- February 9, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

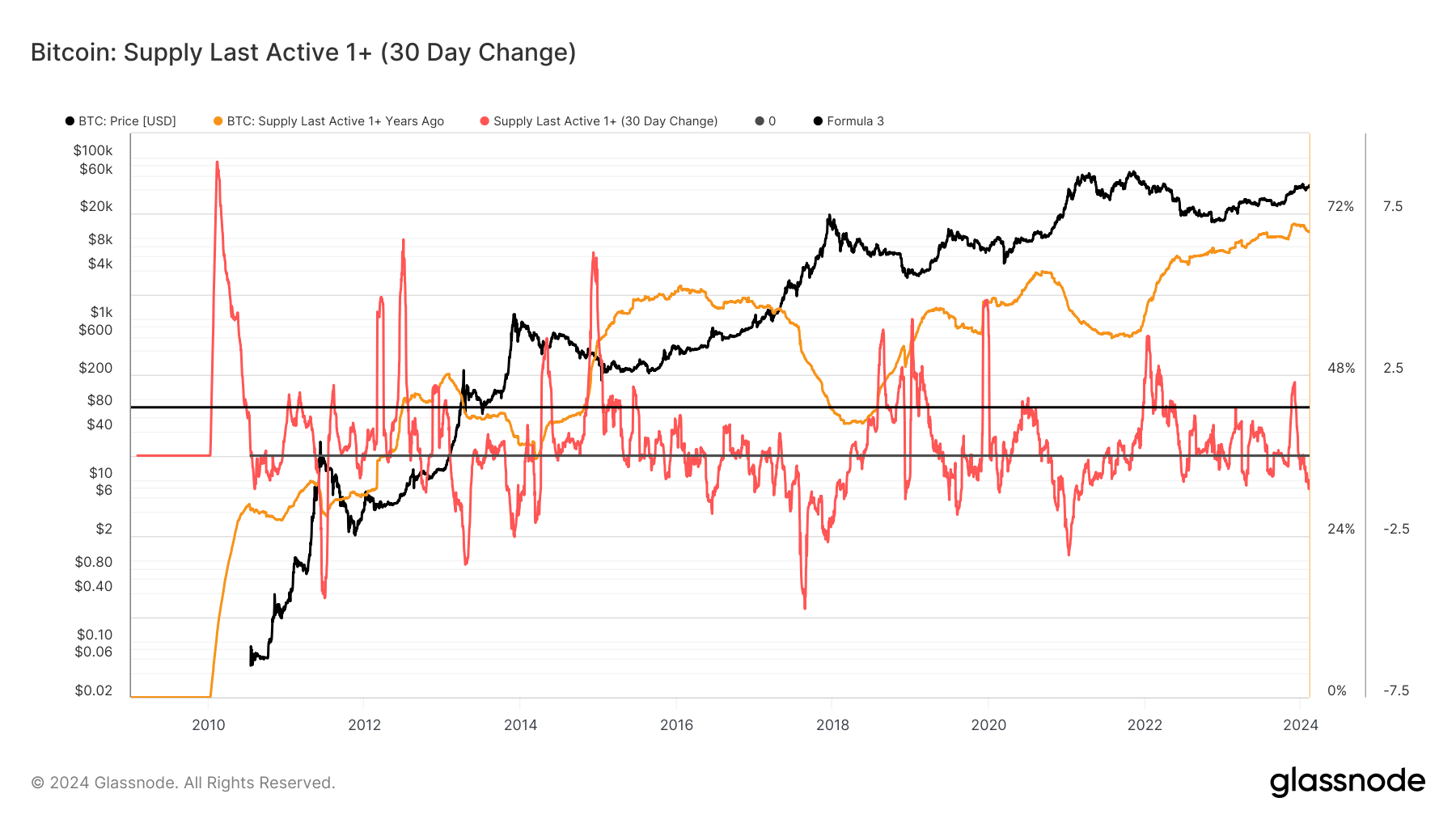

Bitcoin market forces are demonstrating an intriguing trend. The cohort of Bitcoin holders who have kept their Bitcoin for over a year, also known as the Supply Last Active (SLA) 1+ year, reached an all-time high of approximately 71% in November 2023.

As a general principle, these holders tend to acquire Bitcoin during bear markets when prices are low, holding onto it until prices rise. As the market transitions into a bullish phase, this cohort starts liquidating their Bitcoin assets, garnering profits from their initial low-cost purchases.

Consequently, as Bitcoin prices surge in bull markets, the SLA 1+ year decreases. This trend appears to confirm itself as Bitcoin recently soared to $46,000. Correspondingly, the SLA 1+ year supply has dipped by over 1% from its peak to 69.2%.

This trend, initially noted by CryptoSlate in December 2023 and confirmed by Dan Pantera, hints that if the SLA 1+ year supply continues declining, Bitcoin prices could rise further. This trend is worth keeping a close eye on as it may have significant implications for the Bitcoin market going forward.

The post Long-term Bitcoin holders selling off could signal more price increases appeared first on CryptoSlate.