- April 3, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

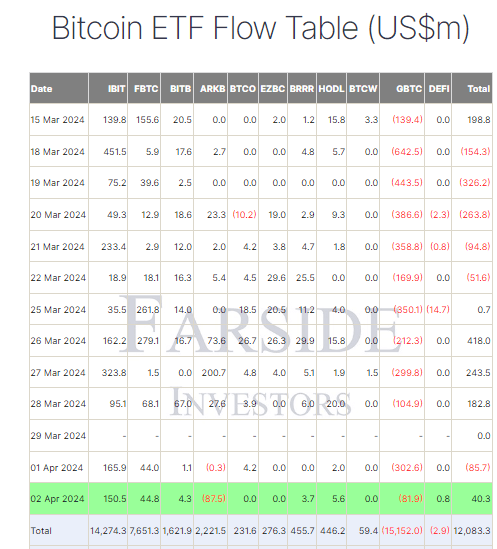

Bitcoin (BTC) exchange-traded funds (ETFs) on Apr. 2 experienced a moderate net inflow of $40.3 million, according to Farside data. Particularly noteworthy is the Grayscale Bitcoin Trust (GBTC), which saw a relatively smaller outflow of $81.9 million, signaling a significant slowdown from previous outflows. GBTC has now totaled $15,152.0 billion in net outflows.

Farside data reports that the ARK ETF (ARKB) recorded its largest single-day outflow of $87.5 million, yet it has accumulated total inflows of $2,221.5 billion. On the other hand, BlackRock’s (IBIT) Bitcoin ETF attracted a healthy inflow of $150.5 million, boosting its total net inflow to an impressive $14,274.3 billion. In a positive turn, the Hashdex Bitcoin ETF (DEFI) saw its first net inflow since Feb. 21 of $0.8 million, reducing its total outflows to just $2.9 million.

According to Farside data, cumulative net inflows across all Bitcoin ETFs now stand at $12,083.3 billion.

The post Despite Grayscale and ARK’s outflows, Bitcoin ETF market records net inflow appeared first on CryptoSlate.