- February 22, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

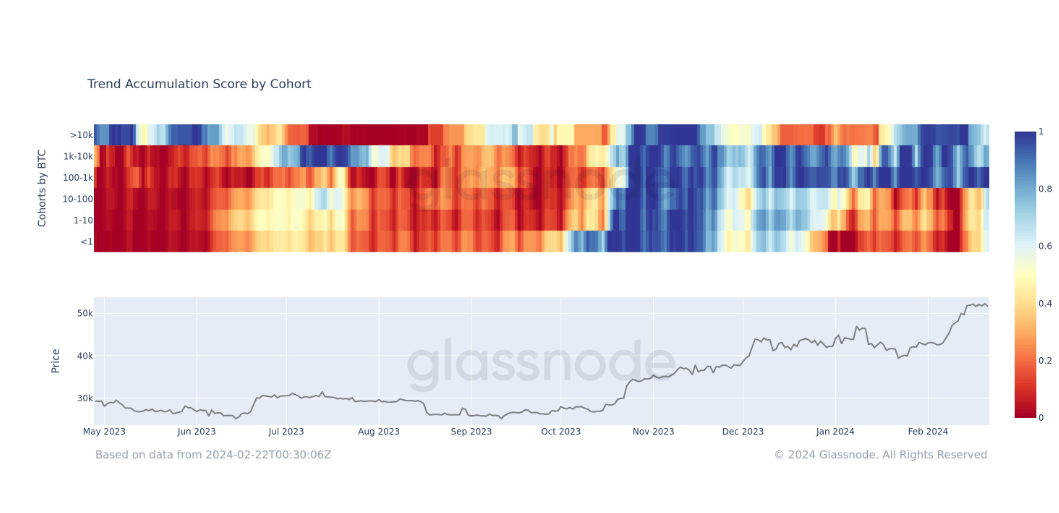

With Bitcoin price holding steady over the $50,000 mark for more than a week, intriguing patterns are emerging regarding Bitcoin accumulation. CryptoSlate’s recent data analysis highlights that approximately 111k BTC have been amassed by various cohorts over the past 30-day period.

Some cohorts have been in a distribution phase over the last month, mainly holders with less than 100 BTC. The Accumulation Trend Score, gauged over 15 days, shows a noticeable shift from heavy distribution to light accumulation. Based on current trend scores, this suggests that the most intensive distribution period might already exist in the rearview for these cohorts.

This metric is derived from distinct entity wallet cohorts’ behavior, factoring the entities’ size and the number of coins they’ve procured over the previous fortnight. A value near 1 denotes a trend toward accumulation, while a value toward 0 suggests distribution. Certain entities like exchanges and miners are not factored into these calculations.

In essence, smaller cohorts who hold fewer Bitcoins may have past peak distribution and could be moving into a period of significant net accumulation.

This is the first time that all cohorts have been in some form of accumulation since October 2023.

The post Bitcoin steadies above $50,000 for over a week as new accumulation patterns emerge appeared first on CryptoSlate.