- October 11, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

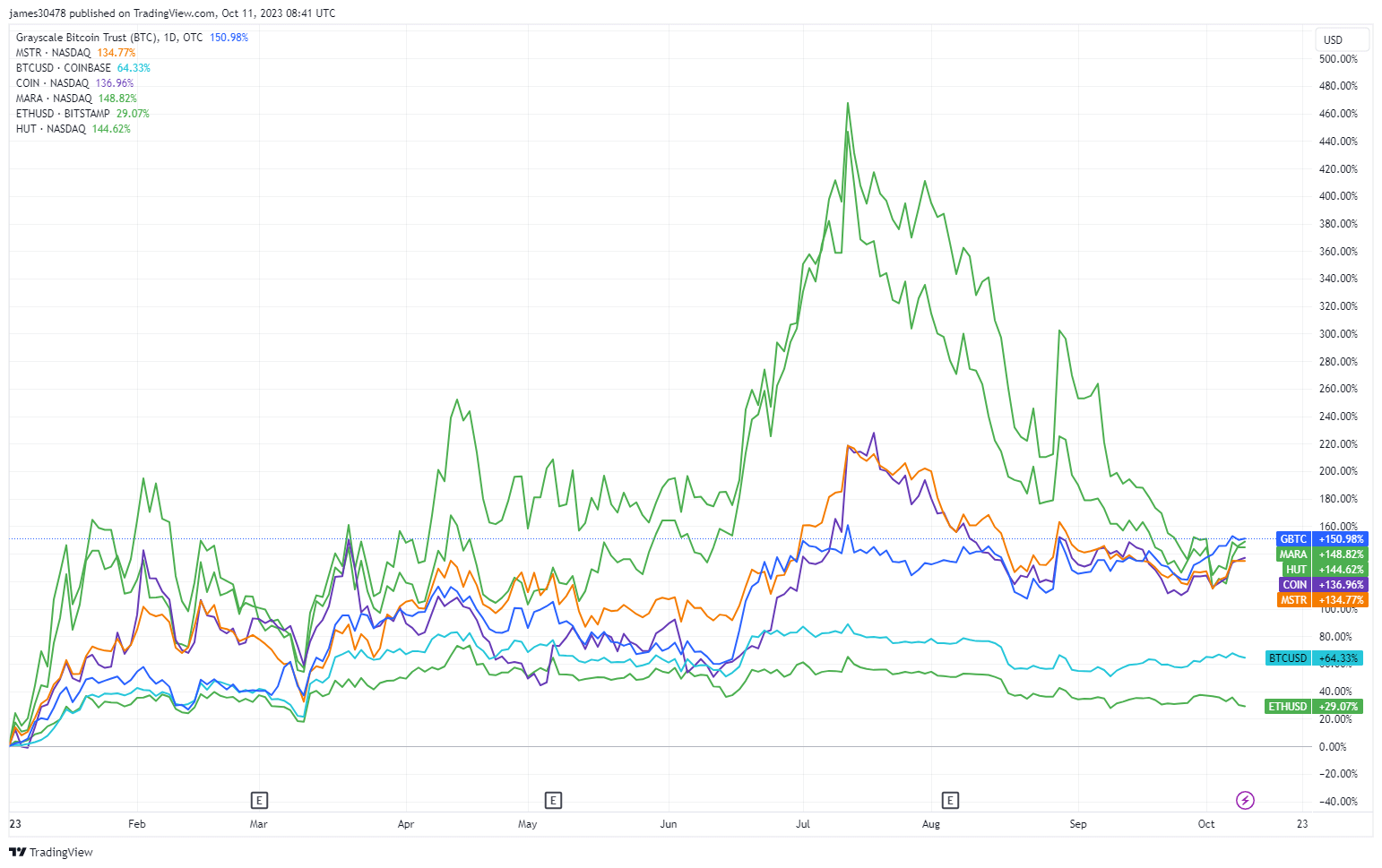

The Grayscale Bitcoin Trust (GBTC) has emerged as one of the top performers in the crypto market, charting a 150% increase this year. This triumphant rise has outshone significant players such as Bitcoin, up by 64%, and Ethereum, up by 29%. An array of Bitcoin mining stocks, Coinbase and Microstrategy, were also trailed in the wake of GBTC’s ascent.

The discount of GBTC to Net Asset Value (NAV) has contracted to 16%, the smallest measure since the latter half of 2021. This contraction may be a strategic indicator of the market’s evolving dynamics.

Since June 2023, GBTC’s performance has notably outstripped Bitcoin, a trend that could potentially be interpreted as a premonition of a future approval for a spot Exchange Traded Fund (ETF). However, the validity of such an interpretation hinges on a forthcoming decision from the U.S. Securities and Exchange Commission (SEC). The crypto market, therefore, teeters on the edge of this pivotal decision, with the future path of GBTC and other assets hanging in the balance.

The post Grayscale Bitcoin Trust’s impressive surge a potential indicator for spot ETF approval appeared first on CryptoSlate.