- April 8, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

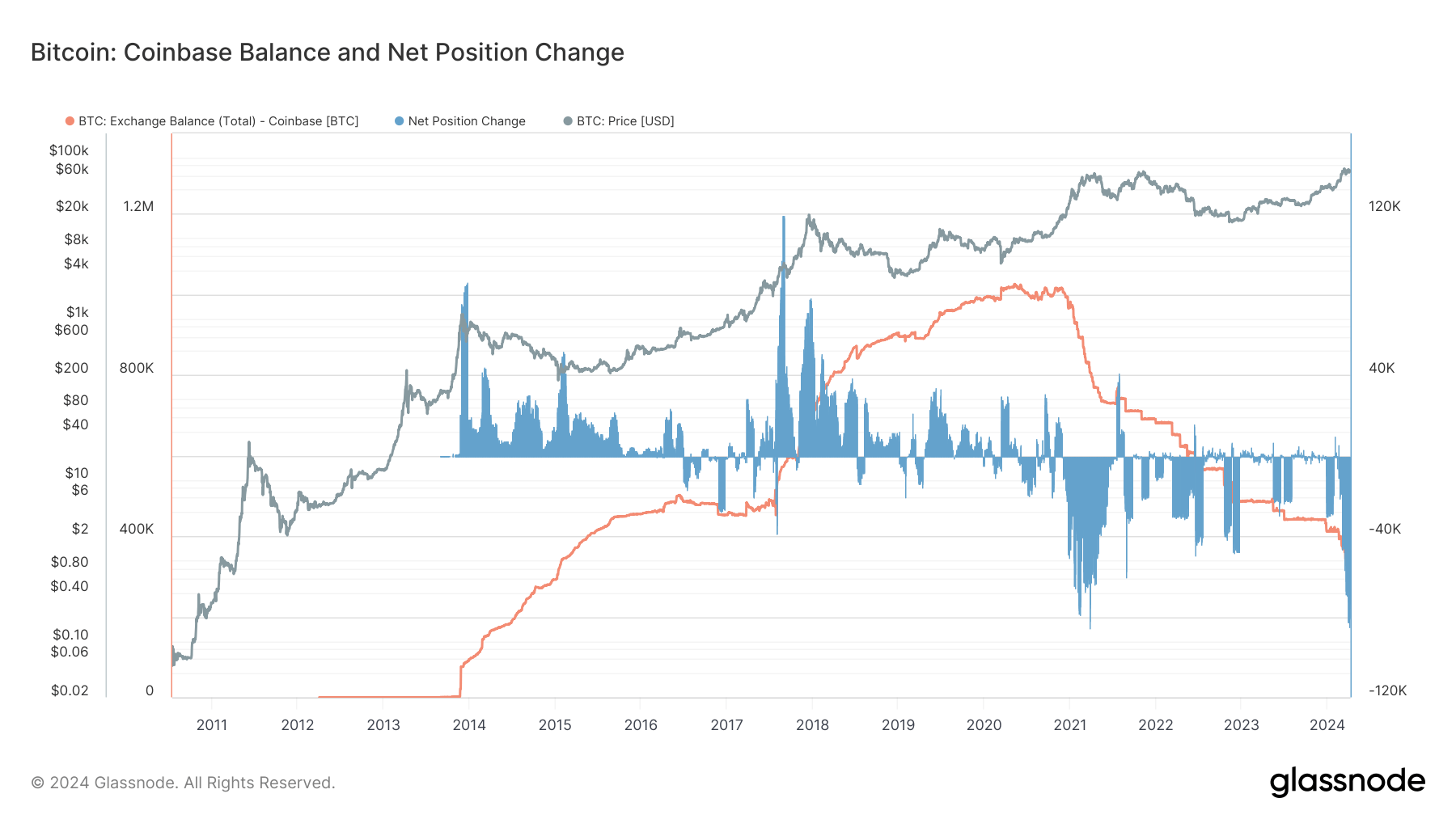

Glassnode data reveals a substantial decrease in Bitcoin (BTC) holdings on the Coinbase exchange. Over the last 30 days, a notable 85,000 BTC have been withdrawn from the platform, marking the second-largest net outflow on record for a 30-day period. This mirrors a similar occurrence in March 2021, when 86,000 BTC left Coinbase.

The exchange’s Bitcoin balance has shown a consistent decline since March 2020. In December 2020, Coinbase possessed approximately 1 million BTC, but by July 2021, this figure had dwindled to just 730,000 BTC – a reduction of 270,000 BTC amidst the price surge from $10,000 to $60,000.

More recently, this downward trend has accelerated. Following the launch of the inaugural Bitcoin ETFs in January 2024, Coinbase held 411,000 BTC. Presently, this figure has plummeted to 294,000 BTC, indicating a decline of roughly 120,000 coins in a mere two months, coinciding with a price hovering around $72,000. These trends suggest both retail and institutional investors are swiftly withdrawing their Bitcoin holdings from the exchange.

During the last two months, CryptoSlate has documented several significant withdrawals from Coinbase, with the most recent being approximately $1.1 billion.

The post Coinbase Bitcoin holdings plummet by 85,000 BTC in 30 days, second biggest on record appeared first on CryptoSlate.