- March 1, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

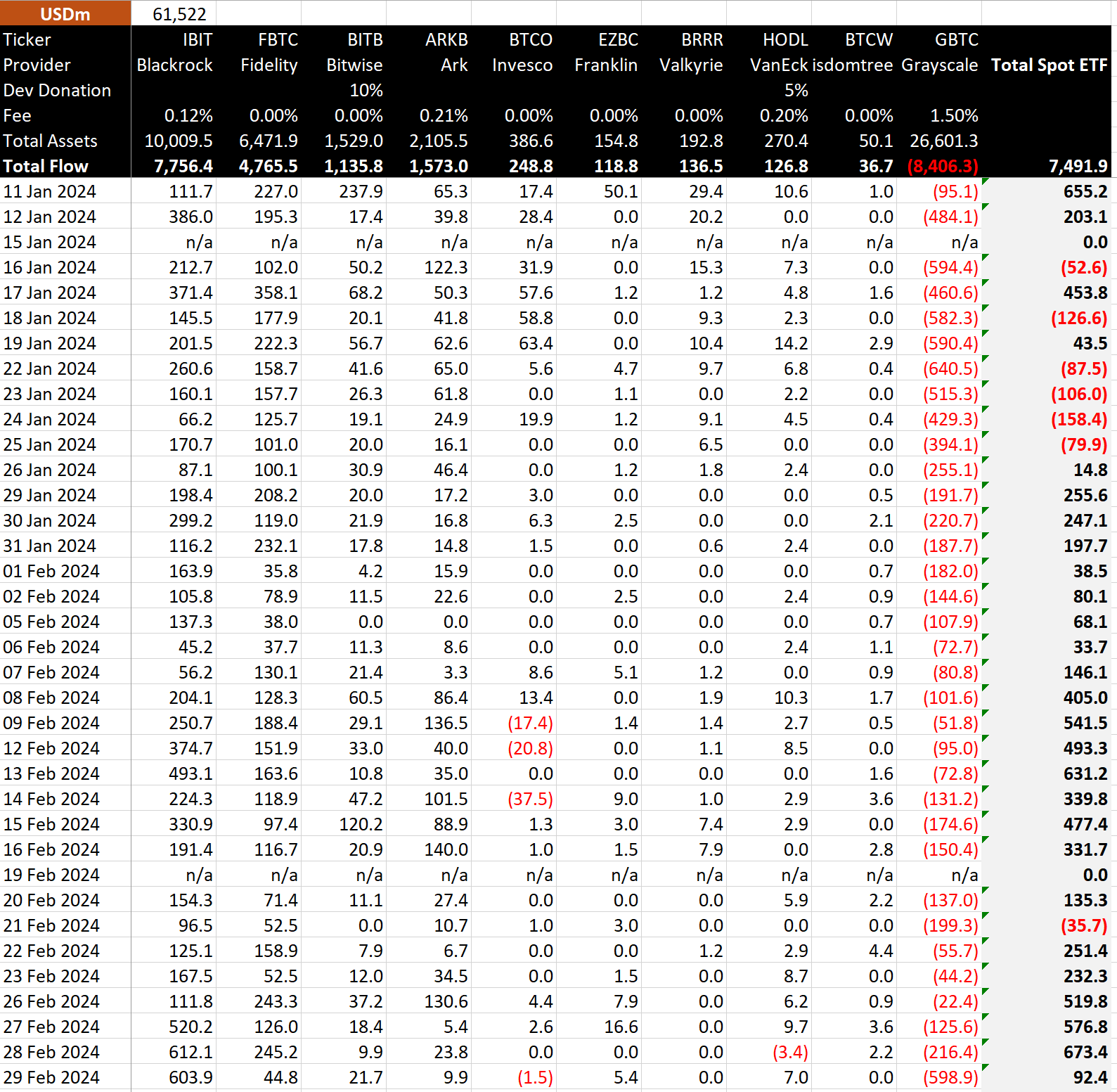

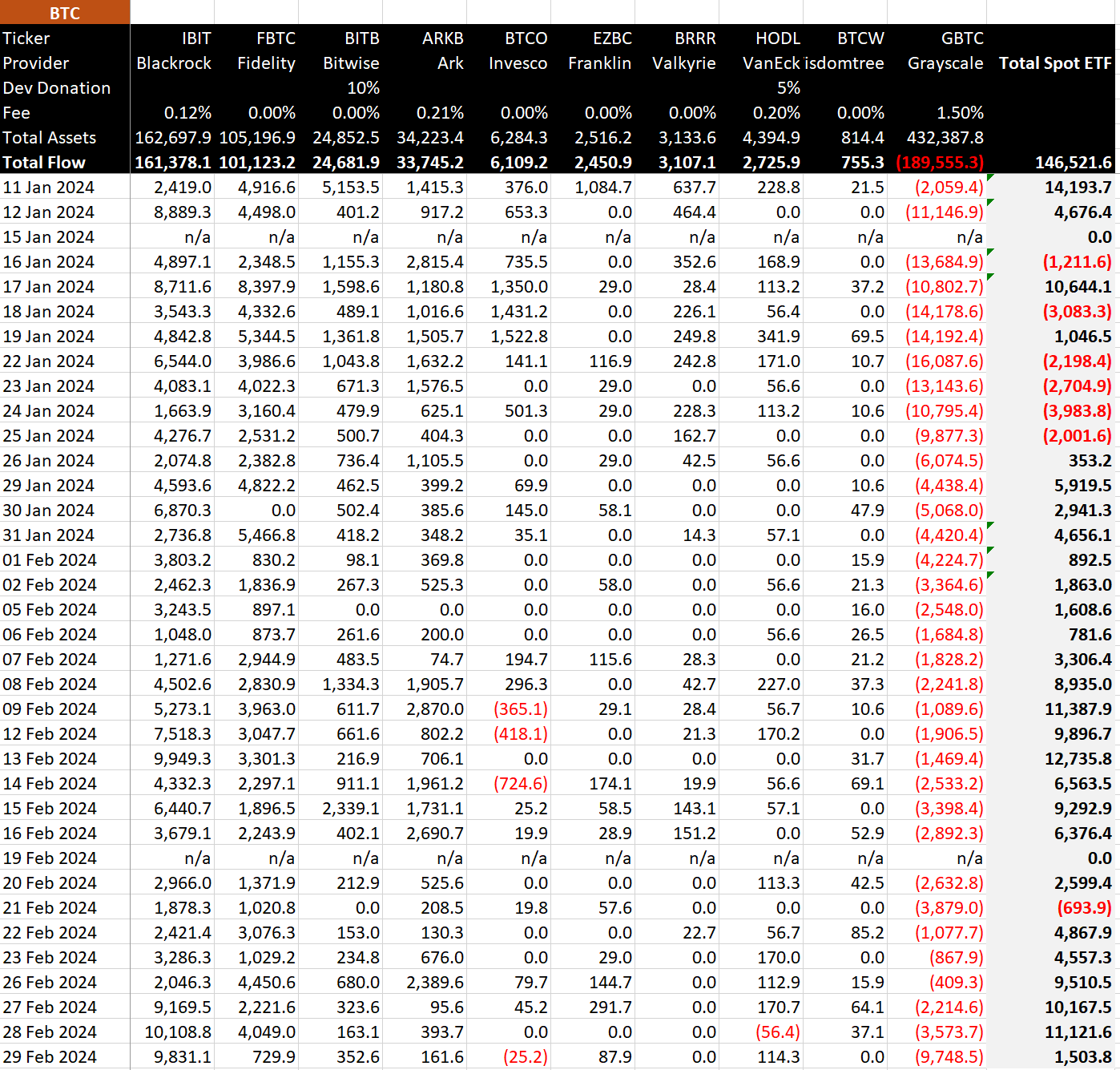

Data from BitMEX suggests that BlackRock’s IBIT had another remarkable day for the Bitcoin ETFs. It witnessed the second-largest inflow since trading started, with $604 million coming under management, equivalent to roughly 10,000 BTC. This dramatic influx escalated the cumulative total of inflows for IBIT to an impressive $7.8 billion. As a result, BlackRock’s total Bitcoin holdings have surged to 161,378 BTC.

Data from BitMEX also showed a massive outflow from the Grayscale Bitcoin Trust (GBTC), which experienced its second-largest outflow since inception, with a staggering $599 million exiting its ETF. This outflow has pushed GBTC’s total outflows to a worrying $8.4 billion.

Consequently, the total inflows on the day amounted to a mere $92 million, equivalent to roughly 1,500 BTC.

Furthermore, the total net flows for all spot Bitcoin ETFs have reached a significant benchmark of $7.5 billion, equating to roughly 146,522 BTC.

The post BlackRock’s Bitcoin ETF sees massive inflow while Grayscale faces second largest outflow appeared first on CryptoSlate.