- August 23, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

The Bitcoin network is currently experiencing a precarious phase, with market indicators revealing substantial investor weakness from multiple facets.

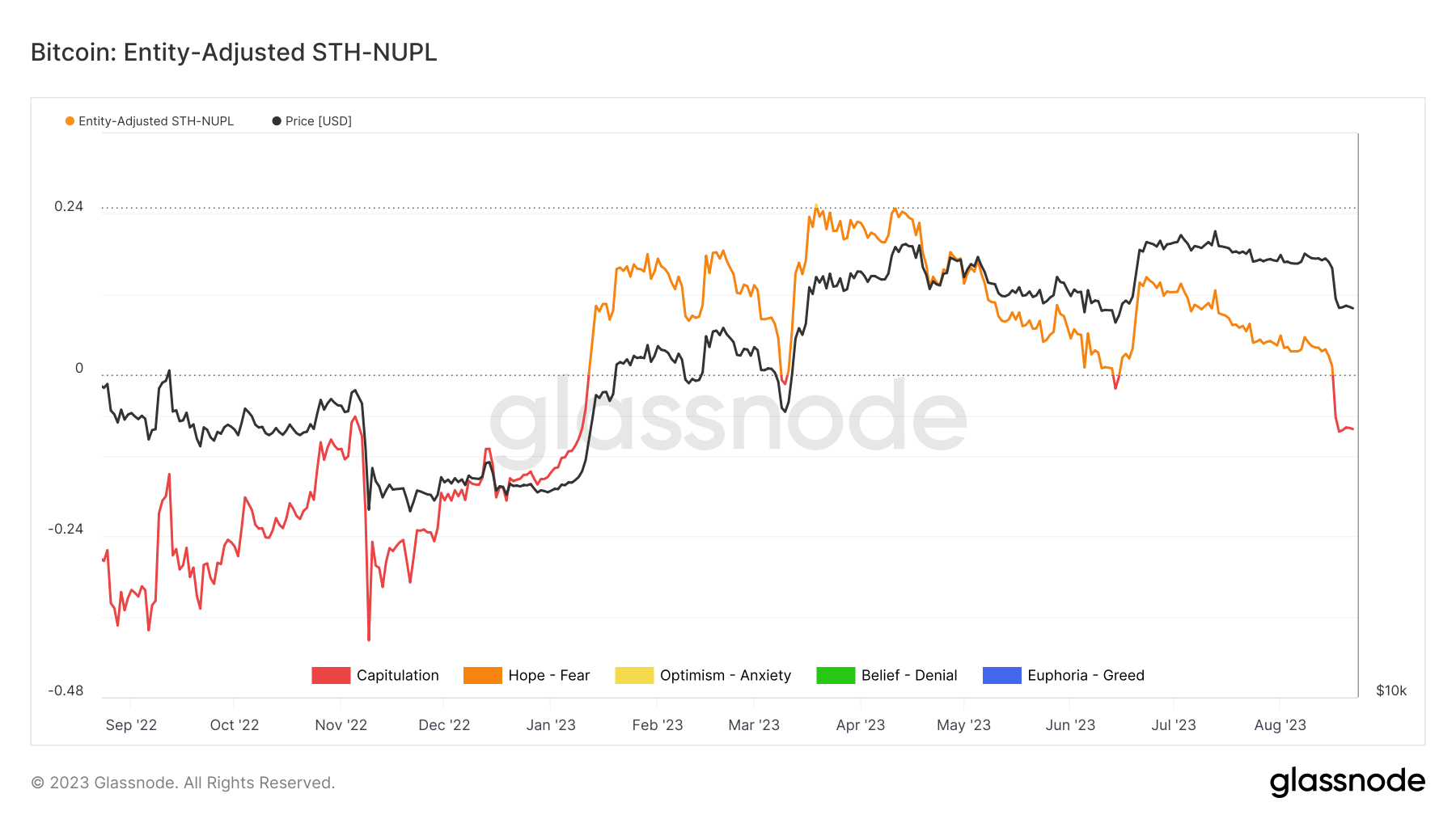

A significant part of this fragility stems from short-term holders, those who have been in possession for less than 155 days. The current capitulation levels of this cohort bear a stark resemblance to the downturn witnessed during the FTX collapse, suggesting a profound shakeout that has purged a substantial portion of this investor group.

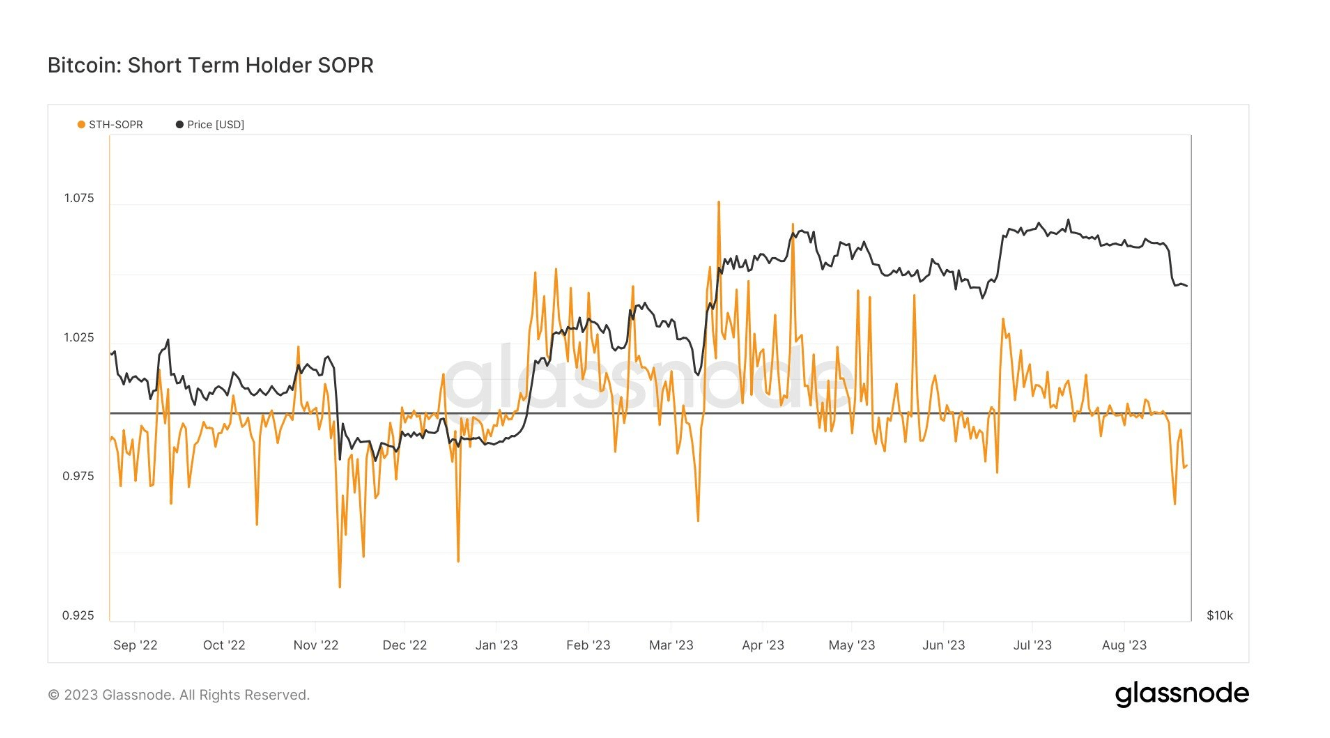

Employing the Spent Output Profit Ratio (SOPR) – a metric specific to spent outputs over the last 155 days – helps in gauging the actions of these short-term investors.

Recent findings indicate that their investment behavior mirrors the pattern seen during the SVB and FTX collapse, characterized by the selling of assets at substantial losses. This correlation suggests that these investors, driven by short-term market fluctuations, may contribute significantly to the current market instability.

The post Bitcoin’s shaky stage mirrors FTX collapse as short-term holders cut losses appeared first on CryptoSlate.