- January 23, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

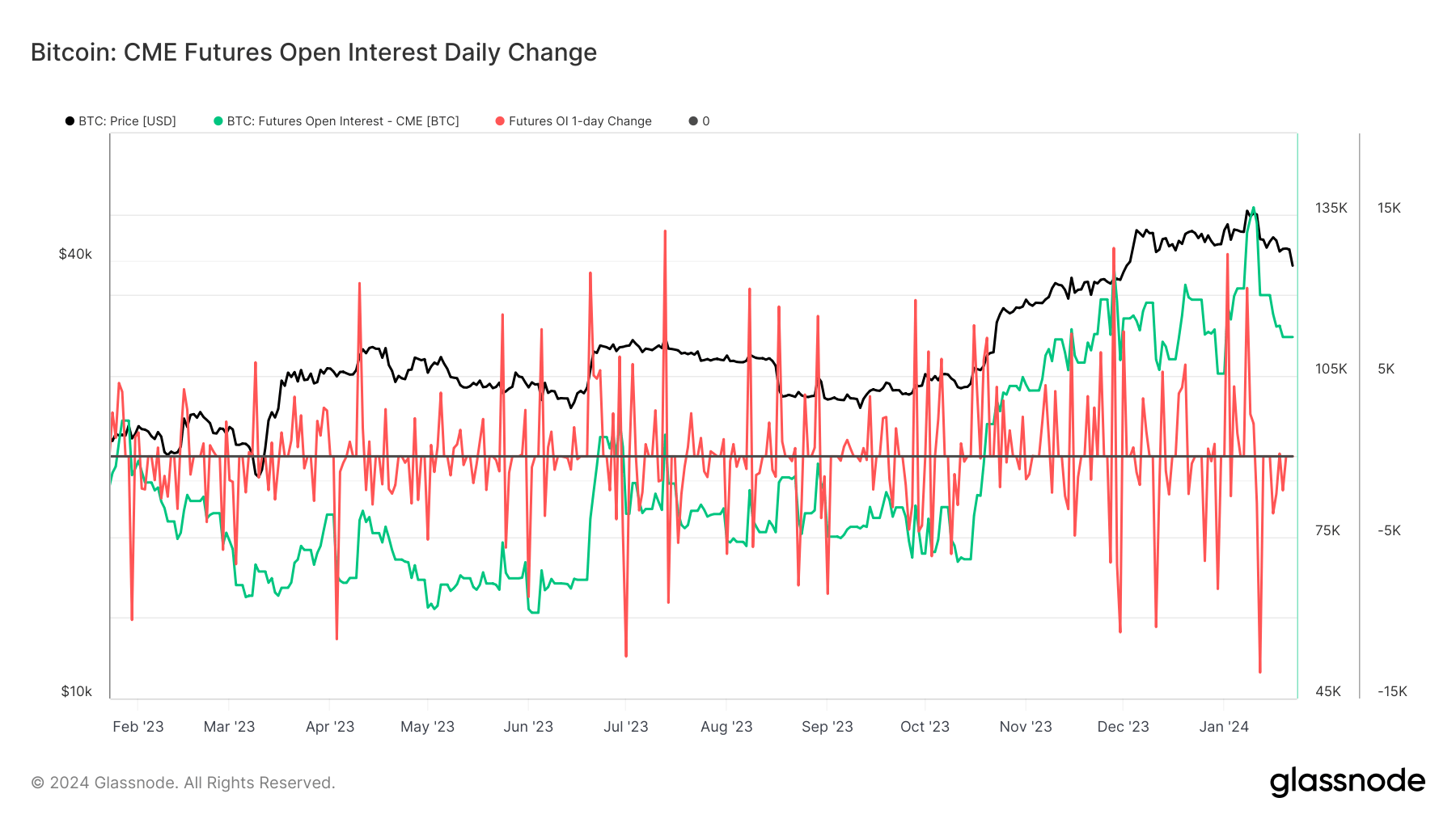

The futures open interest market has witnessed a seismic shift, with CME rising to prominence, outpacing Binance to hit a 30% dominance. This ascension was propelled by the lead-up to the spot Bitcoin ETF, which saw a high of 136,000 Bitcoin allocated in CME on Jan. 10, which decreased to 112,000 Bitcoin by Jan. 22.

A significant one-day drop in CME open interest was observed on Jan. 12, with a decrease of around 13,000 Bitcoin, which coincided with Bitcoin’s largest one-day drop since the FTX collapse. Meanwhile, Binance has approximately 100,000 Bitcoins in open interest.

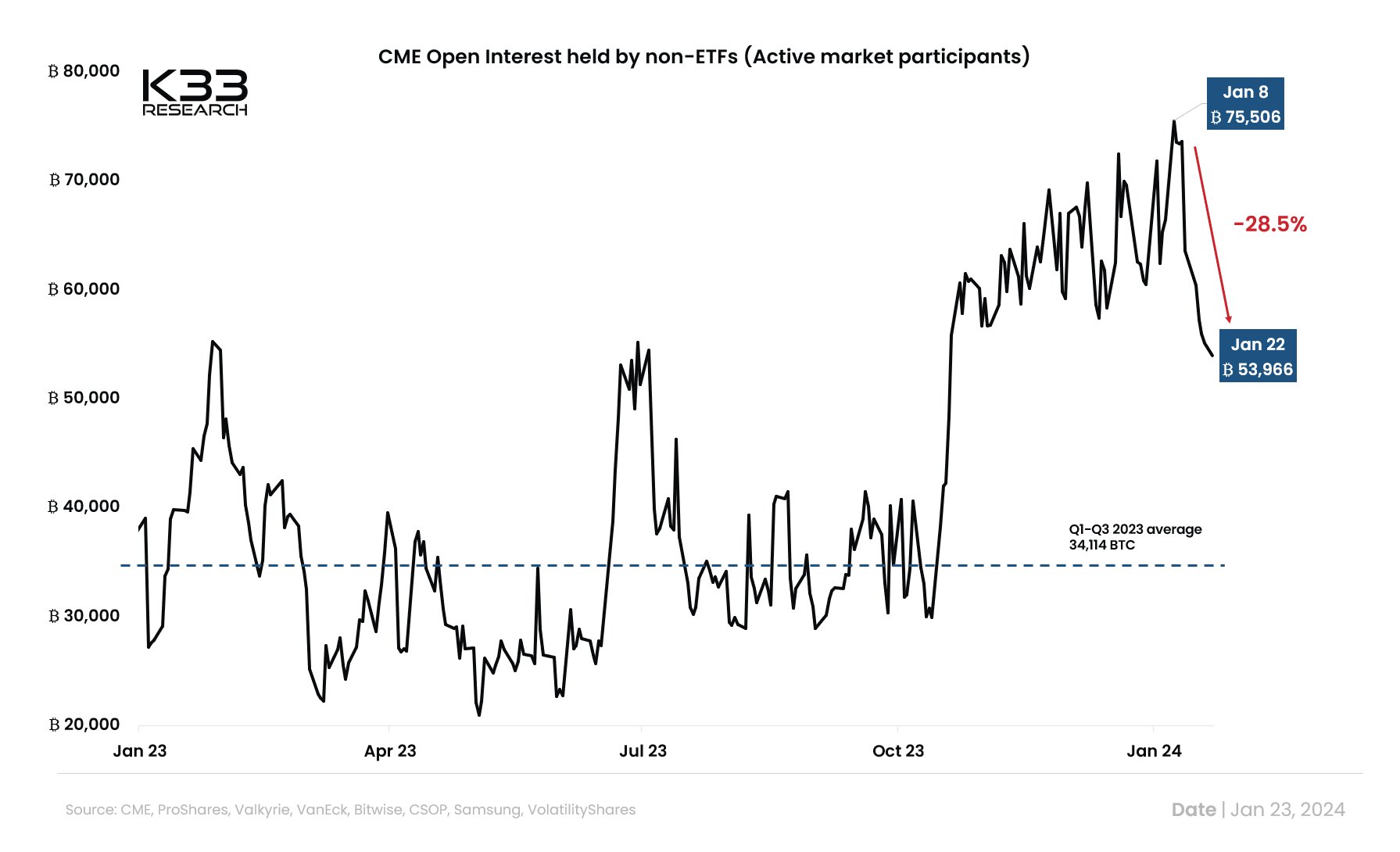

However, analyst Vetle Lunde of K33 research suggests a potential further reduction in CME Open Interest (OI), with 20,000 Bitcoin positioned above the average.

According to Lunde, this reduction correlates with a decline in CME OI held by non-ETFs, which has dropped by 21,540 Bitcoin since Jan. 8. Meanwhile, ETPs globally have seen net inflows of 15,968 Bitcoin in the same period, which, according to Lunde, indicates a rotation into spot ETFs from CME.

These dynamics pose an intriguing question: could this signal an opportunity for Binance’s open interest to regain its top position?

The post Could Binance be on the verge of taking back its lead from CME in futures markets? appeared first on CryptoSlate.