- December 17, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Ethereum Whale Dominance Hits Record High: What Comes Next? appeared first on Coinpedia Fintech News

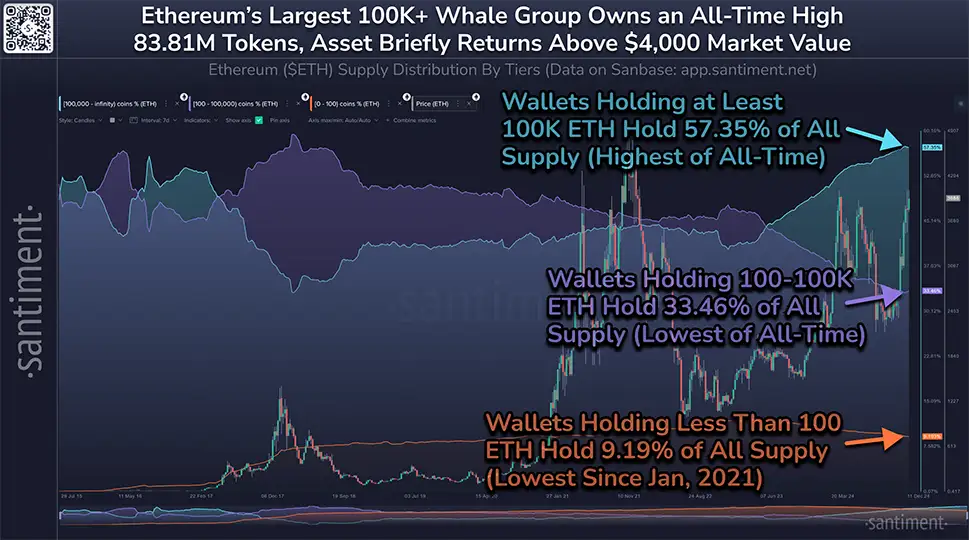

Ethereum whale dominance is at the peak and it’s hard to ignore what this could mean for the future. It is highest in history so far. While smaller investors hold less than ever, whales are quietly accumulating more ETH. Is this a sign of another bull run, or something else entirely?

Whales Are in Control

As of now, 104 wallets hold over 100,000 ETH each. That’s 57.35% of Ethereum’s total supply, the highest level ever recorded. While these massive wallets grow in power, mid-sized investors (those holding between 100 and 100,000 ETH) now control just 33.46%, the lowest share in history.

It’s not looking great for small investors either. Wallets with less than 100 ETH make up just 9.19% of the supply. That’s their smallest slice since January 2021. The trend has been building since late 2022, when big investors began aggressively accumulating ETH. Clearly, the whales know something, and they’re playing the long game marking the rise in Ethereum whale dominance.

History Shows Whales Move the Market

This isn’t the first time whales have shaped Ethereum’s price. Back in late 2020 and early 2021, similar levels of whale accumulation kicked off a massive bull run that sent ETH to new heights. But there’s a flip side to this. When whale dominance peaked in 2022, it was followed by a sharp price correction.

Whale activity doesn’t just happen—it’s often a signal. Right now, ETH sits at $4,015, with immediate resistance at $4,109. On the 4-hour chart, the nearest 20-day moving average (MA) is at $3,931, and strong support rests at $3,575, backed by the MA 200.

The technical indicators show cautious optimism. The Relative Strength Index (RSI) sits at 58.42, meaning ETH isn’t in overbought territory yet. However, On-Balance Volume (OBV) at -44.94 reflects a level of hesitation among investors.

Money In, Money Out: Investor Breakdown

A closer look at investor behavior adds more context. According to IntoTheBlock data, 74% of Ethereum holders have kept their assets for over a year. Short-term holders break down like this:

- 22% bought ETH between 1 month and 12 months ago.

- 4% are newer investors, buying within the last month.

Profitability paints a bullish picture, too. Right now:

- 94% of investors are in profit.

- 3% are breaking even.

- Only 3% are at a loss, primarily those who bought during Ethereum’s all-time high (ATH) of $4,891 in November 2021.

However, there are still around 4.27 million addresses holding 1.21 million ETH in loss. Most of these losses occurred when ETH was purchased between $4,093 and $4,891—not far from the current price level.

What’s Next?

So what does all of this mean for the average investor? Well, it depends. On the bullish side, whales seem confident. They’re buying up Ethereum, especially during dips, and this often signals long-term optimism. If this trend continues, ETH could climb to the $4,500 – $5,000 range.

But there’s a risk, too. When a few wallets hold so much of the supply, the market becomes vulnerable. A coordinated sell-off from these whales could cause a sudden drop. It’s something to watch closely as ETH’s story unfolds.

Either way, Ethereum whale dominance is a clear reminder: the big players still have the most power in this market.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.