- February 21, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The establishment of Hong Kong as a crypto hub is a development that could have the potential to trigger a new Bitcoin bull market. As Bitcoinist reported, crypto exchanges in Hong Kong can obtain a Virtual Asset Service Providers (VASP) license to legally operate in the Chinese special economic zone.

Just yesterday, the Hong Kong Securities and Futures Commission released a statement outlining its plan to allow not only institutional investors but also retail investors to trade cryptocurrencies such as Bitcoin and Ethereum.

“As long as you don’t violate the basic rule of not jeopardizing financial stability in China, Hong Kong is free to pursue its own goal under the slogan of ‘one country, two systems,’” Nick Chan, a member of the National People’s Congress and digital asset lawyer, told Bloomberg.

Why Could Hong Kong Spark A Bitcoin And Crypto Bull Run?

For the Bitcoin and crypto markets, the reopening of Hong Kong means the potential of massive new inflows of funds. Hong Kong is the fourth largest financial center in the world, after New York, London and Singapore, making it one of the largest capital hubs in the world.

Furthermore, the special economic zone is considered the first option for wealthy mainland Chinese to withdraw their capital from the isolated country. Estimates put the figure of mainland Chinese moving capital in the special economic zone at around US$500 billion in order to gain access to the global financial system.

Even though Hong Kong will not enable truly decentralized crypto applications and self-storage, the injection of new capital could be very good news for Bitcoin and crypto markets. After all, the days when China accounted for a majority of crypto trading volume were not that long ago.

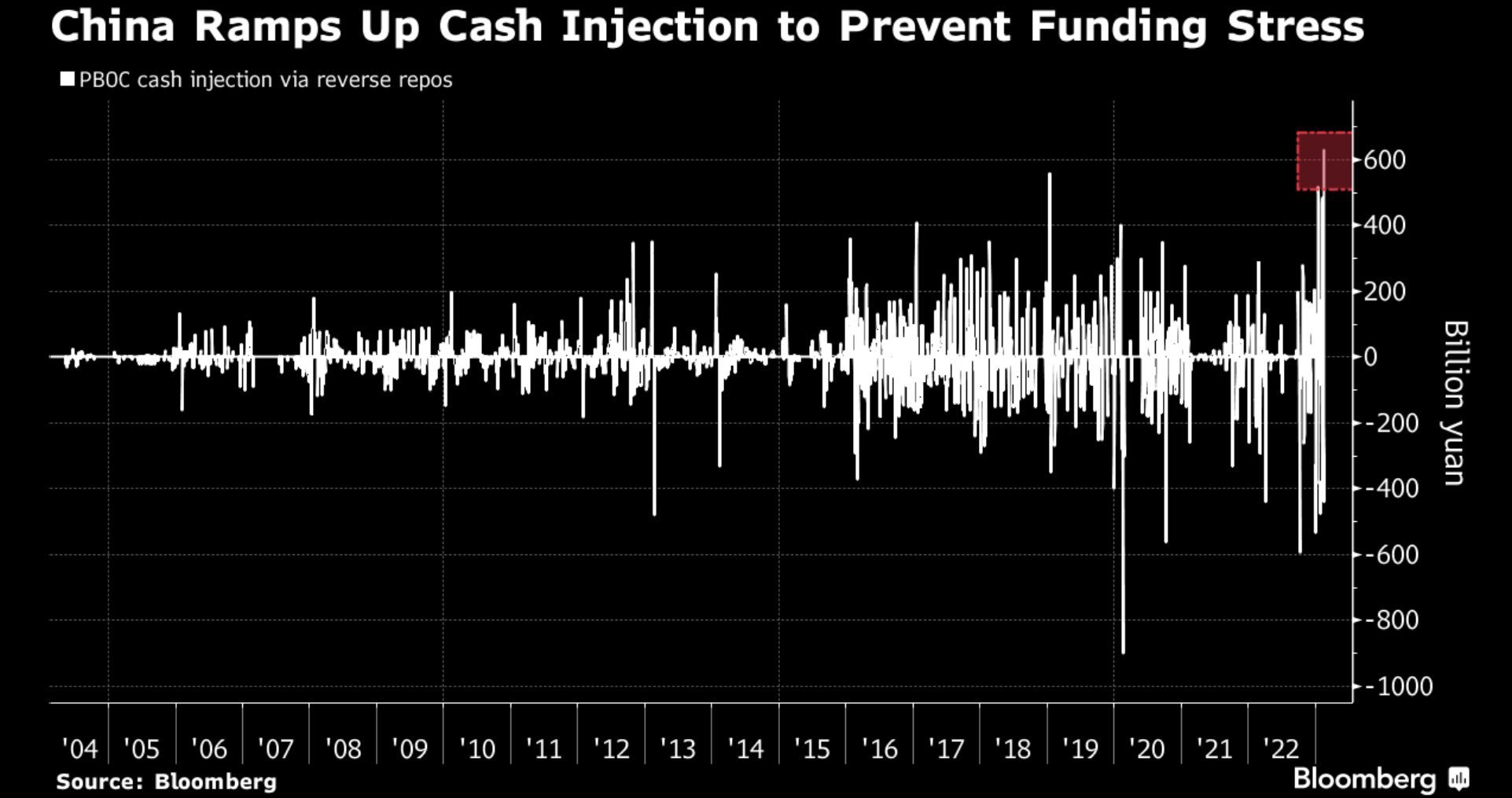

Hong Kong’s plan to become a crypto hub also coincides with China reopening after Covid-19. As “tedtalksmacro” discussed in a Twitter thread, China’s central bank made the largest liquidity injection in its history last Friday to help pull the country’s economy out of its historic slowdown:

Last Friday, $92bn USD (net) was injected to bring down borrowing rates and make cash easier to come by – which is not too dissimilar to what the Fed did during the pandemic!

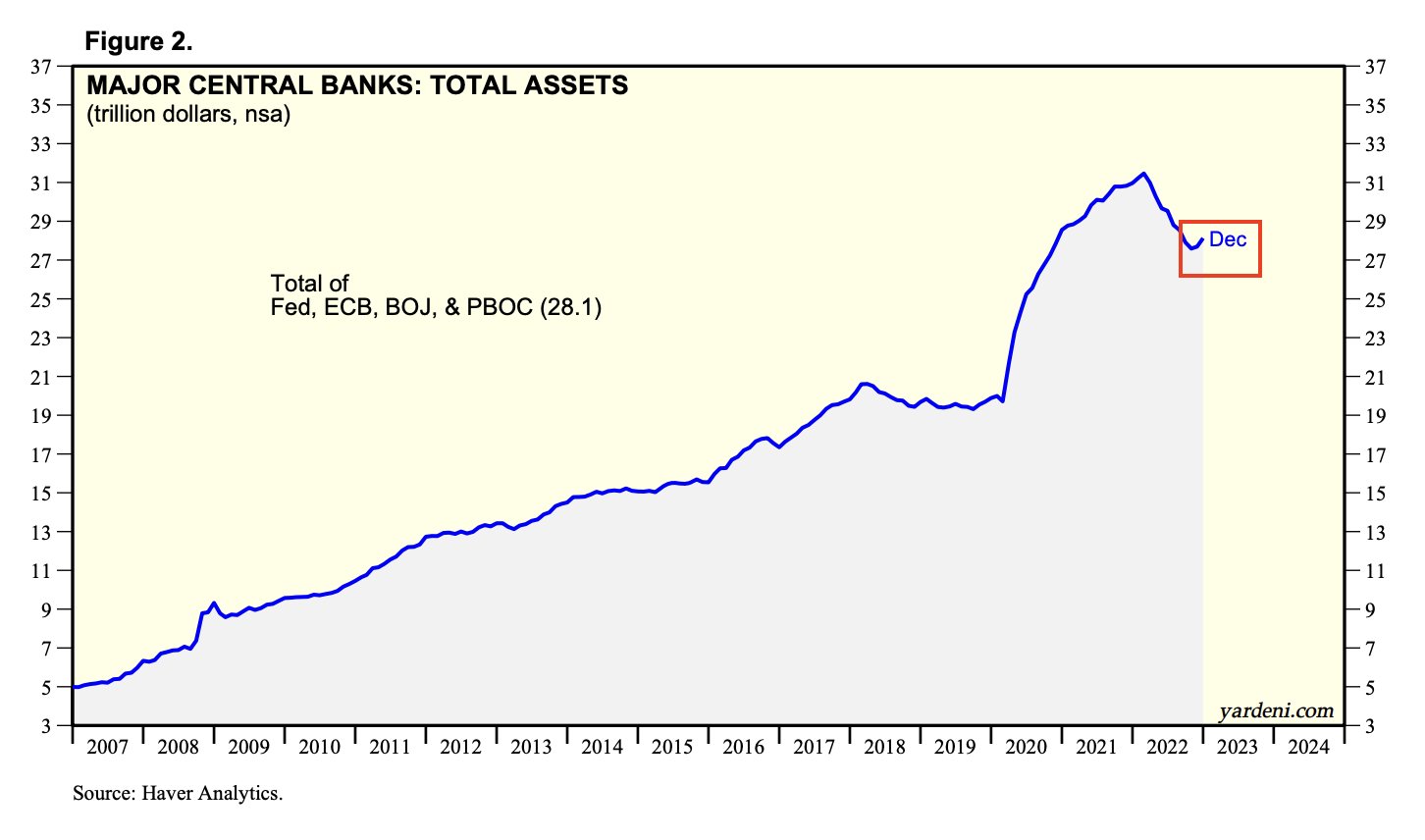

And this has implications for Bitcoin and crypto as well. As the macro analyst notes, the People’s Bank of China (PBoC) is the world’s third-largest central bank, with assets of around $6 trillion, playing a key role in global liquidity.

“While most analysts are focused on how the Fed tightening will reprice risk assets this cycle, they’re failing to consider the scale of easing in the east,” the analyst claims.

Japan has the world’s fourth-largest central bank. Together, the two countries provide liquidity to global markets, far outpacing the Fed’s tightening measures. As a result, there is currently already an increase in global liquidity, as the analyst shows with reference to the chart below.

Crypto is not tied to any particular economy or entity, but rather is a liquidity junkie – it longs for the risk-hungry investor to get cash and bet on the fastest horse. That’s set to be exactly what will happen this year in China.

Economists expect the PBoC to play its role in stimulating the Chinese economy and cut interest rates in the coming months to support and encourage a sustained economic recovery. For Bitcoin, this could mean, according to the analyst:

Of course, not all of the cash injected by the PBoC will end up in risk assets. But I’d bet that a decent portion of it will! Just like we saw from the West in 2020, heightened liquidity from central banks = prices of risk assets (like BTC) go up.

The opening of Hong Kong as a crypto hub combined with monetary policy in China could thus be a catalyst for a new Bitcoin bull market. At the time of writing, BTC was trading at $25,004, trying to break through key resistance at $25,244.