- April 3, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

During the 2013 Cyprus financial crisis, Bitcoin’s reaction provided an early indication of its potential as a “risk-off” asset and alternative safe haven. The instability in Cyprus’s banking system was attributed to lax regulation within the sector and overextension among property developers, as reported by The Guardian.

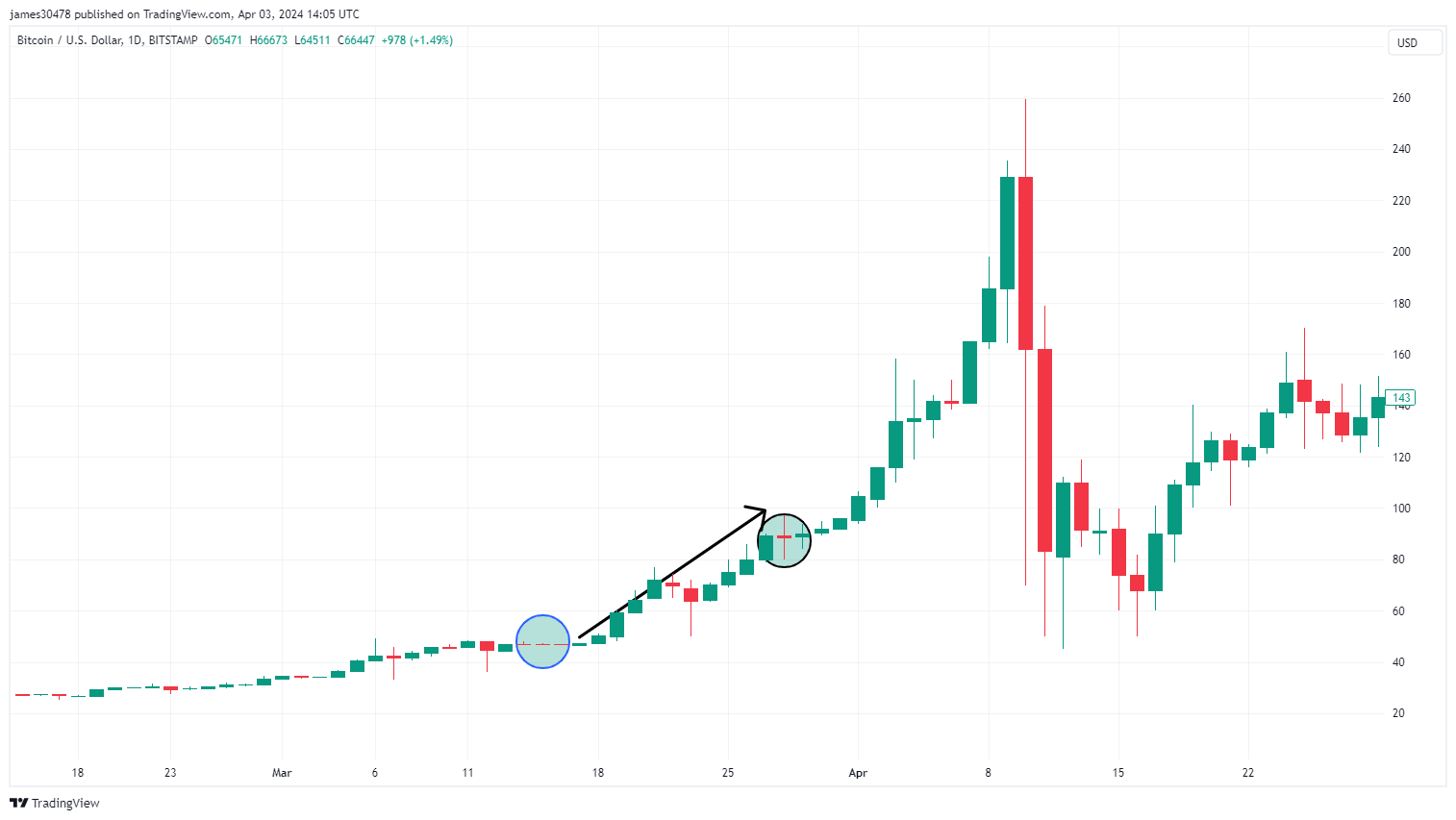

Before the crisis escalated, on March 16, Bitcoin’s value was approximately $48, showing a decline reflected by three consecutive days of red candlesticks from March 14 to March 16. However, as the crisis unfolded and Cypriot banks closed on March 18, Bitcoin surged to around $52.

This marked the beginning of a rapid ascent, with Bitcoin skyrocketing over 77% to roughly $92 by March 28. This coincided with the formal announcement of a €10 billion bailout for Cyprus, leading to the winding down of the nation’s second-largest bank.

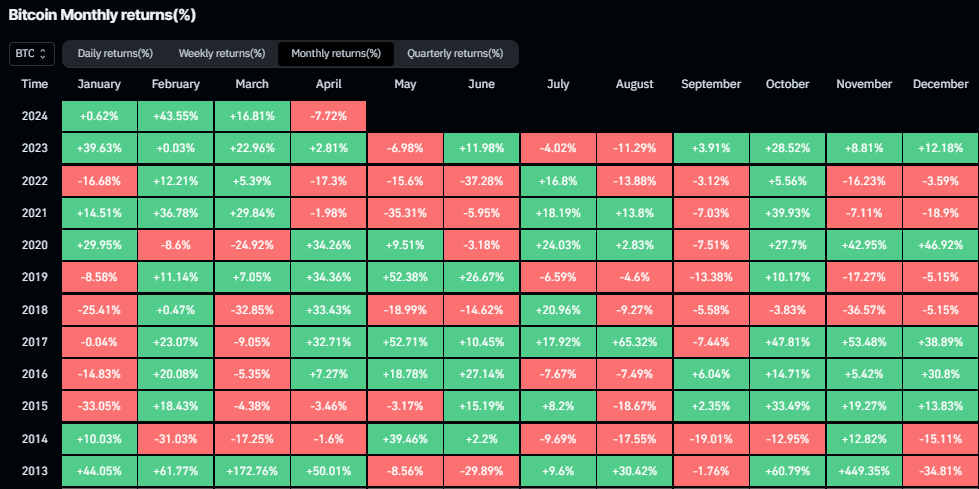

Despite ending March 28 slightly lower at $82, Bitcoin’s surge during the month was exceptional — delivering a 173% return, its second-best monthly performance on record.

The weekly timeframes were even more staggering, with returns of 52%, 29%, and 74% for weeks 11, 12, and 13 of 2013, respectively, according to Coinglass.

The post Cyprus’ 2013 banking crisis was Bitcoin’s origin as a safe haven asset appeared first on CryptoSlate.