- September 25, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Chainlink has observed some sharp growth recently, but can the cryptocurrency keep up this run of bullish momentum?

Chainlink Has Enjoyed Notable Returns During The Past Week

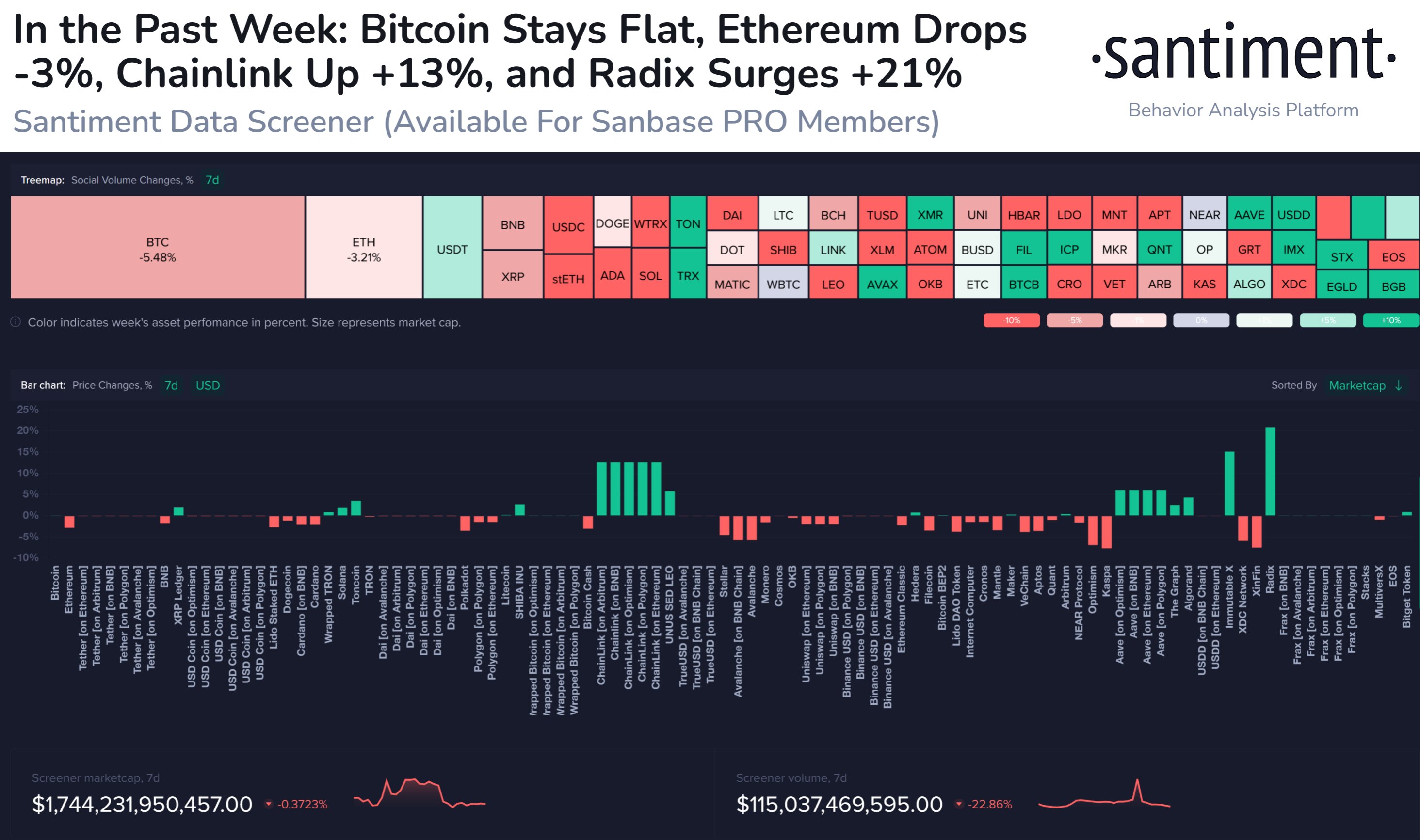

While the rest of the digital asset sector has been struggling recently, Chainlink has stood out as a coin that has registered a rapid uptrend. The price has continued this recent run during the past day as well, as its price is now floating above the $7.2 level.

During the past week, every coin except LINK inside the top 20 assets by market cap has seen negative returns. LINK’s strong gains, thus, make it by far the best performer in the sector.

Despite the strong performance in the past month, though, Chainlink has still not recovered back to the levels it was at before the crash in August. Nonetheless, it’s not too far off now, meaning that if this uptrend can continue in the coming days, the cryptocurrency should complete its recovery.

What The Different Metrics Say About This LINK Surge

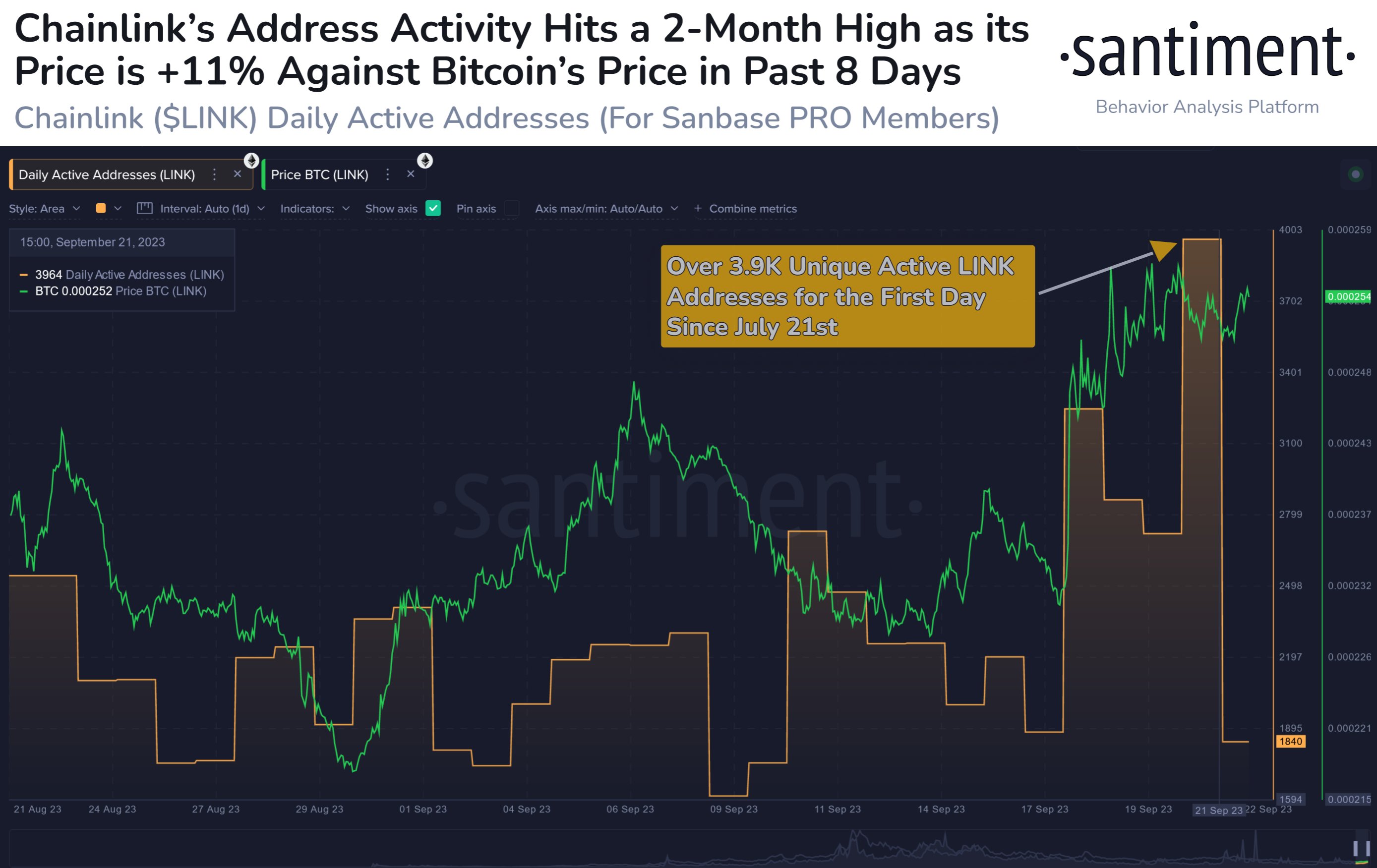

Now, as for whether the run can continue, perhaps data from the on-chain analytics firm Santiment might provide some clues. First, the rally appears to be backed by a high amount of address activity, as the below chart shows:

As displayed above, the number of daily Chainlink active addresses has hit the highest level since July recently. The “active addresses” here refer to the unique addresses that are taking part in some kind of transaction activity on the blockchain.

The number of active addresses could be considered as a representation of the number of users trading the asset, so a high value of the metric implies that the coin is seeing a high amount of activity.

The active addresses staying high during the rally is a positive sign, as it implies that the traders are showing interest in the surge. This is different from the uplift seen near the start of the month, which didn’t get backed by such activity, and therefore, ran out of fuel before long.

Santiment has also pointed out an interesting pattern that LINK has been observing recently and it’s that the price uplifts have generally followed increases in the coin’s exchange reserve.

This pattern has repeated for the latest surge as well since the supply on exchanges had hit a new high for the year right before the rally started. This trend is different from what usually happens with other cryptocurrencies, where a flow of coins into exchanges is often a bearish signal.

Even though Chainlink has risen sharply recently, it would appear that social media talk around the asset has only seen a moderate increase, as the data for the “social volume” suggests.

Too much social media hype has historically been bad for rallies, so Chainlink only seeing a relatively healthy increase in its social volume could be a promising sign for the sustainability of its surge.