- August 10, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Decentralized exchanges (DEX) on Coinbase newly launched layer2 network Base had more trading volume than those on established layer1 networks like Cardano (ADA) and others less than 24 hours after it went public, according to DeFillama data.

Data from the DeFiLlama showed that Base was among the top 10 networks by trading volume, with a volume of $26.23 million. On the other hand, established layer1 blockchain networks like Fantom (FTM), Cardano, and Tron (TRX) saw less than $20 million in transactions cumulatively.

It should be noted that Base’s volume is miles behind Ethereum, Solana (SOL), and Binance-backed BNB Chain.

Meanwhile, even before its public launch, Base had seen significant usage through the BALD meme coin. At its peak, the meme coin reached a market cap of over $85 million before crashing.

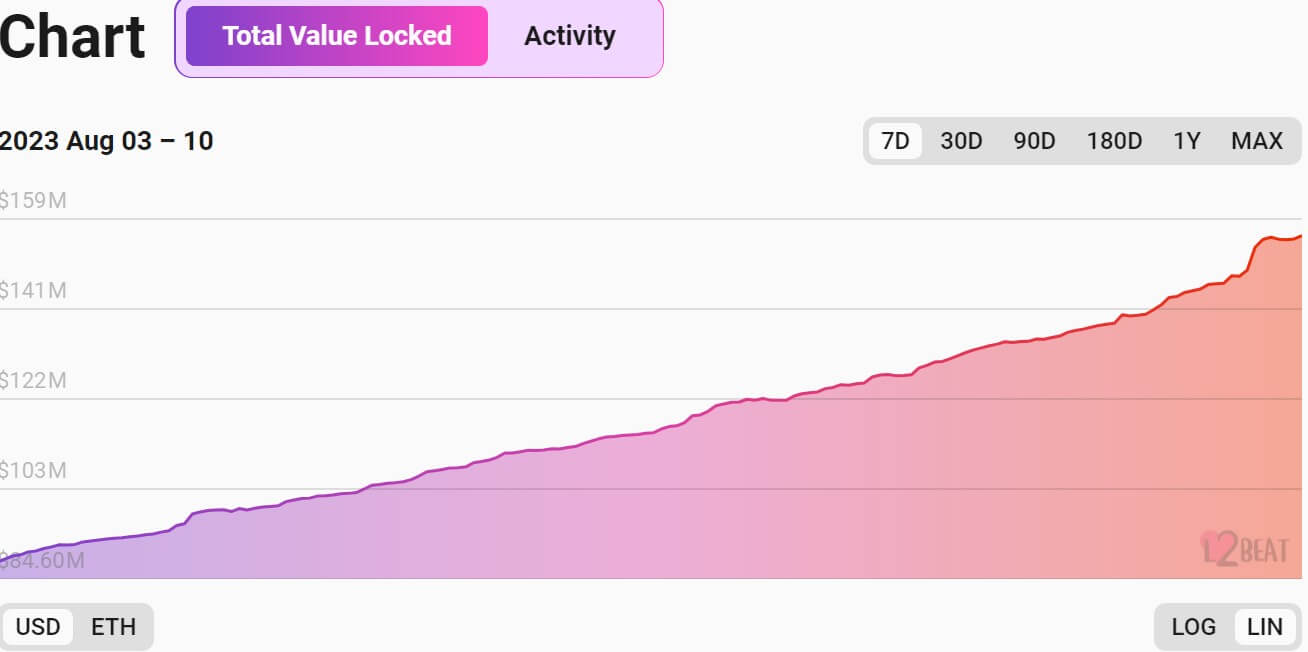

TVL surpasses $150M

Besides that, the total value of assets locked (TVL) on Base also surpassed $150 million during the period, according to L2Beat data.

Data from L2Beat shows that Base’s TVL currently sits at $155 million after rising by more than 77% over the past week, making it the fifth largest layer-2 network, ahead of StarkNet, and others.

Aside from its TVL increase, Base also saw a significant increase in daily transactions per second (TPS).

According to L2Beat, Base daily TPS soared 160% to 5.81. While this is relatively lower than other L2 networks like Arbitrum (ARB), Optimism (OP), and zkSync Era, market observers have suggested that Base would see more adoption as its ecosystem grows.

Coinbase launched Base to the public on Aug. 9 after debuting its testnet in February and the developer-only release in July. The exchange markets the network as the first blockchain by a publicly listed company, representing part of its efforts to improve the adoption of web3 and blockchain technology.

The post Coinbase newly launched BASE network transaction volume higher than Cardano, others appeared first on CryptoSlate.