- September 8, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

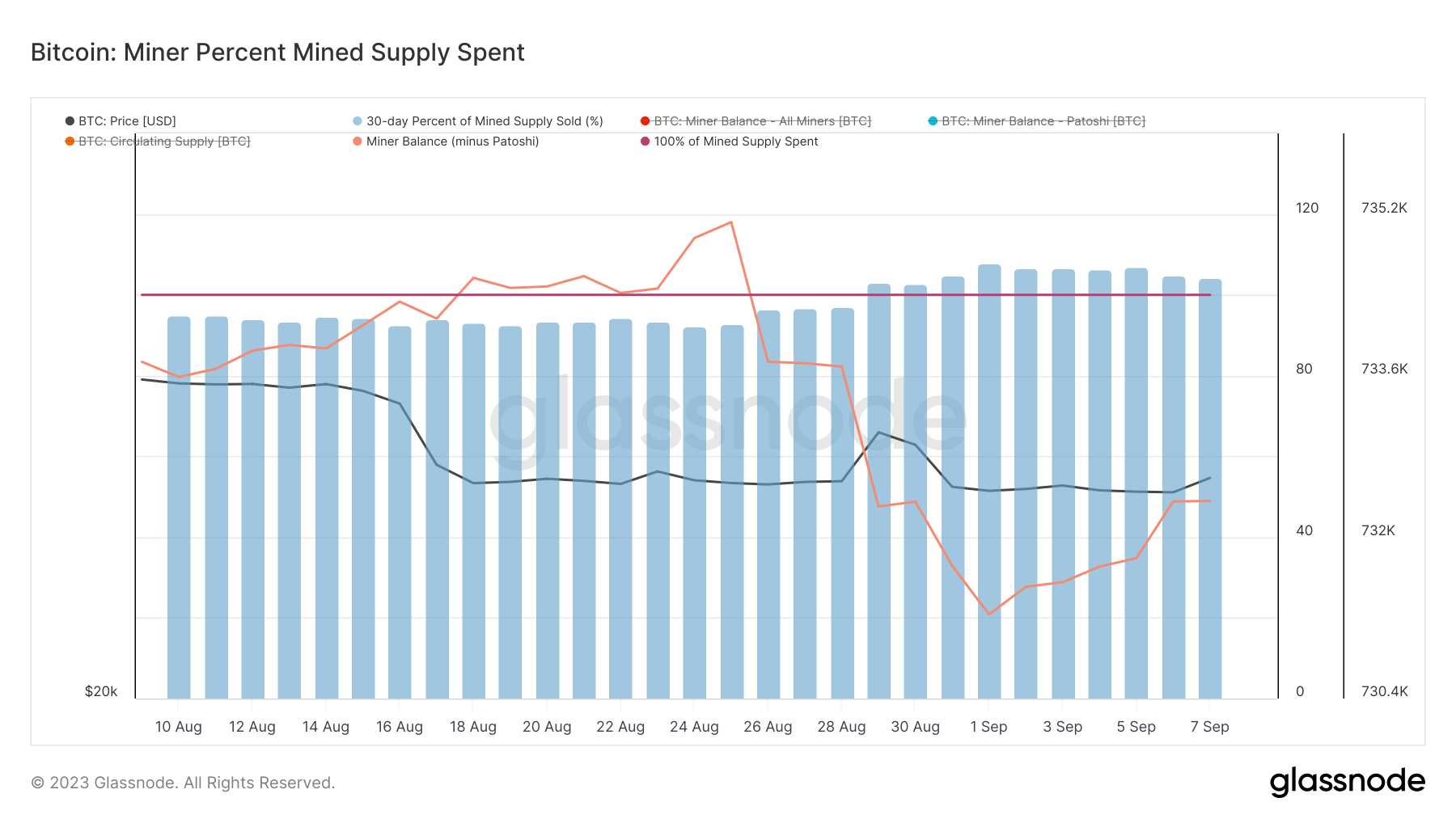

The Miner Supply Spent metric measures the percentage of the total mined supply that miners spend over a 30-day window. This provides insight into the financial behavior of miners, which are some of the most important entities in the Bitcoin ecosystem.

Miners selling more Bitcoin than they mined indicates they are dipping into their reserves, possibly due to increased expenses or a strategic decision to sell more at current market prices.

Since Aug. 29, miners have been selling more BTC than they mined, with the values going as high as 107%. Miner balance decreased by over 4,000 BTC in a week, dropping from 735,000 on Aug. 25 to 7321,000 BTC on Sep. 1.

The selling of Bitcoin in excess of the mined supply can introduce additional supply to the market, pushing prices further down. As Bitcoin’s price dropped from $27,000 to $25,000 during this period, this miner sell-off could have contributed to the downward pressure.

However, the decrease in Bitcoin’s price might be what’s making miners more eager to sell, especially if they anticipate further declines or want to secure profits at current levels.

The post Miners are selling more than 100% of the mined supply appeared first on CryptoSlate.