- May 2, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

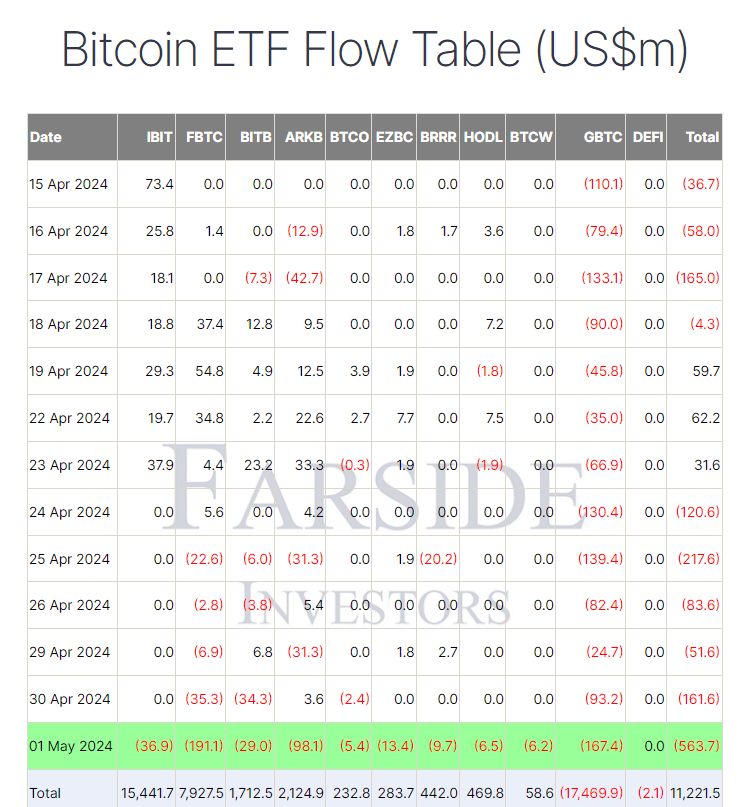

Farside data shows that on May 1, Bitcoin exchange-traded funds (ETFs) suffered a record $563.7 million outflow – the worst single-day performance since their inception. This massive capital exodus marked the sixth consecutive trading day of withdrawals, aligning with Bitcoin’s over 20% plunge from its all-time high.

BlackRock’s IBIT saw its first redemption of $36.9 million since launch after five straight days of no flows. Despite this, IBIT maintains an impressive $15,441.7 billion in total inflows. Fidelity’s FBTC experienced its largest single-day outflow of $191.1 million, the fifth consecutive trading day of withdrawals, yet still boasts $7,927.5 billion in cumulative inflows, according to Farside data.

Farside data shows that Ark’s ARKB endured its biggest outflow of $98.1 million, bringing total inflows down to $2,124.9 billion. Grayscale’s GBTC saw $167.4 million redeemed, its largest single-day outflow since April 8, pushing total net outflows to a staggering $17,469.9 billion. Despite the recent turmoil in Bitcoin price, Bitcoin ETFs have collectively accumulated a substantial $11,221.5 billion in net inflows.

The post Fidelity Bitcoin ETF’s $191 million outflow surpasses Grayscale as BlackRock records first redemptions appeared first on CryptoSlate.