- December 13, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

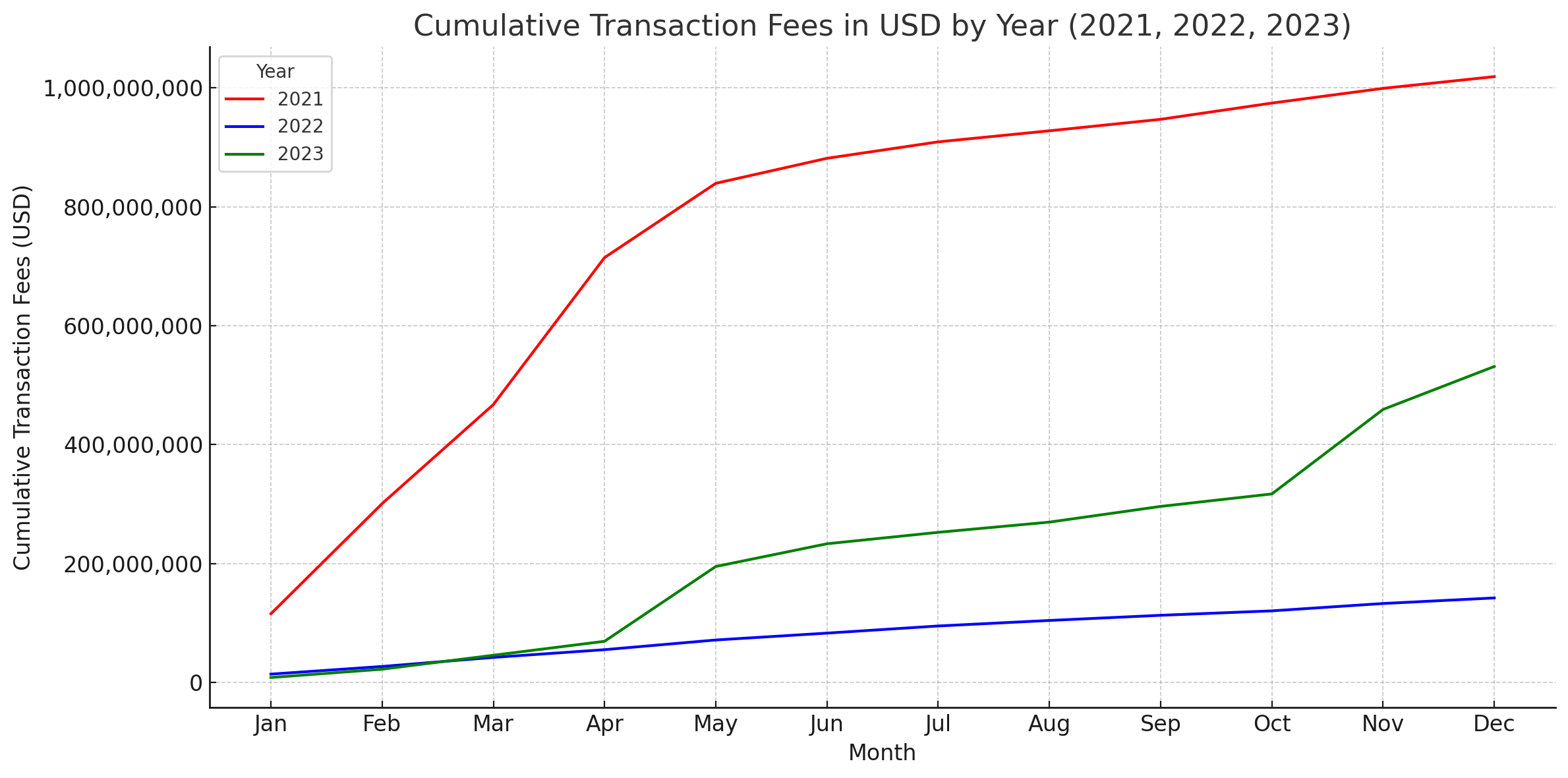

An examination of the dynamics of Bitcoin transaction fees over the last three years reveals notable trends. Miners, traditionally earning revenue through block rewards, have to be increasingly reliant on transaction fees due to the continued reduction of these rewards.

The 2021 bull market saw transaction fees surpassing the $1 billion mark. In contrast, both 2022 and 2023, amid more bearish conditions, shared a similar, much lower, path but diverged with the advent of Inscriptions in March 2023.

The introduction of this new factor catalyzed a surge in 2023’s transaction fees to an estimated $500 million, overtaking the less than $200 million recorded in 2022. This analysis explains the rising influence of market conditions and technological advancements on miners’ revenue streams.

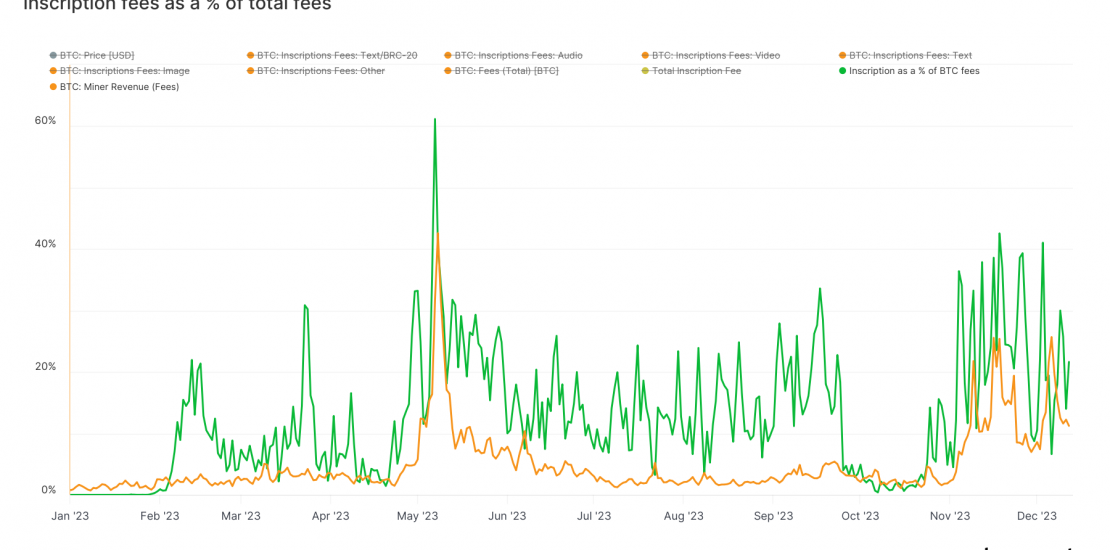

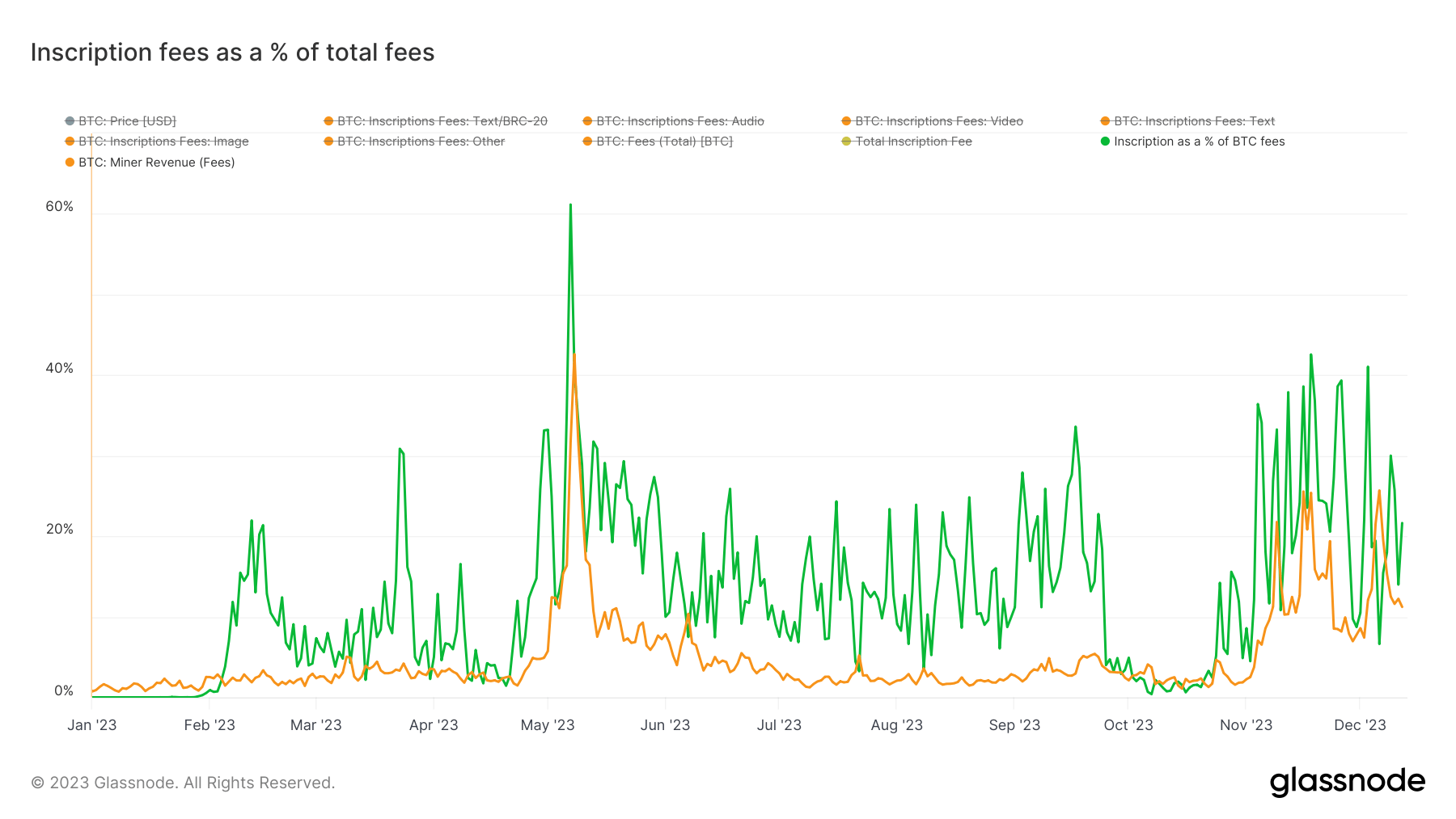

Typically, miner fees accounted for about 3%-5% of total earnings. However, an observable spike in these fees has been linked to the introduction of Inscriptions or BRC-20 tokens.

In May, the miner fee revenue peaked at 43%, leaving block rewards contributing 57% of the total. Within this 43% of fees, Inscriptions accounted for a remarkable 61%. More recently, in November, there was a significant increase in the proportion of Inscriptions as a percentage of Bitcoin (BTC) fees. The BTC miner revenue from fees has soared to 20%, with Inscriptions representing anywhere from 20% to 40% of these fees.

This evolving landscape indicates a structural shift, where technological advancements such as Inscriptions are transforming traditional revenue models for miners.

The post Bitcoin miner revenue reshaped by Inscriptions, transaction fees hit $500M in 2023 appeared first on CryptoSlate.