- December 21, 2025

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The investment landscape in 2025 has delivered an unusual outcome that few would have anticipated at the start of the year. Assets traditionally viewed as slow movers have risen as the clear winners, while the cryptocurrency market has quietly slipped to the bottom of the performance rankings.

As the year draws to a close, data from across commodities, equities, and digital assets shows an imbalance in returns, revealing that cryptocurrencies now sit behind every major asset class in year-to-date performance.

Clear Split Between Traditional Assets And Crypto

The performance data for 2025 reveals a strong divergence between traditional markets and digital assets, with the gap widening as the year progressed. According to the figures revealed on the social media platform X by ‘Bull Theory,’ silver is the top-performing asset for 2025, posting gains of about 130% year-to-date. Gold is the second-best-performing asset of 2025, with an increase of about 65%, while copper has climbed close to 35%. These numbers reflect sustained strength across the commodities sector.

Equity markets are also currently trading in positive territory. The Nasdaq is up around 20% on the year, the S&P 500 has gained approximately 16%, and the Russell 2000 is higher by about 13%.

The only negative numbers are from the crypto industry. In contrast, the crypto market sits at the bottom of the performance rankings. Bitcoin is currently down by about 6% from its 2025 opening price, Ethereum has declined around 12%, and the entire altcoin market (removing Ethereum) has suffered a much deeper drawdown of about 42%. Therefore, the crypto market is now officially the worst-performing asset class in 2025.

Chart Image From X. Source: @BullTheoryio

From Mid-Year Rally To Q4 Breakdown

The current weakness of the crypto market is very different from the optimism that dominated the beginning and middle of 2025. During that period, the crypto market experienced a powerful recovery that reignited bullish sentiment across the board. Bitcoin, Ethereum, XRP, and several large-cap tokens pushed to new all-time highs.

Bitcoin’s rally peaked in October, when it set its standing record of $126,000 after months of steady accumulation and strong momentum. Ethereum, on the other hand, registered a new all-time high of $4,946 in August, while XRP’s all-time high came earlier in July. XRP’s record price of $3.65 was the most notable, as it was its first time breaking into a new all-time high since 2018.

That bullish trend began to unravel as the fourth quarter got underway, starting with the crypto market flash crash on October 10. The decline has extended since then, and Bitcoin and the broader crypto market have now fallen into negative territory from their 2025 opening levels.

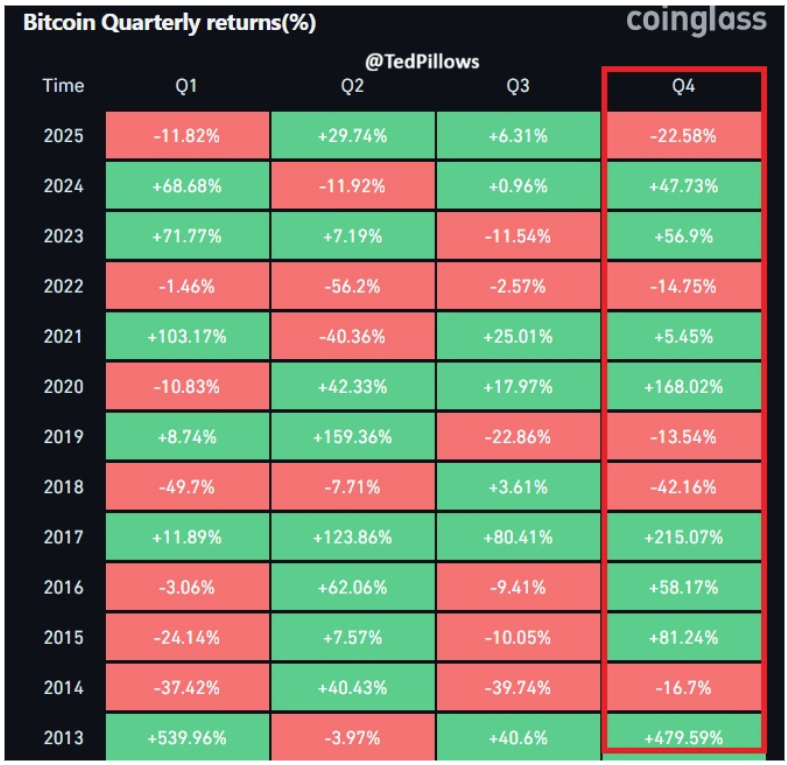

Quarterly returns data shows that Bitcoin just recorded its worst fourth-quarter performance in seven years. The result is a year in which digital assets, despite a powerful mid-year rally, are closing out as the worst-performing major asset class.

Bitcoin Quarterly Returns. Source: @TedPillows On X

Featured image from Unsplash, chart from TradingView