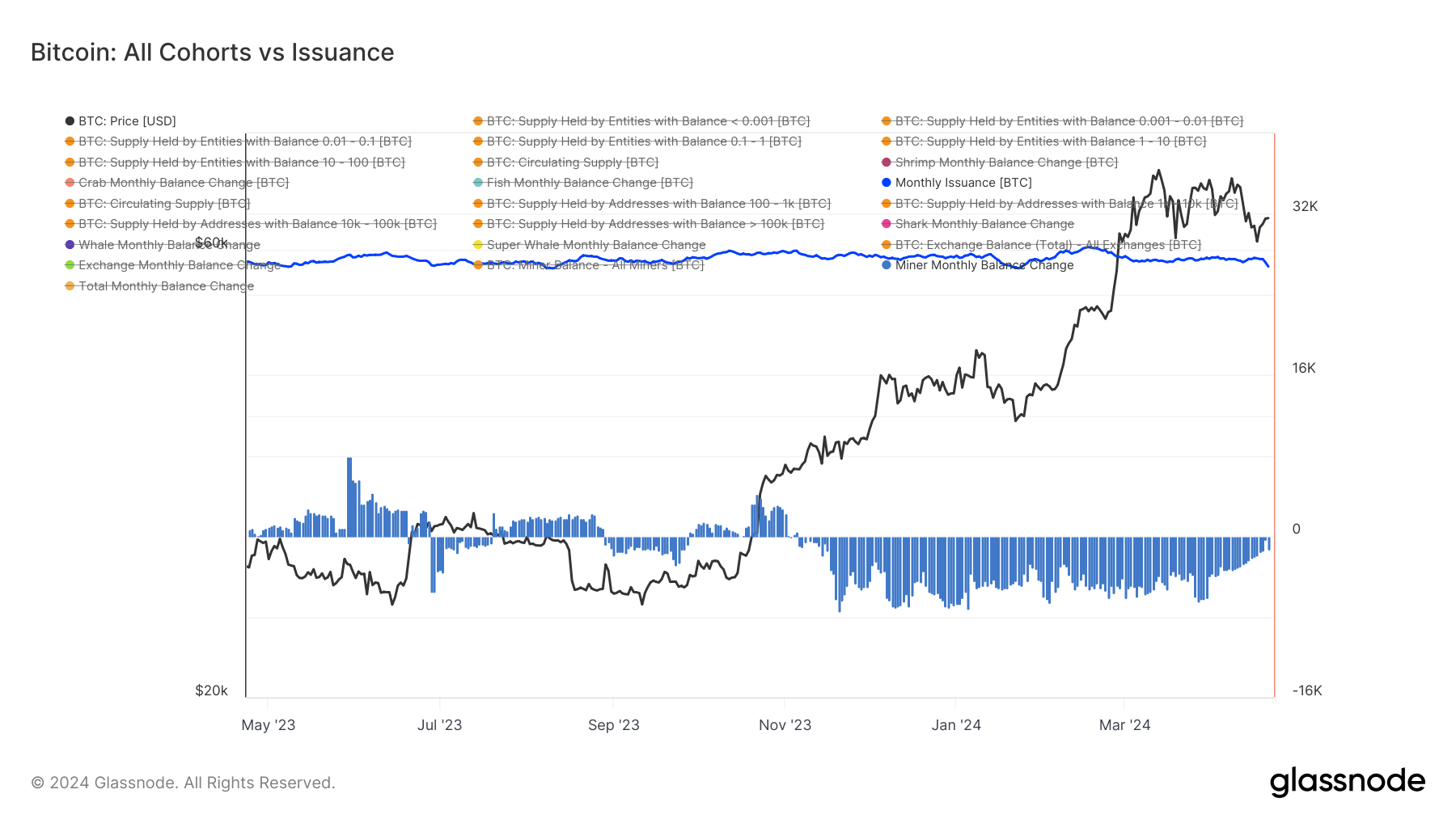

Unlike the LTHs, however, the miners, which represent the other major source of selling pressure in the market, have still continued to distribute recently. Nonetheless, as the chart below would suggest, the selling from these chain validators has at least been going down in scale.

The graph shows the data for the monthly balance change for the miners as a whole. This cohort had turned into a seller back in November and had kept up the selling at a more or less consistent rate over the next few months, as the monthly balance change had maintained around the same notable red values.

Recently, however, the metric has been trending up and although it’s still negative, the latest value has been about the lowest since the selloff began, as the miners sold just 1,300 BTC over the past 30 days.

The analyst suggests that this group could even turn into a net accumulator soon, as “the halving forces miners to become more efficient. Weak miners purged, less selling into the market.” The halving here naturally refers to the periodic event on the BTC network where block rewards are permanently slashed in half.

The block rewards are what miners receive for solving blocks on the network and serve as the main component of their revenue, so these events have significant consequences for this group. Halvings occur approximately every four years and the latest one took place just a few days back.

With selling pressure from these two cohorts, who had been actively distributing recently, now drying up, Bitcoin perhaps may finally be able to regain its bullish push from earlier, at least to some degree.

BTC Price

Bitcoin has been making some recovery from its recent lows, but the overall picture is that the asset is still consolidating inside its recent range as it trades around $66,600.