- September 18, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

On-chain data shows the Chainlink whales have deposited $350 million of the asset into exchanges, a sign that could be bearish for LINK’s price.

Chainlink Large Transactions Volume Has Spiked Recently

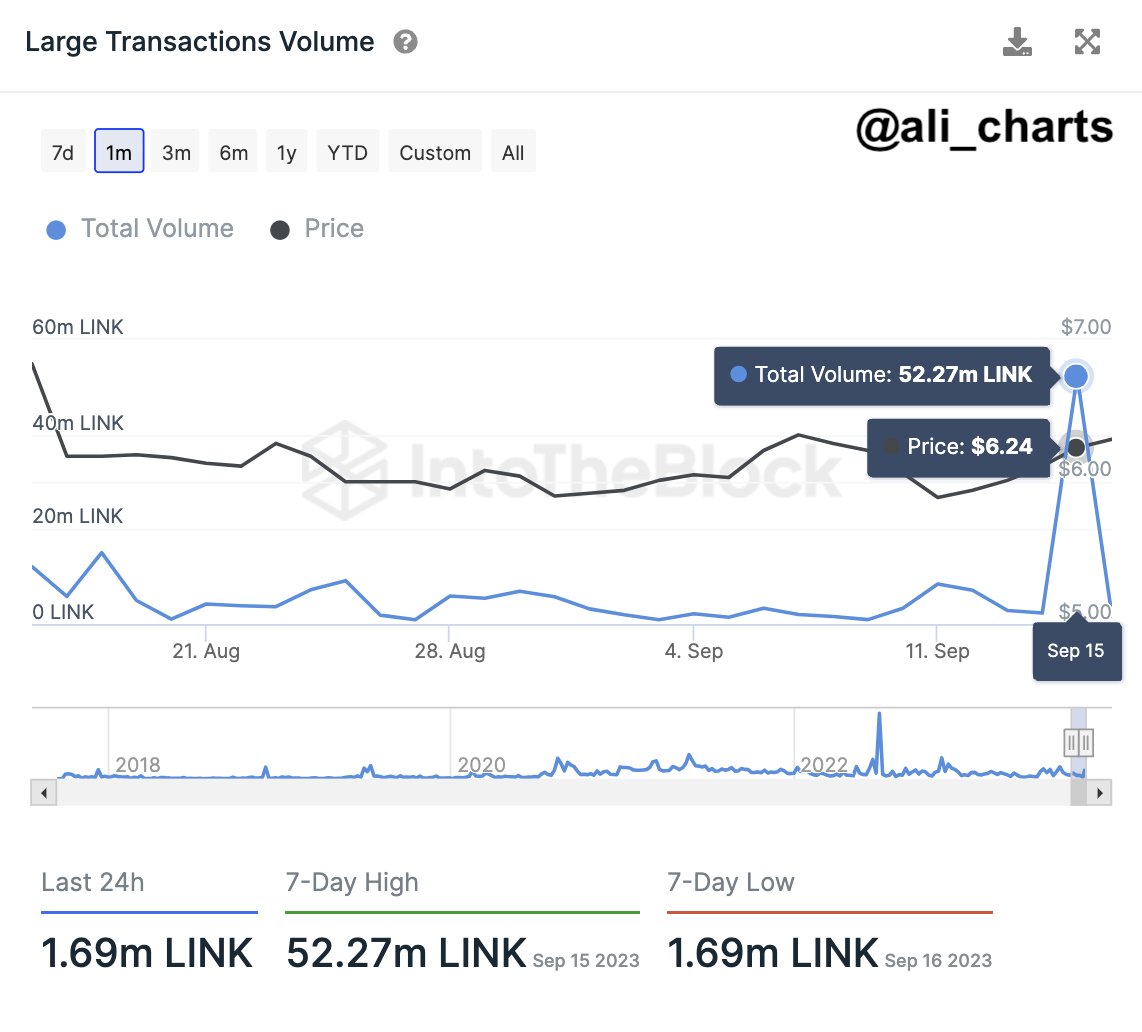

As pointed out by analyst Ali in a post on X, LINK has recently observed a burst of activity on its network. The indicator of interest here is the “large transactions volume,” which measures the aggregate amount of Chainlink being moved in transfers worth at least $100,000 in value.

Generally, the only investors who make such large transactions regularly are the whales and institutional investors, so this indicator can provide us with hints about the total activity that these holders are displaying right now.

When the value of this metric is high, it means that the large players in the market are moving around a high number of tokens currently. This can imply that these investors are participating in buying or selling in the market, although it can’t point at which of the two the holders are doing exactly.

On the other hand, low values that imply these humongous holders are remaining on standby, possibly because they don’t have much interest in the cryptocurrency at the moment.

Now, here is a chart that shows the trend in Chainlink’s large transaction volume over the past month:

As displayed in the above graph, Chainlink’s large transaction volume observed a huge spike just recently. During this spike, whales and other large entities moved nearly 52.3 million LINK (worth about $350 million at the current exchange rate) on the blockchain in a single day.

As mentioned before, this indicator alone can’t tell us whether these investors were buying or selling with these transactions; it only tells us that they were active.

Ali, however, has revealed that these transfers were in fact towards centralized exchanges, meaning that these investors had deposited their coins into the wallets of these platforms.

Generally, one of the main reasons why investors may transfer to these exchanges is for selling purposes, so these deposits can be a sign that the whales have been gearing up for a selloff.

So far, though, Chainlink hasn’t felt any bearish effect from these transactions, and in fact, the price has gone the opposite way.

LINK Has Broken The $6.7 Mark With A Strong 8% Surge

During the past day, Chainlink has enjoyed some sharp bullish momentum as its price has now gone above the $6.7 level. With its gains of 8%, LINK is by far the best performer among the top assets by market cap.

It’s possible that if the whales had indeed made the deposits for distribution, the market would have been able to absorb the selling pressure just fine. Another potential scenario, however, can also be that these humongous holders had only made the transfers in advance, waiting for the perfect opportunity to pull the trigger.

Naturally, in the latter scenario, this latest surge wouldn’t be able to last too long, as these whales going through with their selloff would provide a major impedance to the price.