- March 8, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

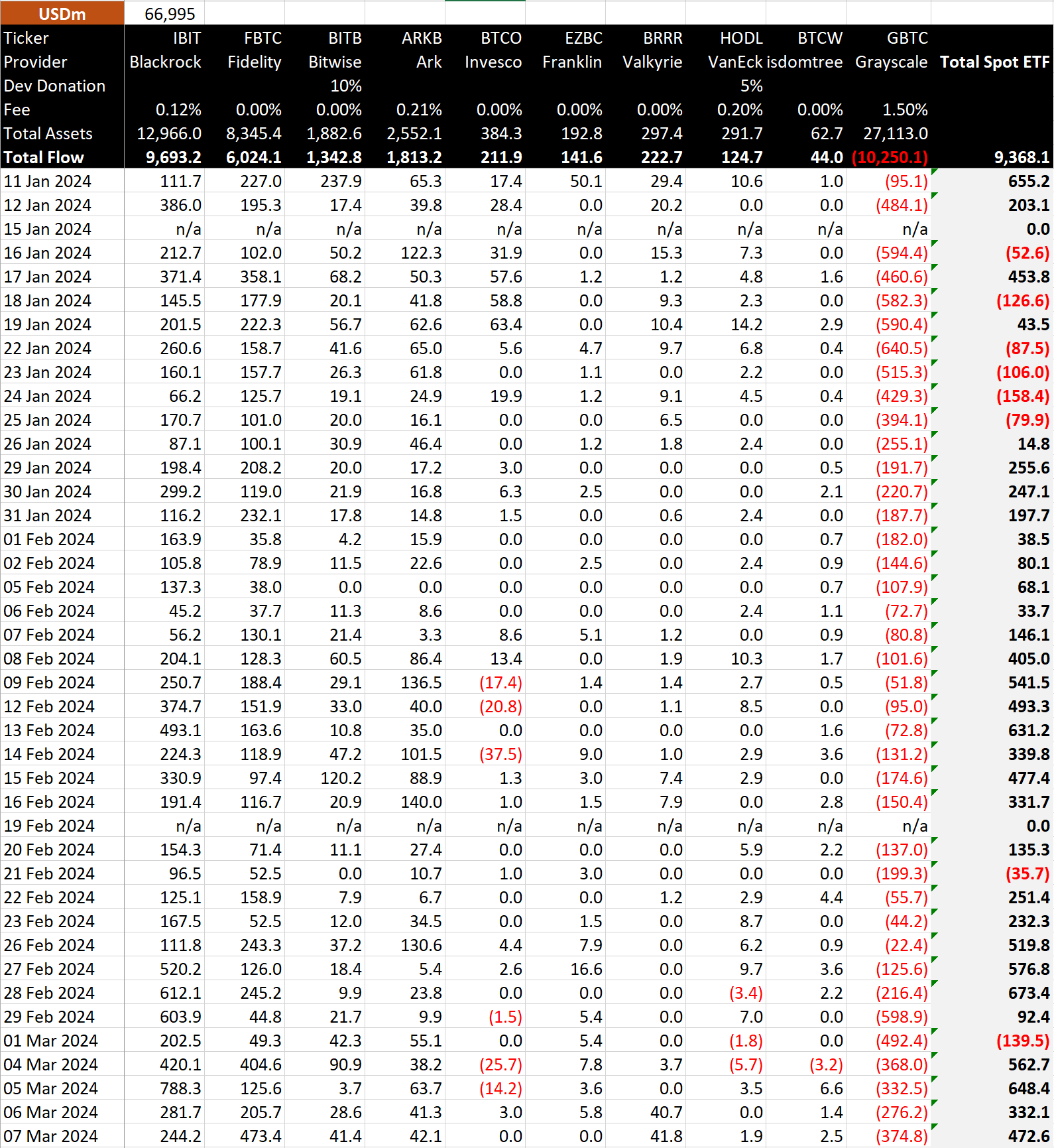

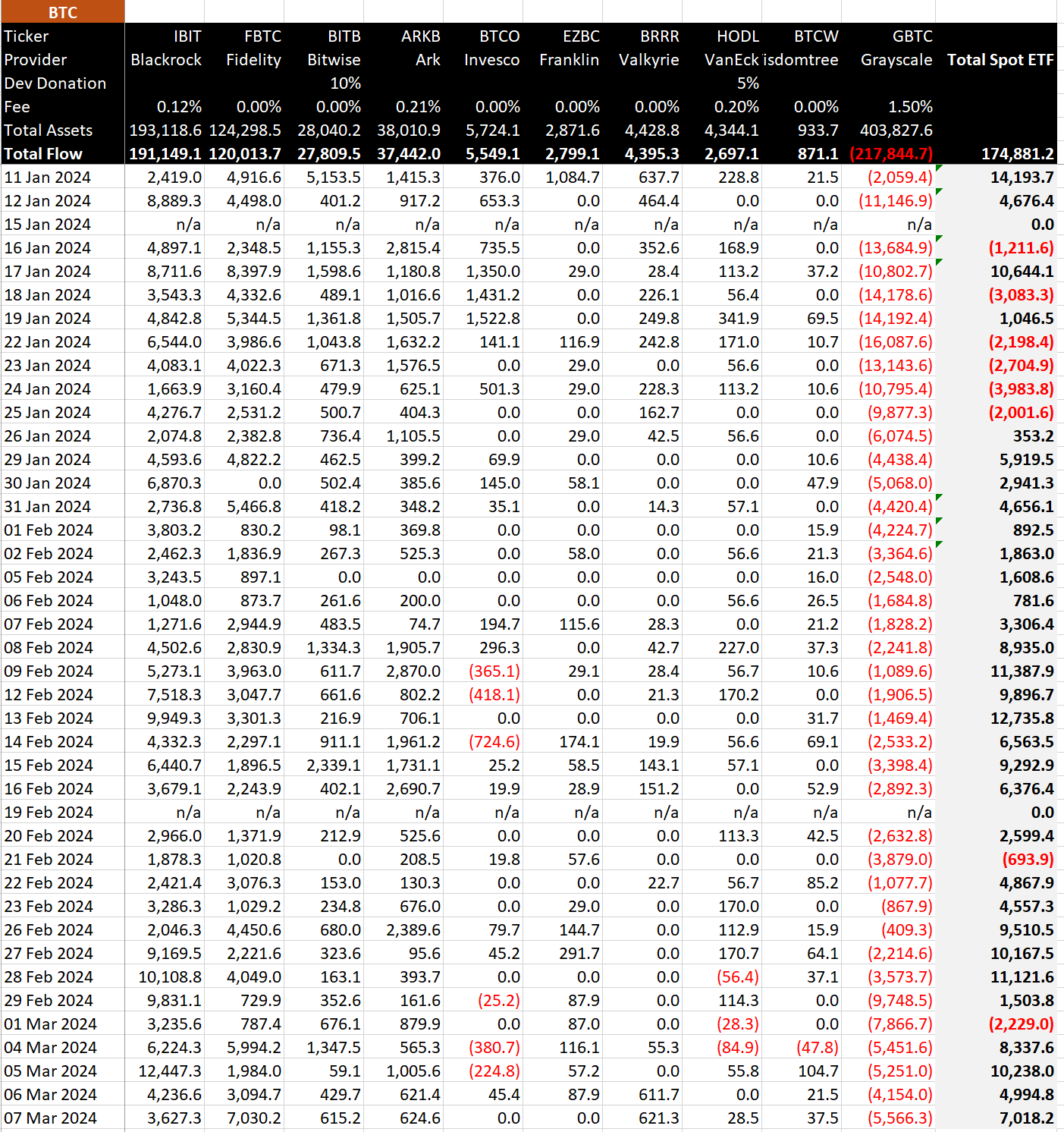

Data from BitMEX shows that the Bitcoin exchange-traded funds (ETFs) observed an inflow of approximately $473 million, equivalent to about 7,000 BTC on March 7. Fidelity’s FBTC topped the charts with a record-breaking inflow of $473 million, marking its largest single-day inflow. This surge increased its total net inflows to over $6 billion and expanded its Bitcoin holdings to roughly 120,000 BTC.

BlackRock’s IBIT has consistently registered robust inflows, with a recent $244 million, elevating their total net inflow to $9.7 billion and Bitcoin holdings to roughly 191,000. Bitwise’s BITB and Ark’s ARKB, the mid-tier ETFs, also experienced inflows of $41 million and $42 million, respectively. ARKB’s total net inflows reached $1.8 billion, with BITB slightly lagging behind at $1.3 billion.

BitMEX data shows that Grayscale’s GBTC continued to see outflows, negating the theory of diminishing outflows. It suffered $375 million in outflows, pushing its total net outflows to a jarring $10.3 billion and resulting in roughly 218,000 BTC leaving the ETF since launch.

Despite the GBTC outflows, the combined net inflow into Bitcoin ETFs stands at a solid $9.4 billion, equivalent to a staggering 174,881 BTC, according to BitMEX.

The post Fidelity’s Bitcoin ETF reaches its personal record with a $473 million single-day inflow appeared first on CryptoSlate.