- January 4, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

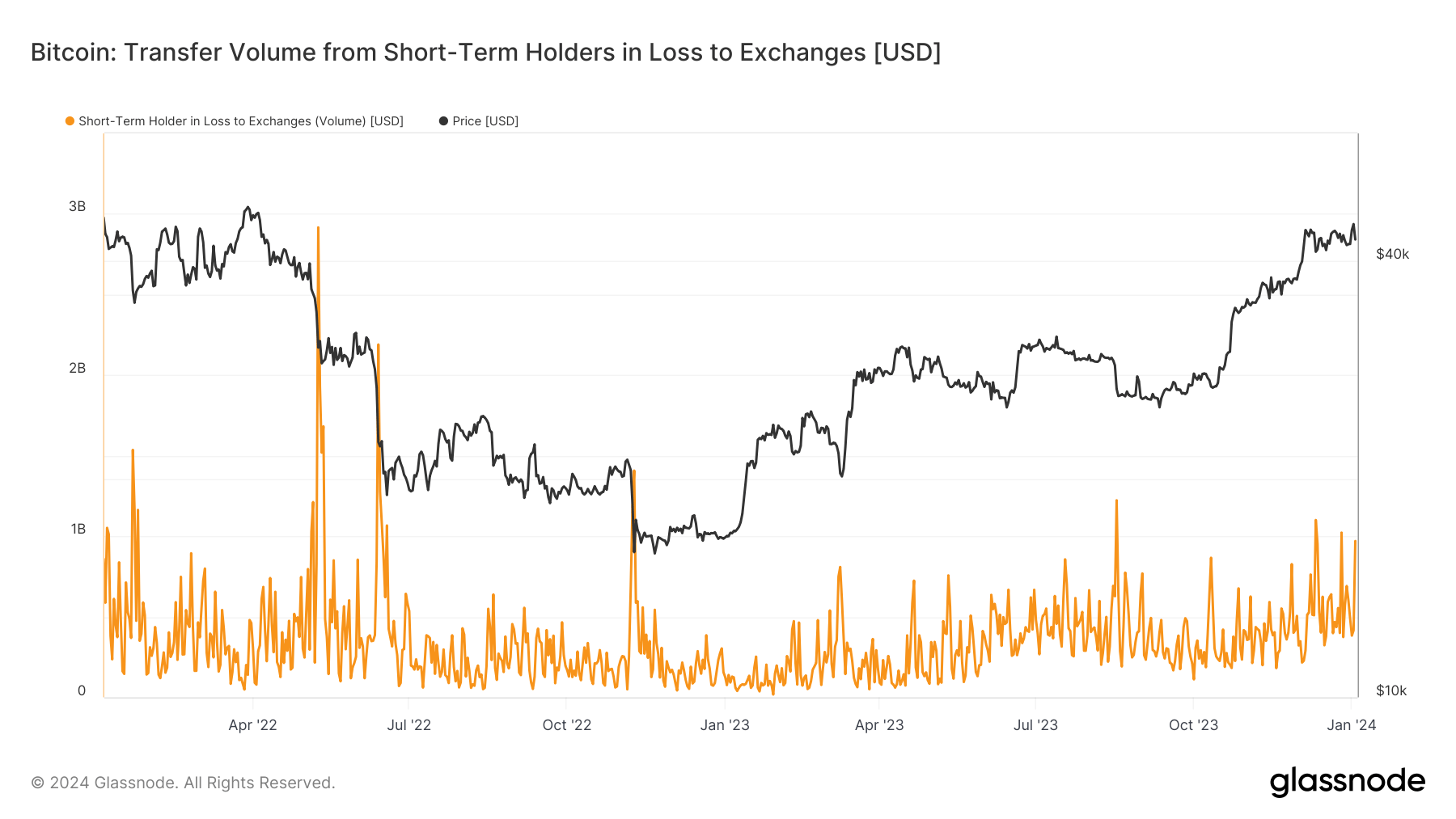

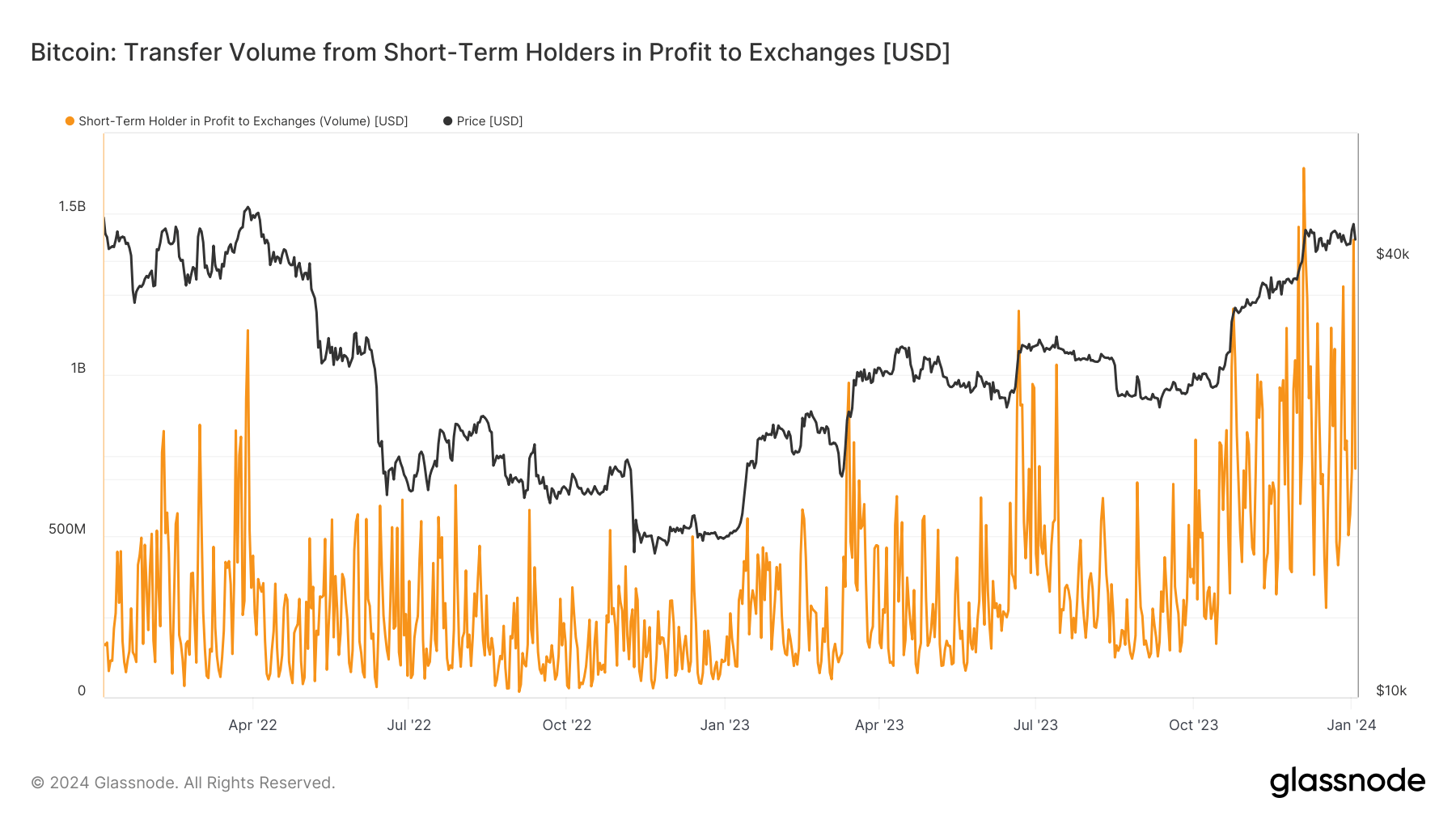

A recent dip in Bitcoin’s price has unveiled the activities of short-term holders, defined as those holding Bitcoin for fewer than 155 days. Upon investigation, it has been found that these holders transferred roughly $1 billion of coins to exchanges while at a loss. In the past year, this recorded activity marks the fourth most significant loss specifically related to transfers to exchanges at a loss.

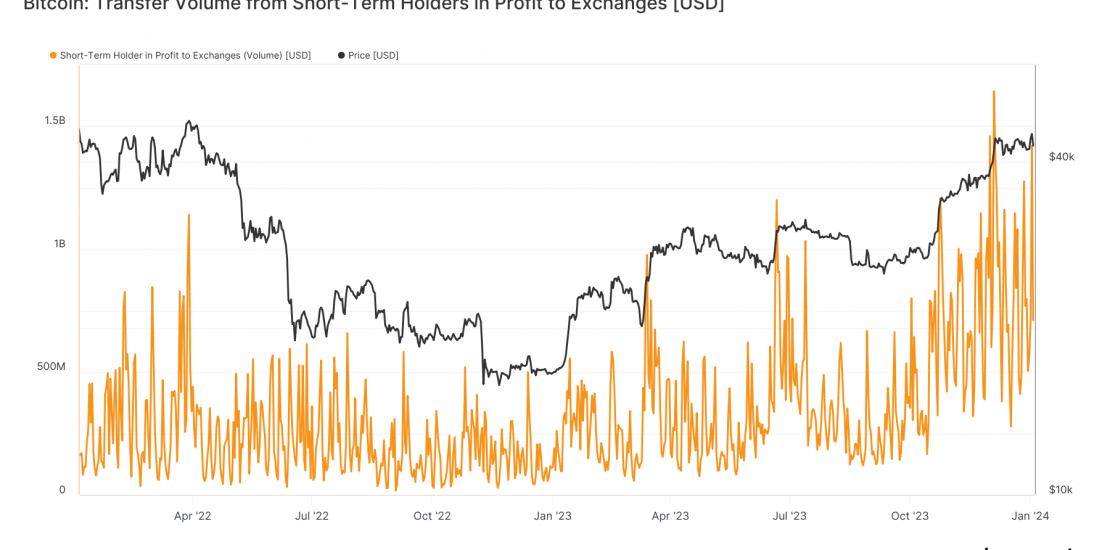

Looking back at earlier periods of profit-taking, data reveals that these same short-term holders dispatched about $1.5 billion to exchanges on Jan. 2 as Bitcoin’s value ascended above $45,000. This occasion signifies the third most prolific episode of profit-taking from this specific group within the past two years. This event was outshone only by two instances in early December when Bitcoin first breached the $40,000 mark, leading to heightened profit-taking.

The post Bitcoin’s slide reveals short-term investors transferring $1 billion in losses appeared first on CryptoSlate.