- November 15, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

On-chain data shows the Bitcoin profits held by the ‘trader’ group have shot up recently. Here’s whether they are as high as at the last top.

1 To 3 Months Old Bitcoin Investors Are Currently Up 47%

As CryptoQuant Head of Research Julio Moreno explained in a new post on X, traders’ unrealized profits have reached high levels recently. The on-chain metric of interest here is the “Profit/Loss Margin,” which tells us about the net profit or loss the Bitcoin investors hold.

This indicator works by going through the transaction history of all coins in circulation to find the price at which they were last moved. If this previous transfer price for any token was less than the current spot value, then that particular coin can be assumed to hold an unrealized profit.

Similarly, coins of the opposite type are considered to be carrying some net loss. The Profit/Loss Margin sums these profits and losses for the entire network, representing the net situation.

In the context of the current topic, the Profit/Loss Margin of only a segment of the BTC investors is of interest: the traders. These investors bought their coins at least one month and three months ago.

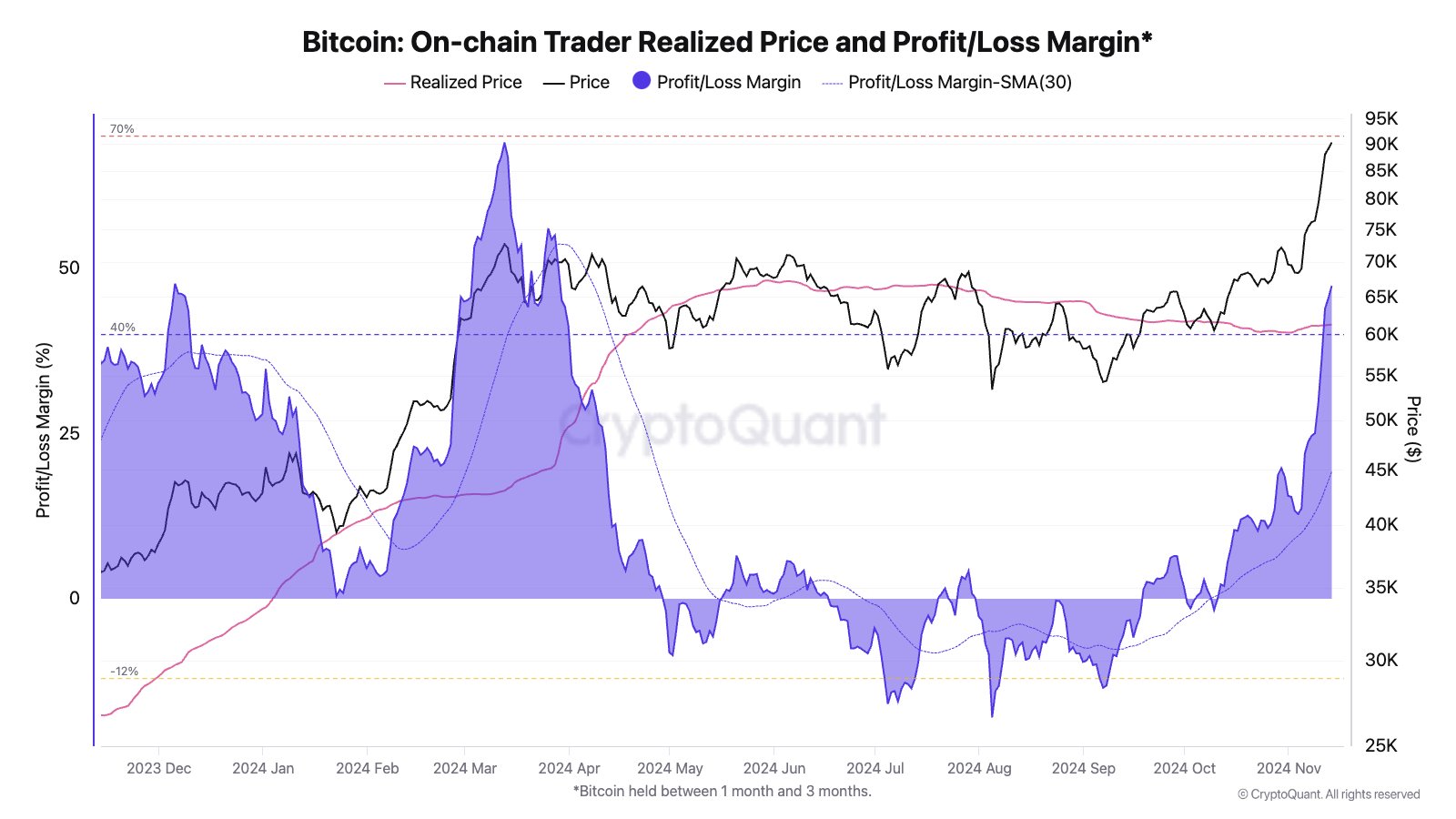

Now, here is the chart shared by Moreno that shows the trend in the Bitcoin Profit/Loss Margin for the BTC traders over the past year:

As displayed in the above graph, the traders’ Bitcoin Profit/Loss Margin has recently surged high into the positive zone, which implies these investors are now carrying a significant amount of gains.

More specifically, this cohort has held a net profit of 47% since the recent price surge. Historically, the higher the investors’ profits, the more likely a top has been for the cryptocurrency’s price.

The reason behind this is that holders become increasingly tempted to harvest in profit-taking the larger the size of their gains. The traders are especially likely to participate in selling, as this cohort includes relatively inexperienced hands who tend to panic easily.

The chart shows that the top in March occurred when this indicator was about 69%. So far, the metric has not gone this high yet.

That said, BTC also hit a top back in December of last year when the profit/loss margin of the traders was at 48%, which is only 1% more than the latest value.

It remains to be seen whether the Bitcoin rally will continue despite the risk of profit-taking from the traders or if a cooldown will happen first.

BTC Price

At the time of writing, Bitcoin is trading at around $88,800, up more than 16% over the past week.