- January 3, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

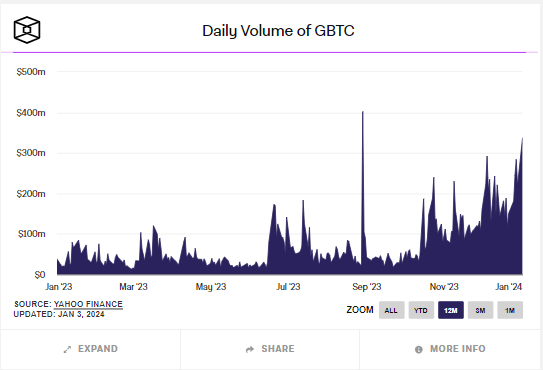

As the digital asset world anticipates the forthcoming approval of Bitcoin ETFs, Grayscale’s Bitcoin Trust (GBTC) is experiencing significant fluctuations in its trading volume. GBTC saw its second-largest trading day volume in the past 12 months on Jan. 2, 2023, registering $338 million. Interestingly, this figure pales compared to the trading volume during the 2021 Bitcoin bull run, which saw figures exceeding $500 million and even reaching the $1 billion mark on occasions.

The most significant trading day volume in the past 12 months for GBTC was recorded on Aug. 29, 2023, with an impressive $400 million.

One notable trend is the narrowing GBTC discount to NAV, which now stands at approximately -5%. This decrease is believed to be a response to the possible approval of a spot ETF.

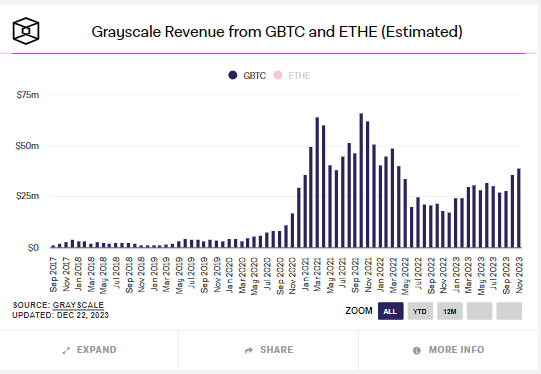

Moreover, Grayscale posted a revenue of $40 million in November, the highest since April 2022. This revenue is primarily derived from Grayscale’s fees, with GBTC charging a 2% annual fee. However, according to Bloomberg ETF analyst Eric Balchunas, it’s important to note that the emerging spot ETFs will charge significantly lower fees, close to 0.4%, creating potential competitive pressure for GBTC.

The post Grayscale’s Bitcoin Trust sees trading surge as spot ETF decision looms appeared first on CryptoSlate.