- February 23, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Definition

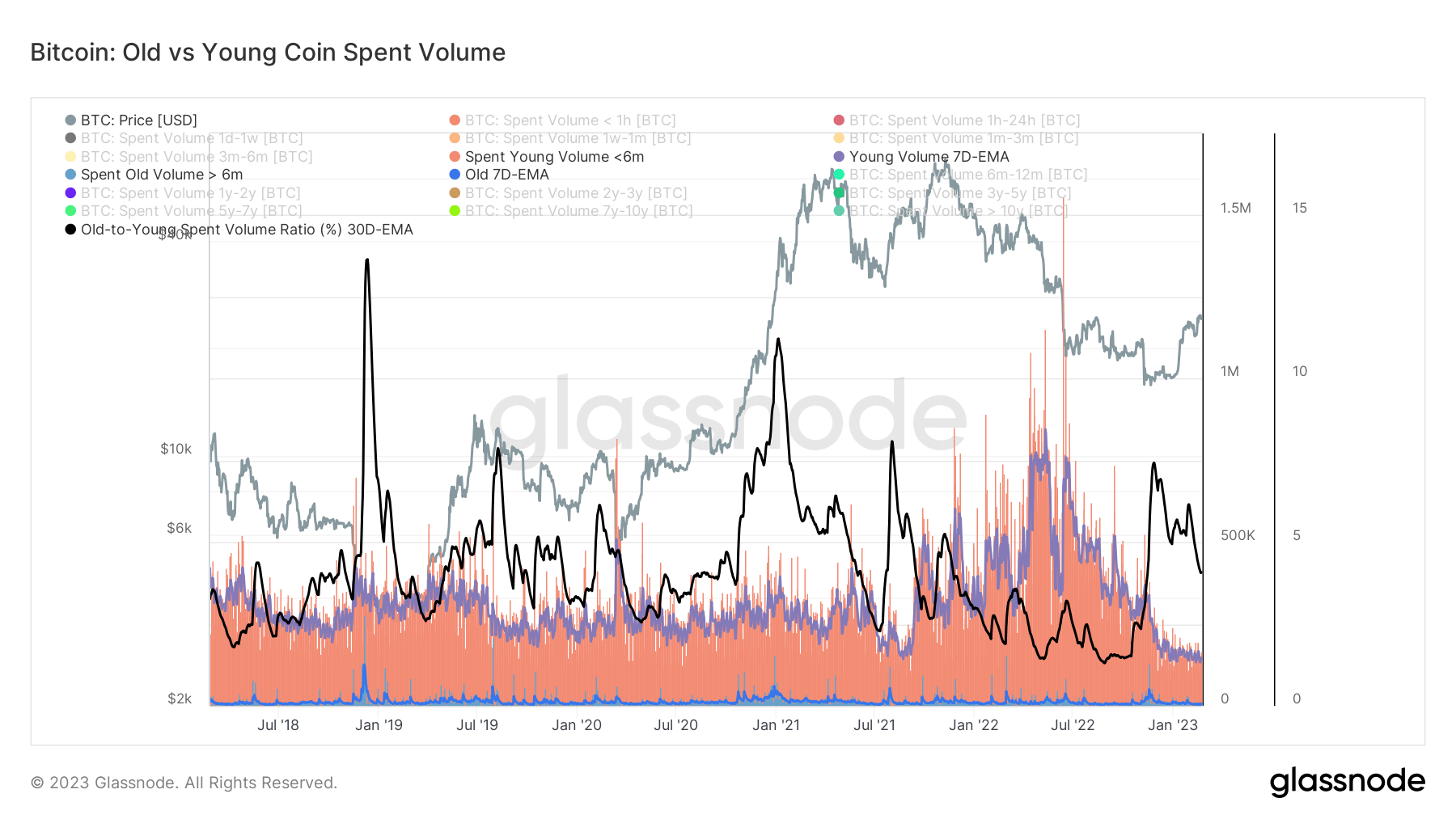

This chart overlays the aggregate spent volume of both the Old (> 6m) and Young coin (< 6m) supply as well the Old / Young Spent Volume Ratio (%).

- Younger coins

historically represent the vast majority of day-to-day transaction volume.

historically represent the vast majority of day-to-day transaction volume. - Older coins

historically represent a minority of day-to-day transaction volume, and thus changes in their spending patterns can signal shifting market trends and investor sentiment. In periods where older coins are spent in large volumes, it indicates that previously dormant supply is re-entering liquid and active supply, and may suggest a shifting in aggregate positioning by longer-term holders.

historically represent a minority of day-to-day transaction volume, and thus changes in their spending patterns can signal shifting market trends and investor sentiment. In periods where older coins are spent in large volumes, it indicates that previously dormant supply is re-entering liquid and active supply, and may suggest a shifting in aggregate positioning by longer-term holders.

Spikes in the Old / Young Spent Volume Ratio (%) generally occur during bullish fervor as previously dormant supply begins to realize profits in large volume — including during capitulation events where previously dormant coins de-risk in volume.

Quick Take

- Despite elevated transactional activity on the Bitcoin blockchain in recent weeks due to the rise of Ordinals and inscriptions, coin volume is at historic lows.

- Young coins are spending roughly 167K BTC — the lowest level for five years.

- Old coins are also not being spent in relation to history — roughly 10k BTC spent over seven days.

- The old-to-young spent volume ratio % was at the fifth highest ratio during the FTX collapse — indicating capitulation and is currently descending to a rough average of the past five years.

The post Bitcoin old and young coin spent volume at historic lows appeared first on CryptoSlate.