- January 3, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

The digital asset market has witnessed Bitcoin’s significant fall in the past 24 hours, dropping from $45,000 to roughly $40,000, resulting in more than $660 million being liquidated, according to Coinglass.

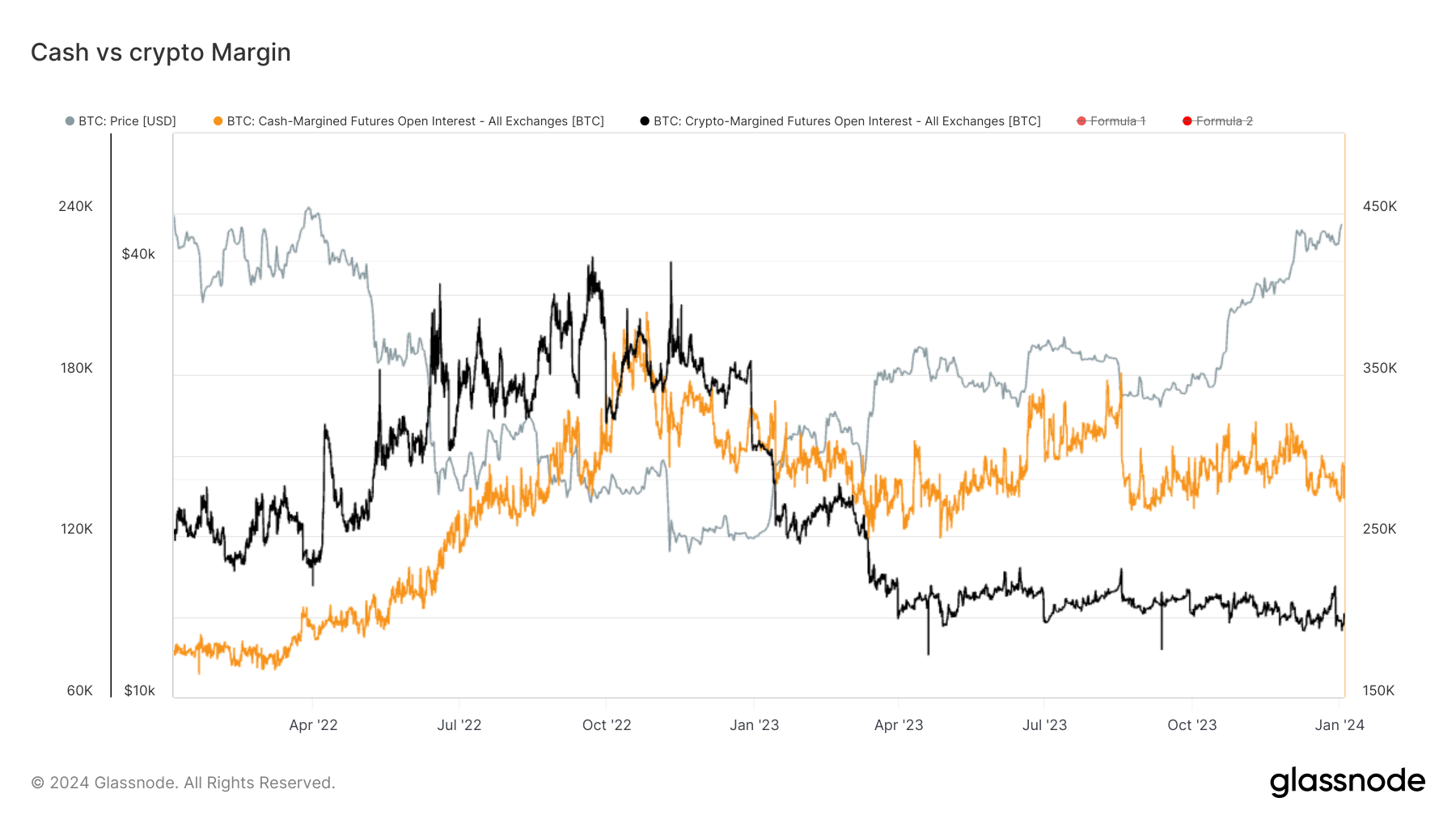

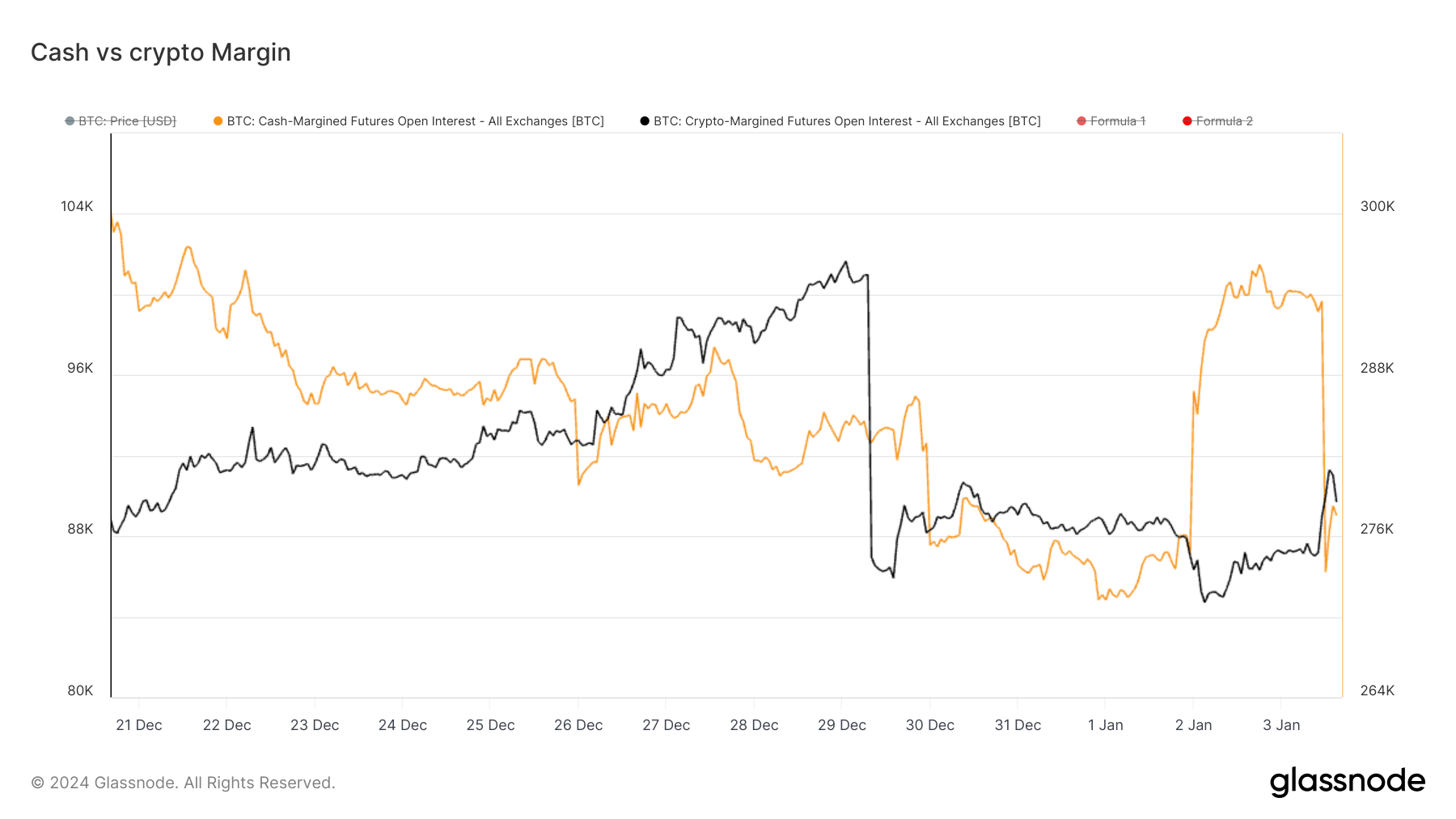

This plunge has brought into focus on the margin used for the open interest in futures contracts. It is noteworthy that the margin in native coins like Bitcoin, rather than USD or stablecoin, has been on a decline. Conversely, cash margins, which are employed by platforms like CME for futures, have seen an upward trend, marking a difference from more retail-focused platforms like Binance, which primarily use more volatile crypto margins.

Since Jan 2, there has been a remarkable increase in cash margin from 275,000 Bitcoin equivalent to 295,000, which has now been reset due to the liquidation event. This is reflective of the total amount of futures contracts open interest that is margined in USD or USD-pegged stablecoins such as USDT and BUSD.

Despite the recent price drop, there’s a slight resurgence in the crypto margin, which needs to be closely observed for potential implications.

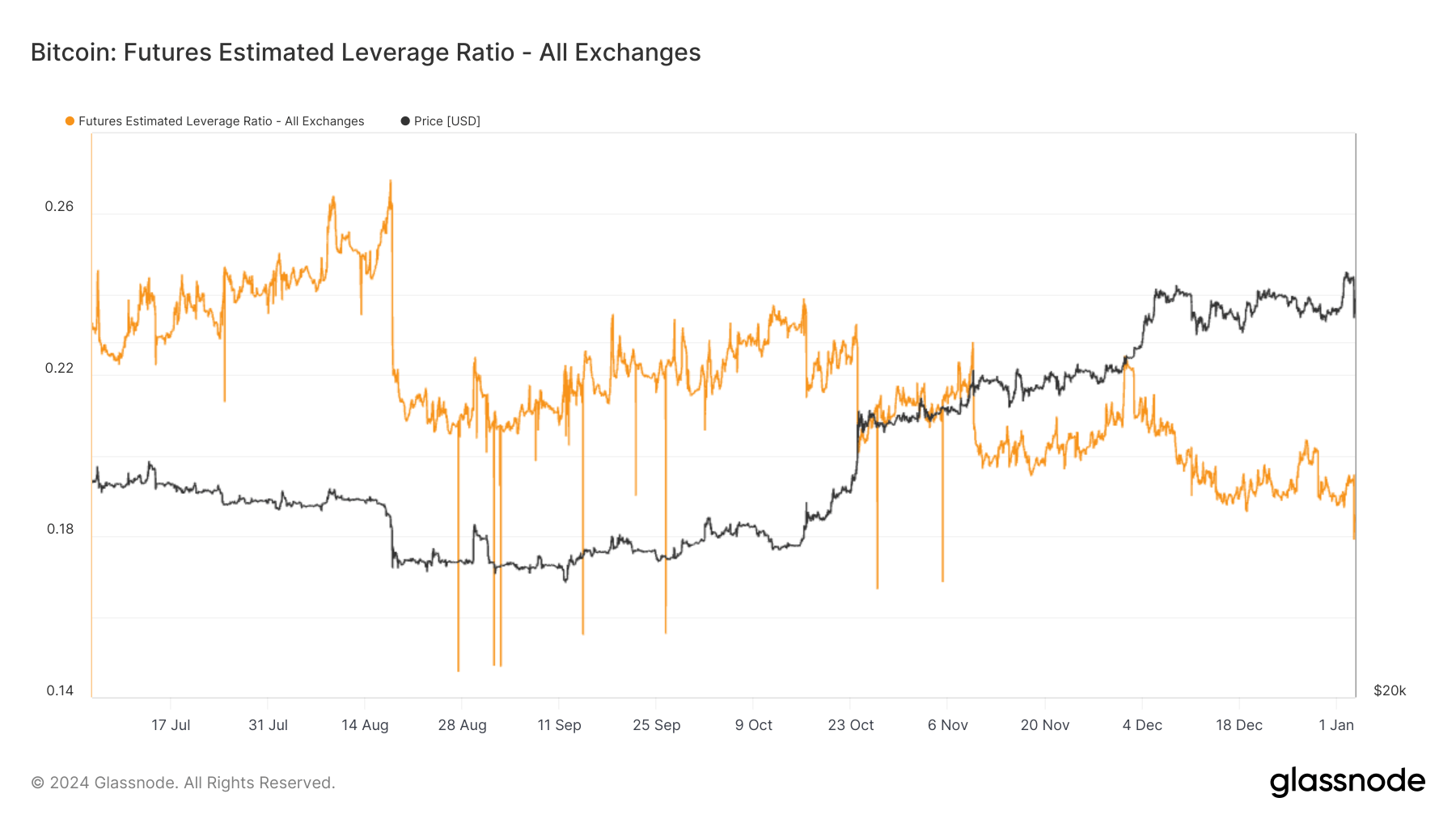

In addition, the Estimated Leverage Ratio, a critical measure of the open interest in futures contracts relative to the exchange’s balance, has dropped to a new low of 0.17, indicating a cleansing of leverage in the system.

The post Bitcoin’s dive to $40k triggers massive liquidations amid shifting margin trends appeared first on CryptoSlate.