- September 20, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

In finance, ‘smart money’ typically refers to institutional or professional investors presumed to possess greater market knowledge and resources. However, an intriguing pattern emerges when examining the top holders across major DeFi platforms.

CryptoSlate analyzed the top 5 wallets (excluding funds and exchanges) and the top 5 fund wallets from major DeFi platforms listed on the on-chain data site Cherry Pick. Platforms included Uniswap, Aave, Curve, Balancer, and 1inch.

Risk Tolerance and Diversification.

The data shows that single wallets linked to institutions generally have lower balances than individual wallets. This could indicate several things.

Firstly, institutional investors may be diversifying their portfolios to mitigate risk. Traditional financial wisdom advocates diversification as a hedge against volatility, and it seems this principle may be carrying over into the developing world of DeFi. This is supported by funds having multiple wallets tagged. Secondly, the lower balances could suggest that institutions are still cautiously exploring DeFi, potentially skeptical of its long-term prospects or operational risks.

Here, ‘smart money’ appears to be exercising caution by not putting all their eggs in one basket or limiting their exposure to the DeFi space altogether.

For example, the average balance in Aave for wallets is approximately $11.46 million, while funds hold an average of just $528,635. This stark contrast could imply that institutional investors are diversifying their risks or are perhaps still testing the waters in the DeFi arena.

Increased losses from funds.

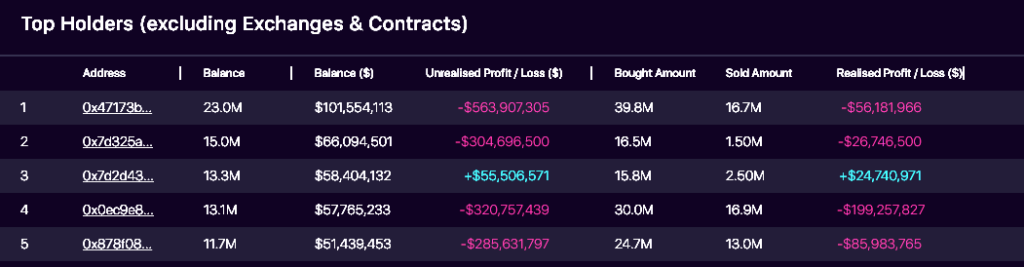

Despite these lower balances, funds exhibit higher realized and unrealized losses. Uniswap’s average realized loss for funds is around $470,000, compared to the colossal average loss of $68.6 million for individual wallets.

Staggeringly, the top UNI wallet has over $500 million in unrealized losses, with all but one of the top five seeing nine-figure unrealized losses. Analyzing the top wallet, it appears to be a wallet linked to the protocol itself, as it received 39.7 million UNI in March 2021, valued at around $1.1 billion.

At Uniswap’s peak just two months later, it was worth around $1.68 billion.

Today, the wallet is valued at $101 million after sending around 16 million UNI out of the wallet over the past 36 months, selling only once for a profit.

The divergence may suggest that while institutional investors are more cautious with their capital, they are more accepting of short-term losses, possibly as part of a long-term investment strategy.

A changing of the guard.

Both individual wallets and institutional funds show a strong inclination toward Uniswap. With an average balance of $66.9 million for wallets and $104,821 for funds, it is evident that Uniswap remains a cornerstone in retail and institutional DeFi portfolios.

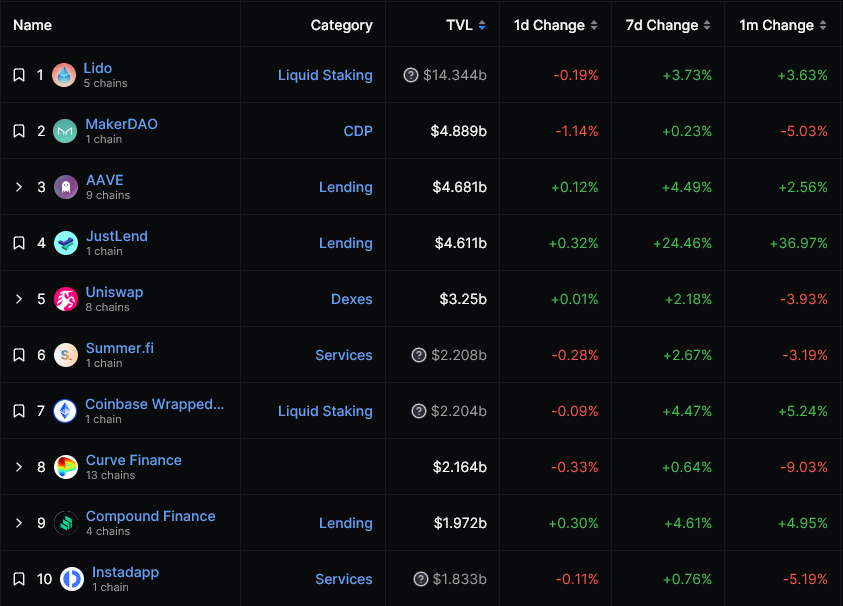

While platforms like JustLend are making strides with a TVL of $4.611 billion, data shows that ‘smart money’ is still primarily invested in legacy platforms, with Lido, Maker, Aave, and Uniswap all remaining in the top 5 DeFi platforms by TVL.

Yet, the top 10, as tracked by DefiLlama, is now missing several legacy DeFi players, such as Balancer, PancakeSwap, SushiSwap, and Yearn Finance. Instead, newer protocols such as JustLend, Summer.fi, and Instadapp have taken their spots.

Profitability and Efficiency

One might expect ‘smart money’ to flock toward platforms with higher revenues and fees. However, this is not necessarily the case. For example, while Uniswap has cumulative fees of $3.254 billion, it has not prevented ‘smart money’ from incurring average realized losses of over $470,000.

Looking ahead, data from DeFiLlama reveals exciting trends in TVL changes over time. Platforms like JustLend have seen a 24.46% increase in TVL in just 7 days.

While our dataset doesn’t provide a direct correlation, it begs the question: Is ‘smart money’ agile enough to capitalize on these rapid shifts?

The post Is ‘smart money’ that smart? Top 5 DeFi wallets have unrealized losses appeared first on CryptoSlate.